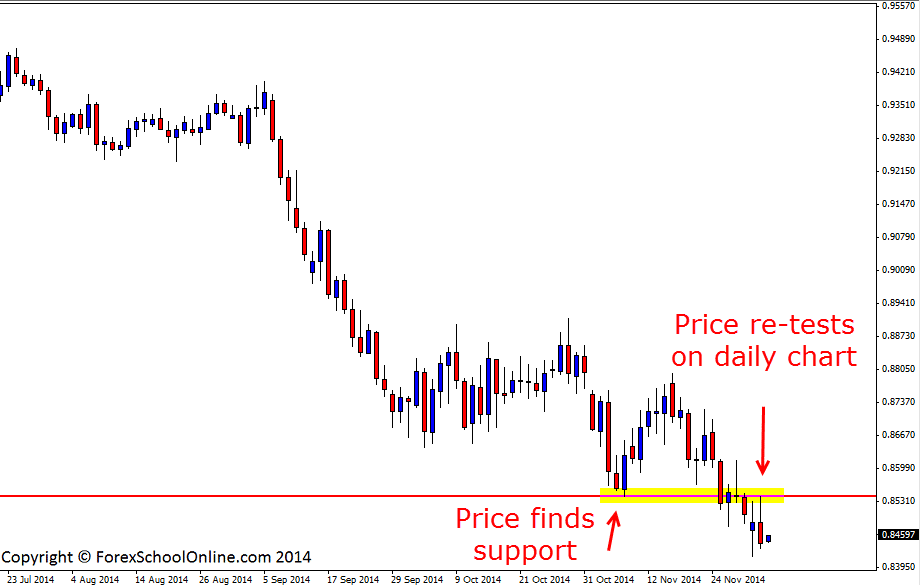

The AUDUSD retraced higher in the previous daily session to test the key daily level. This key daily level has been an important support level where price on the most recent move lower found support. Price on the retrace back higher moved back and into the old support level to make a test to see if the old support would hold and become a new price flip resistance level.

As I covered in the blog post on the 6th Nov 2014 Daily Forex Market Commentary the Aussie has been in a strong down-trend for the past three months and anyone who follows this blog regularly would know that the best way to play these markets when they get into such clear trends is just to wait for rotations back into “value” areas or key daily price flips and then hunt high probability trades on either the daily or intraday charts.

I am often making posts in this blog for traders to follow and showing the key areas within the markets to look for high probability price action setups and also highlighting where value areas within the trends traders could look to join the next wave. The reason I am making today’s post is to highlight exactly how you can use this information to get into high probability A+ trades by seeing this example on the AUDUSD that has formed in the previous daily session.

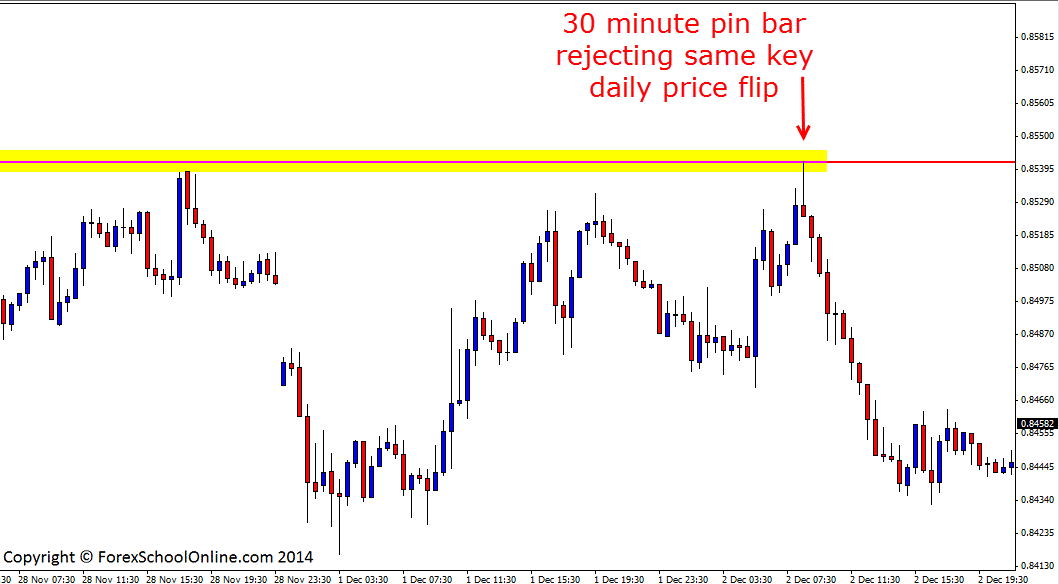

After making the retrace back into the key daily level, traders should have been ready and watching all of their intraday charts and watching the price action behaviour to see if the key daily level was indeed going to hold as a new price action flip level and to also see if price was going to fire off a bearish trigger signal. As you can see on the 30 minute chart below; price fired off an A+ pin bar that was sticking up and rejecting this key daily level. This was a textbook A+ intraday pin bar that because it formed at a major daily level had a lot of weight behind it. You will also notice that the AUDCHF formed a very similar setup to this setup on it’s 30 minute chart.

AUDUSD Daily Chart

AUDUSD 30 Minute Chart

Hai Sir,

how to find market retracement?

Hello Vinod,

the best retracements are found within obvious trends. For example; price is in an obvious trend higher and we are looking for price to “retrace” lower and back into a key support value level to get long with the trend.

You can find more information about this in a lot of the free videos including the video I have just released overnight here; https://www.forexschoolonline.com//2-bar-reversal/ and also other lessons that will help are; https://www.forexschoolonline.com//how-to-trend-trade-price-action-in-depth-tutorial/ and https://www.forexschoolonline.com//high-probability-price-action-trading/

Safe trading,

Johnathon

Are you really trading in 30 minute time frame, i mean trading intraday….??

Hello August,

yes we trade intraday. Please see our posts in this section on time frames from 15 minute chart and above. You can read this trading lesson here which discusses it; Trading Daily Chart Time Frame Down to Intraday

Any questions let me know.

Johnathon

very nice set