A lot of the major stock index’s are retracing as I write this Daily Market trade Setup Commentary for you and into major daily support or resistance areas. As these markets do this and rotate into really ‘hot’ levels, they present potential high probability trade setups for you to keep a really close eye on.

Just three of the major stock indices currently rotating into major daily levels at the moment are the; Italy 40, EU Stock 50 and the Spain 35. In today’s trade setups commentary I am going to take a closer look at the Italy 40 and a quick look at the US tech 100 or the Nasdaq.

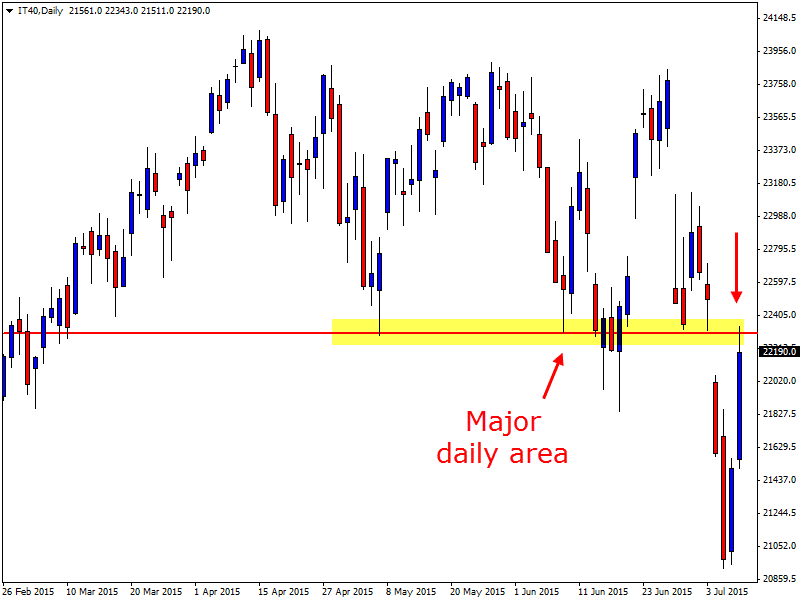

Italy 40

As I discussed in the trade video I put out the other day; *Video* Exotic Forex Pairs Firing Super High Probability Price Action | 7th July 2015 the best way to trade in the current market is with the strong moment and with price breaking in our favor and if we look at the Italy 40 daily chart we can see that price has recently broken strongly lower and through a major daily support level.

Price is now retracing back higher to re-test this major daily level to see if it can hold as a new ‘price flip’ and new resistance level. This is a very solid level to hunt for short trades and to watch the price action behavior in general to see if the bears/sellers will come out of the market to send price back lower and ensure the level holds.

Daily Chart

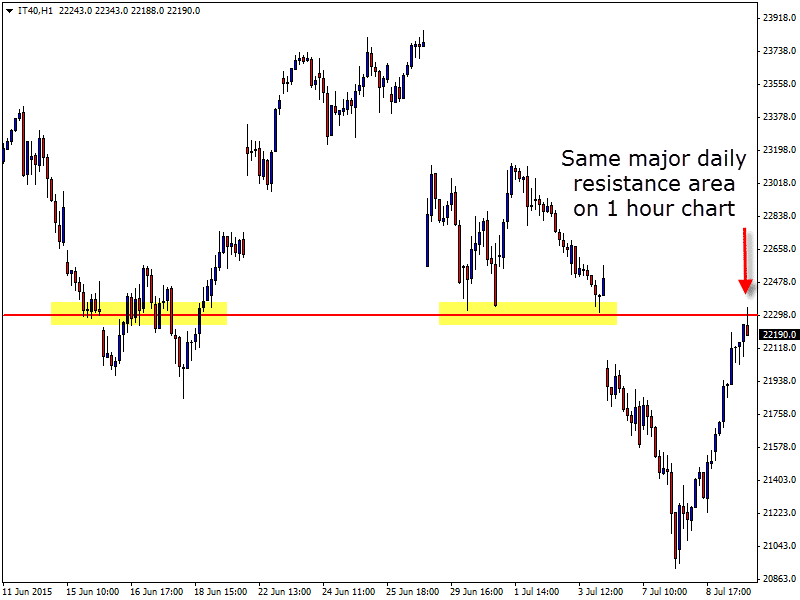

1 Hour Chart

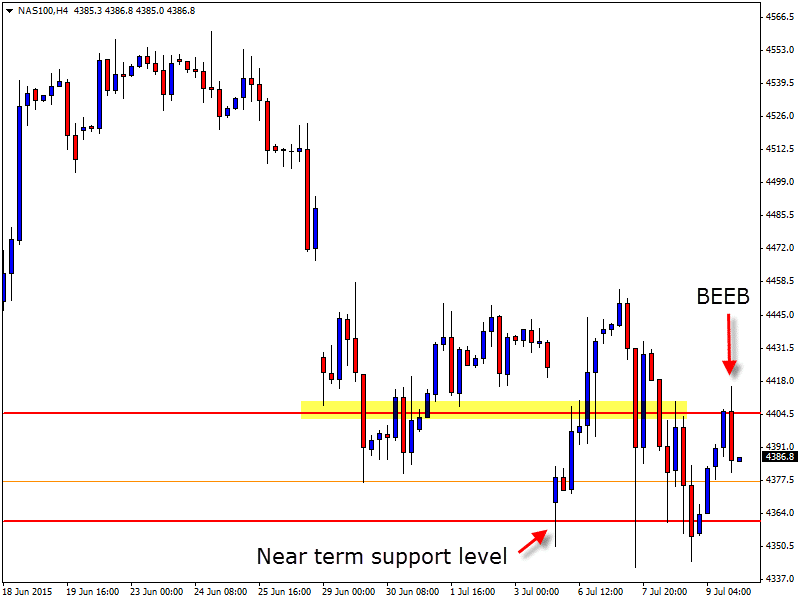

US Tech 100

The US Tech 100 has formed a Bearish Engulfing Bar or a BEEB on the 4 hour chart. As you can see where I have marked on the chart below; this BEEB is rejecting a resistance level, however; for price to move lower it is going to have to break a minor level that price is sitting pretty much straight on top of.

Price is pretty choppy in this pair, however; if price can break this first minor level and move lower, there then looks to be space for price to move into the near term support level.

US Tech 4 Hour Chart

If you want a broker who trades these major stock indices markets, other markets like commodities, as well as your normal Forex pairs, then checkout the brokers we recommend price action traders use here; Using The Correct New York Close Forex Price Action Charts & Broker

Related Forex Trading Education

– Start Increasing Your Forex Trading Profits With Trade Management Training

What was the “high probabilty” for your IT 40 short trade? 55%? 65% or 95%?

Where did you put your SL? Have you already stopped out? If not, according to the current PA, are you going to close your position?

Thanks for your reply!

Heya Shunfengcn,

great questions! Trades are not ranked. They either meet a traders rules set and their trading edge or they do not. I was not entered into this. Price never broke lower and then gapped higher. You can read about how we look to make entries here; https://www.forexschoolonline.com//are-your-entries-blowing-up-your-trading-account-high-probability-price-action-entries/

If you have any other questions please let me know,

Johnathon