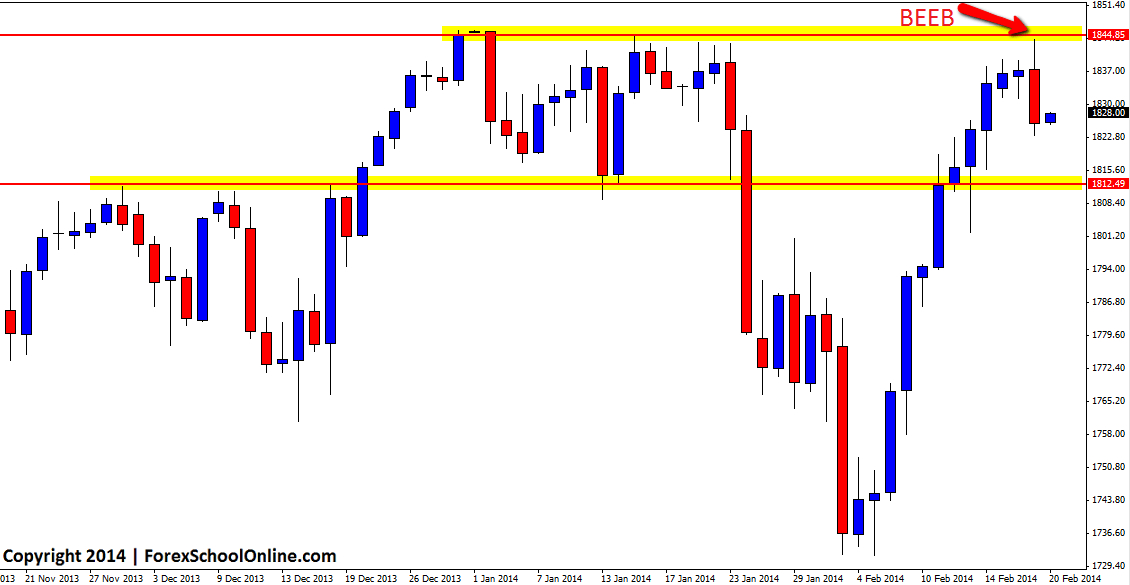

The S+P 500 has formed a Bearish Engulfing Bar (BEEB) on the daily chart that is testing the recent highs after price has made a large run higher. After making an all time high, price moved into a period of consolidation before retracing back lower and price has now moved back into these highs for potentially another attempt at making another higher high.

When price moved higher and attempted to break out, the bears jumped in and snapped price back lower to fully engulfing the previous two candles creating the bearish engulfing bar. Whilst this engulfing bar is at the high and rejecting resistance, it is formed within this consolidation and boxing period. If price can break lower and move below the BEEB the consolidation and boxing area could provide minor areas of support. If price can work through these areas the next major support comes in around 1812.40. The recent momentum is higher and if price can breakout higher and make a new higher high, traders could definitely look to trade with this momentum by starting to look for long trades with rotations back into value.

S+P 500 Daily Price Action Chart

Leave a Reply