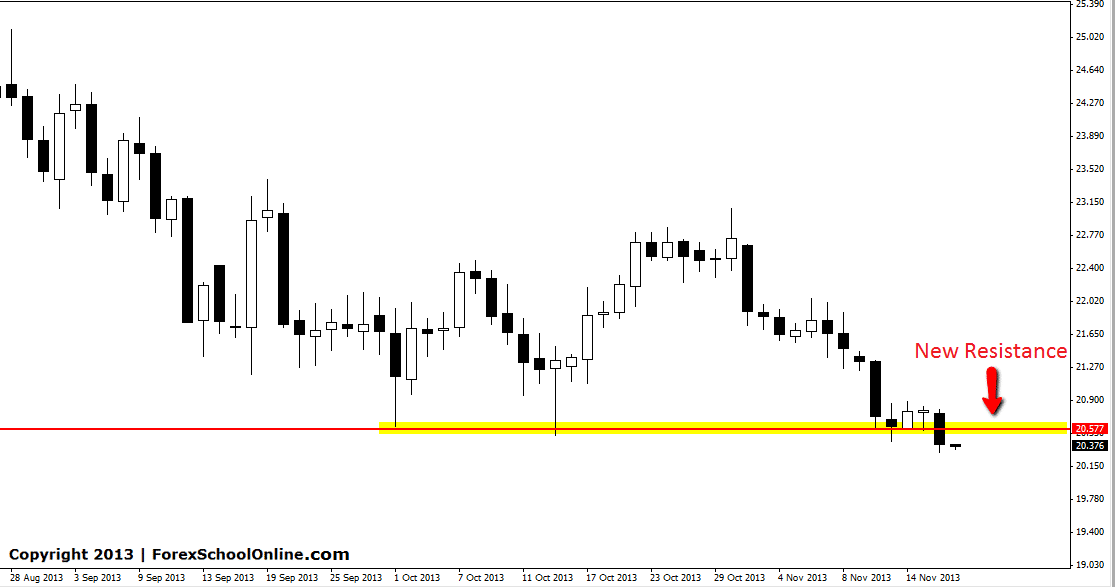

Silver has broken through a key support level on the daily price action chart and and most importantly managed to close below. Traders can learn a lot about where price can and cannot close above/below as I discuss in this article HERE. The 4hr time frame of the Silver chart has fired off a Bearish Engulfing Bar (BEEB) that smashed through this support level ensuring price closed below. This level will now be crucial over the next few sessions as to where price goes and to what traders can do in this market. As long as price stays under this old support level, it could act as a price flip level and look to hold as a new resistance level.

If price moves back higher and into this new resistance level traders could look for bearish price action to trade inline with the recent bearish momentum. To confirm any possible trade there would have to be a high probability bearish price action setup at the key level. Because the pullback level is so close on the daily chart, traders could target trades on their intraday charts. Trading this way would ensure that traders are making a trade from a key daily breakout area, but ensuring that they are making a trade that has space to move into at the same time. My latest educational video explains this and can be watched here: Making Price Action Trades With Space

If price moves back above this level and closes above, it would then flip to become a new support once again.

Silver Daily Chart

Leave a Reply