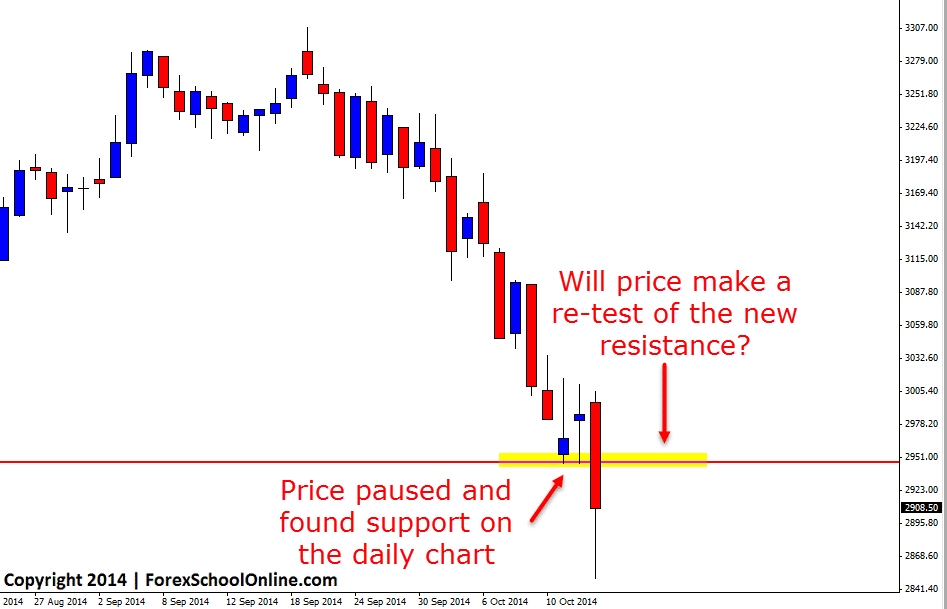

The Stoxx 50 which is an index of the 50 largest blue-chip European companies operating within the eurozone nations is now as I write this retracing back higher after in recent times being smashed relentlessly lower. Just like a lot of the major world equity markets of late; after going on extended uptrend’s and in some cases making all time high after all time high, it has swiftly changed on the daily chart and price has now made an extended run lower.

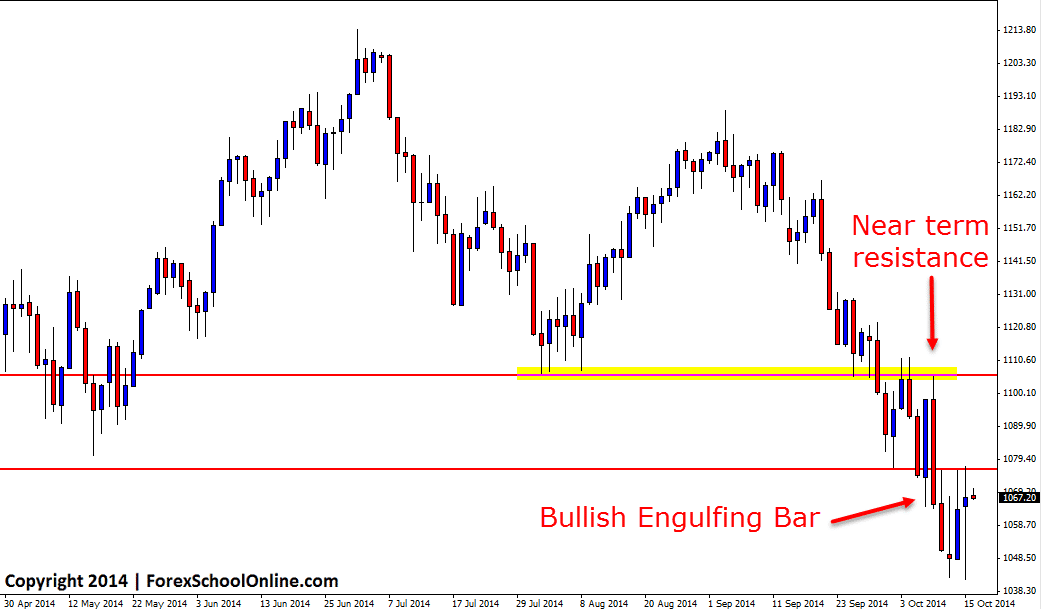

Last week in this blog we posted about the daily Bullish Engulfing Bar (BUEB) on the Russell 2000 index in our 9th Oct Daily Forex Commentary. In that post we also posted about the worry of the near term resistance level above the engulfing bar if price was able to break higher, but what happened next was an indication of who is in control of these markets at the present time. After breaking the high of the BUEB price went straight to the near term resistance and because the bears are in total control of these markets at the moment, price immediately collapsed lower from the first resistance and has now sold off much lower.

The Stoxx index is a very similar looking market with the daily chart showing a massive sell off since the start of September with price making only small retracements back higher. Those traders that follow this blog will know; there is only one way to play a market that has a very obvious momentum and that is to trade with it and not to try and fight it. It makes no sense to try and fight all the big money who are moving the market and try and pick the tops and bottoms. It makes far more sense to look for a value entry at a key supply/demand level trading in the same direction as the strong momentum.

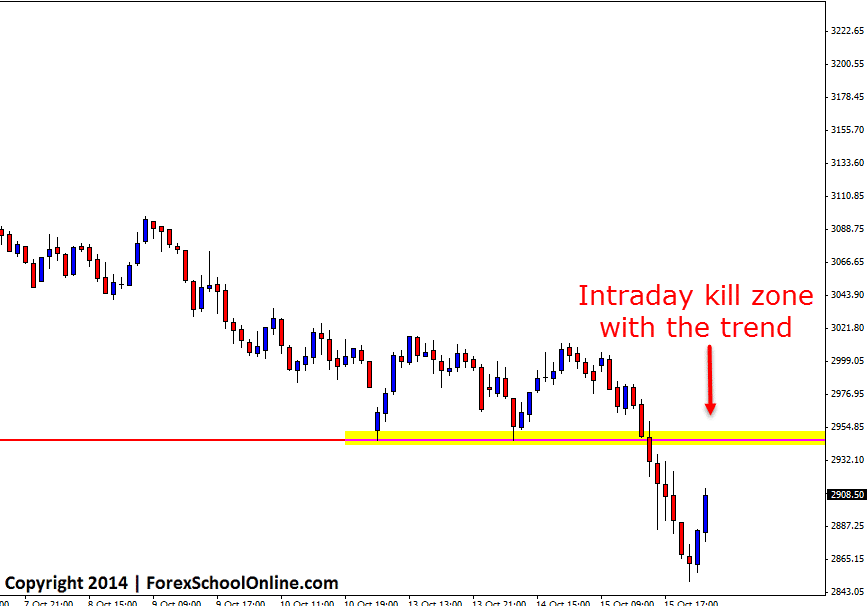

As the 1 hour chart shows below; price is now moving closer to a kill zone where it could be a potentially good area to look for solid short trades with the trend. I discuss at length exactly what kill zones are and how to hunt high probability trades at them here: Hunting Price Action Trades From Kill Zones. For any potential trades to be confirmed there would need to be an A+ trigger signal at the key level like the ones taught inside the Forex School Online Lifetime Members Courses.

If you are looking for the correct New York close 5 day charts that have both Forex pairs and other markets such as the major indices, then check out the trading article

The Recommend Charts and Forex Broker for Price Action Traders

Russell 2000 Daily Chart

Stoxx 50 Daily Chart

Stoxx 50 1 Hour Chart

Leave a Reply