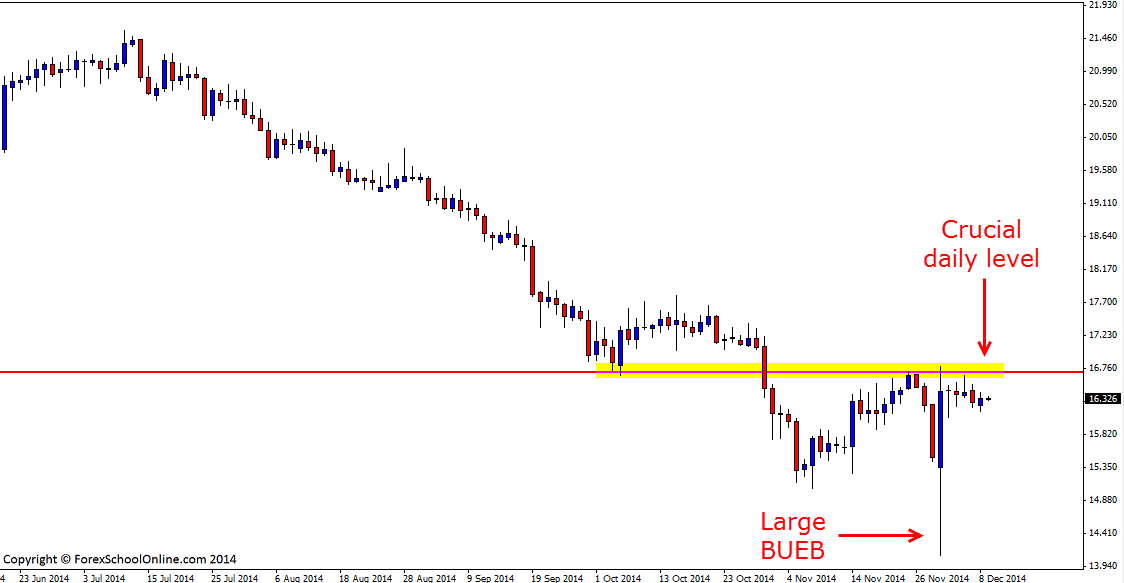

Price in the Silver market has moved up on the back of a huge Bullish Engulfing Bar (BUEB) to be now testing a crucial level on the daily price action chart. This level that is now holding as a resistance, flipped to become what I often refer to in this blog as a price flip level. As the daily chart shows below; price was moving down in a strong trend before price paused and found support. Price then busted through and continued on it’s move lower. As so often is the case this old support level “flipped” and the old support became a new resistance level and whilst the bullish engulfing bar was a big and strong one, the new price flip resistance has stopped it in it’s tracks.

I discuss at length how traders can use these price flip levels, why they are so important and also how to use them to hunt high probability trade setups in the trading lesson here;

Trade Forex Like a Sniper From Kill Zones and Price Flips

After forming the BUEB, price has not been able to break either higher or lower of the engulfing bars high or low. This looks to be important because as well as the resistance being a key level that needs to be broken, for price to make a substantial move higher, the high of the bullish engulfing bar will now also need to be taken out.

The longer this winding up goes on and price consolidates, normally the bigger the explosion is when price does end up breaking out. Price winds up and all the energy compacts. Eventually it explodes into a quick and aggressive breakout. This will be a very interesting market to watch over the coming days and weeks. The momentum overall has been lower for a sustained period of time now, but a break higher through this crucial resistance level could signal a very quick and aggressive move back higher into the space above with opportunities for traders to look for long setups. Stay tuned…

Silver Daily Chart

Leave a Reply