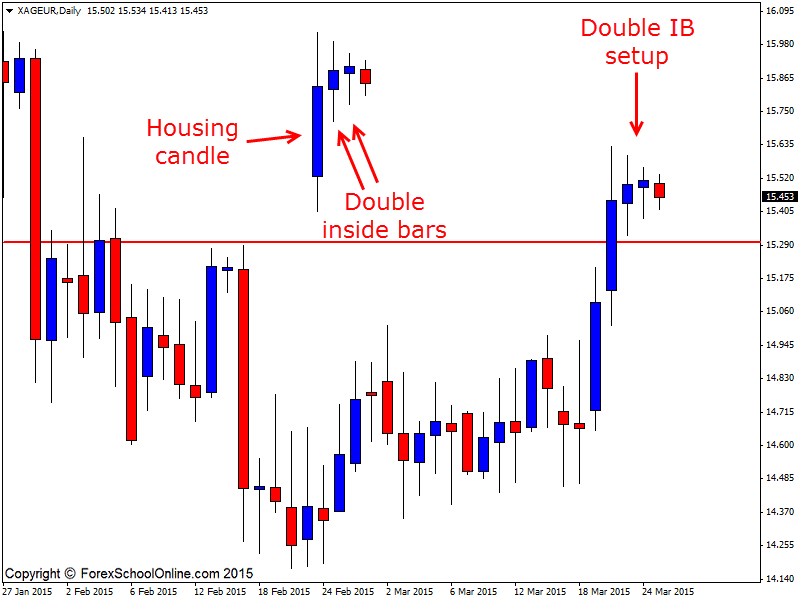

The Silver v Euro or the XAGEUR has formed a Double Inside Bar setup with two inside bars one after the other on the daily price action chart. As I have shown on the zoomed in daily chart below; an inside bar is formed when price is fully contained within the previous candle.

An inside bar is formed when the high is lower than the previous candles high and the low is higher than the previous candles low. For this double inside bar setup, price has formed back to back inside bars. You can find more detailed information on inside bars at;

Trading the Price Action Inside Bar

Traders can often get confused with double inside bars because the valid setups don’t form often. Where the confusion comes in and what traders are often mixing up is that price will wind up and form a bunch of small candles that do not break out of the large housing candle either higher or lower, but if each smaller candle itself is not an inside bar, then the run of inside bars is broken.

Each candle has to be an inside bar and inside the previous candle, not just winding up. The market winding up is important market information, but in this particular scenario it is not what we are looking for.

What is important to note is that price made a strong push higher just before forming these inside bars. It then broke above a resistance level and closed above. The low of the first inside bar is now rejecting the old resistance and new support level which if it can continue to hold as a new support could be critical for price continuing to move higher.

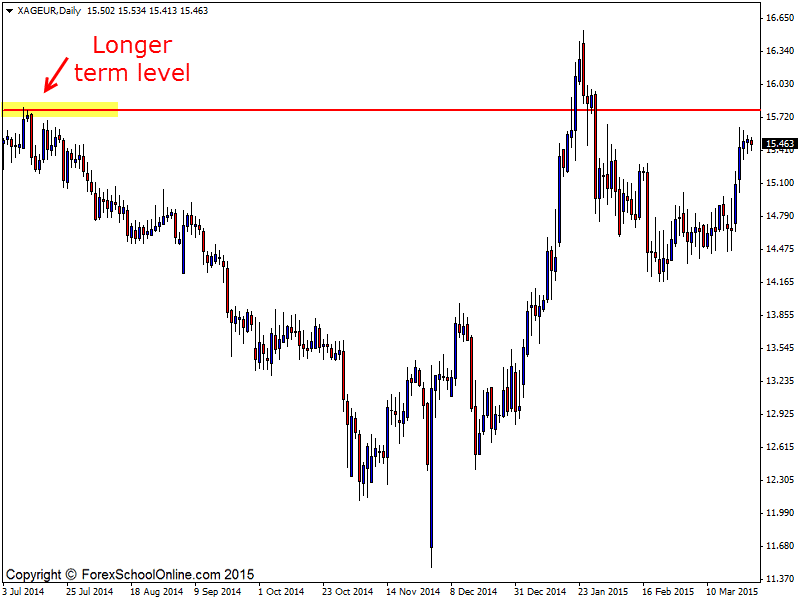

If price can now break higher inline with this recent strong push, the near term resistance on the daily chart comes in at a level that is from a longer term resistance as the zoomed out daily chart shows below. As I have often discussed in this blog before; as price action traders we are trading the whole chart and the whole price action story, not just the level and trigger signal right in front of us and that longer term level is a good example of that.

Daily Chart

Daily Chart – Zoomed Out

Leave a Reply