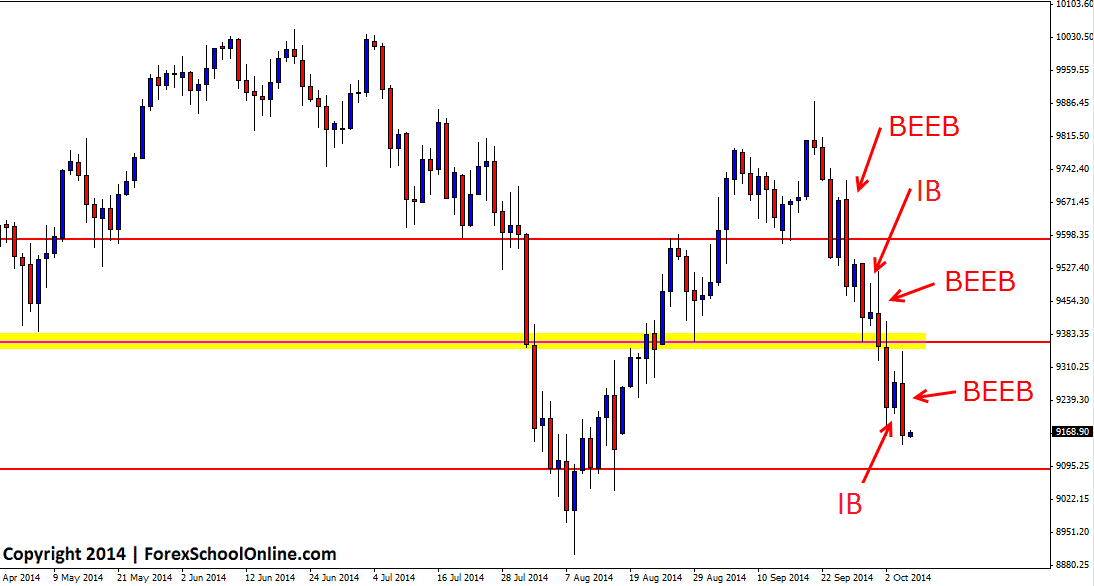

The Germany 30 Index or the DE30 as it is also known has continued lower after we made our last post on the 1st Oct Germany 30 Fires Off Insde Bar on Daily Chart. As we covered in that commentary, this market has recently been moving strongly lower with a string of aggressive bearish signals including a false break pin bar followed up by a bearish engulfing bar (BEEB) and inside bar (IB).

Price has now once again followed this pattern of moving lower aggressively with price forming another inside bar and another bearish engulfing bar, with the high of the engulfing bar moving higher during the recent daily session to test the recent resistance. Price tested the resistance before the bears came in and smashed price back lower with the price closing close to the session and BEEB lows.

This market is in a heavily sideways market and from here if price can continue to move lower the next near term support level looks to come in around the 9089.80 level. Whilst this move lower has been a strong and aggressive one, this has still only been one move lower or one leg lower and there is no clear trend in place in this market as of yet. For that to take place price would need to break our of the sideways trading.

Note: If you are looking for a broker and charts that provide the correct New York close 5 day MT4 charts and both Forex and also other markets such as Indices and major commodities check out the article here: Recommended Charts and Broker For Price Action Traders

Germany 30 Index Daily Chart

Related Forex Trading Education

– The Real Reason Forex Traders Fail – Think and Act Like a Pro

Leave a Reply