After covering a bunch of the major Forex pairs on my 27th May 2015 Daily Forex Trade Setups Commentary, today I want to look closely at and go over exactly how you can analyse the live price action on any chart to read the full price action story.

Whilst there is a heck of a lot more than what I am about to cover in this short post, what I want to emphasize in today’s post is that the price action and the area that you hunt your setups is KING, not the last one or two candles you use to enter the trade.

The trigger signals you use as your entry confirmation are also very important and they must meet a certain criteria, but before you even come to looking for the trigger signals you need to make sure that you have a really high probability area mapped out. All good price action trades are built off really great areas and where you are entering the trade on the chart.

The reason for this is simple and you can think of it like this; when you are entering from great spots on the chart and you are entering from really great areas of either high supply/demand you are putting yourself on the right side of the market when the banks and other big guys are making their moves.

Alternatively, when you do the opposite you are going to be entering when the big guys are just leaving and this is why we concentrate on the AREA first and foremost and then on finding the best trigger signals at the killer areas. To read about exactly how you can do this, the time frames and the routine you should be using, please see here;

The Ultimate Guide to Support and Resistance

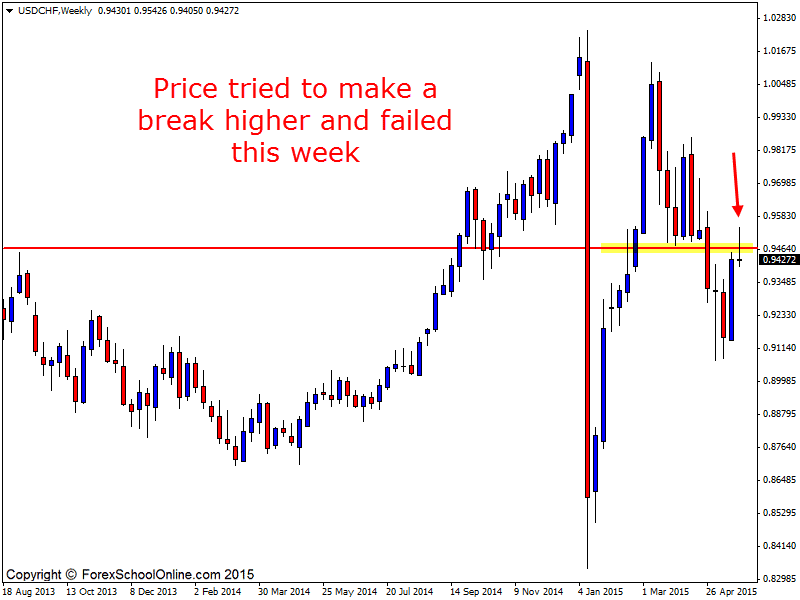

Below you can see the USDCHF weekly, daily and 1 hour charts. The weekly chart shows something pretty important this week in that it has tried to make a move higher and through the major resistance level. This is important information. We can see and know that at this stage the resistance level is holding strong and the bears are still in play.

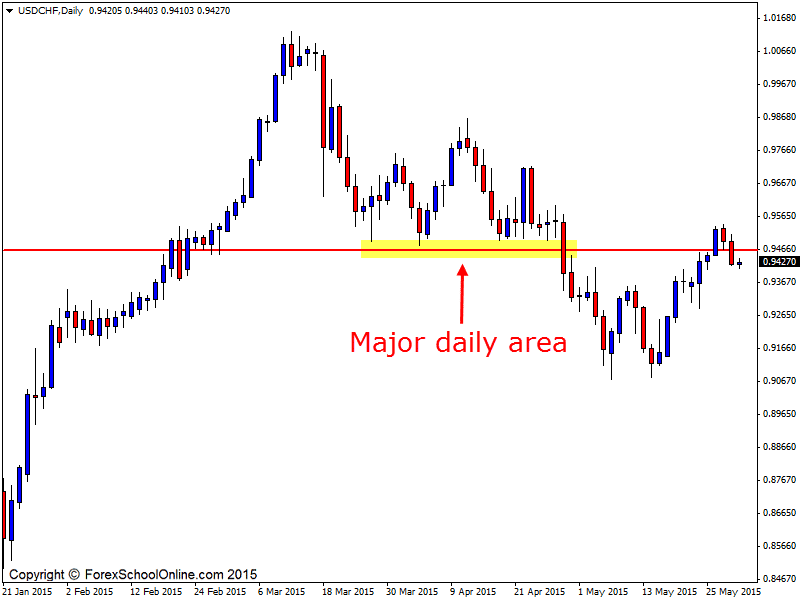

Price had made a strong move higher on the daily chart. If you look at the daily chart you will see it made a double low where price tested the same support level twice just recently before making the most recent run higher. This run higher was strong and looking to burst straight through the resistance, but price is back below and once again at this stage the level remains valid and intact.

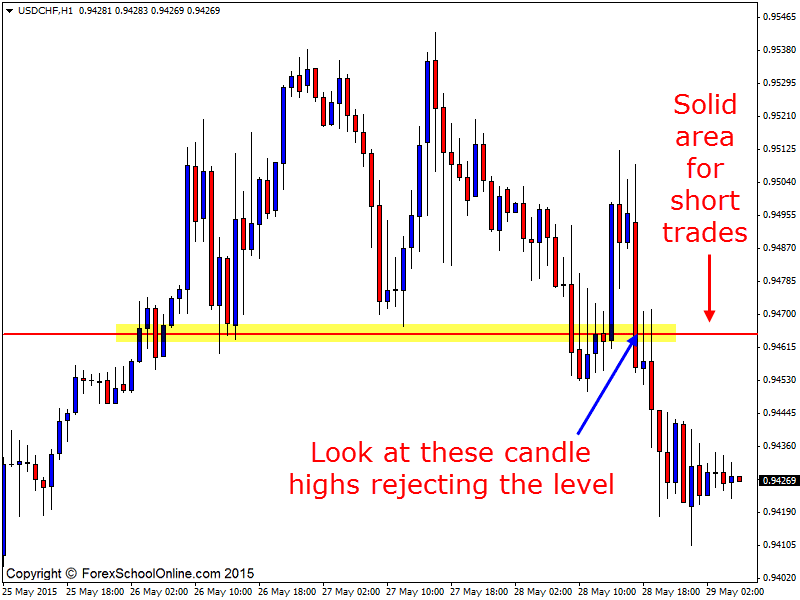

The intraday 1 hour chart really tells us a story. This is where we can see how strong this level is and this is often the case. You will notice on the chart below that I have marked it to highlight it for you. Once price broke through and lower below the major support, price made a quick retrace on the 1 hour chart to test the resistance level. Notice the two candle highs rejecting the level exactly.

If price makes another quick retrace back higher, this level would once again be a very solid level to watch the price action for potential short trades.

These are the types of levels on other charts, not just Forex that you can learn to hunt on both the daily and intraday charts to make very high probability setups. Obviously there is a lot more that does go into it, but always make sure you keep firmly in your mind that the price action area is the KING.

WEEKLY CHART

DAILY CHART

1 HOUR CHART

Thanks for the insights.

I actually drew my S/R line a little higher than yours in the Daily chart, and when I look at my H1 chart, it seems that the my line is much higher than yours, such that all the price seems like they have not reach my price action area.

May I ask, when we want to see rejection of the price action area, do we have to really see the PB/EB/2BR passes through the S/R lines we drew,, or as long as they are close enough we can say that they are rejecting the area?

Hi Gary,

it depends on what we are looking for and in what scenario or situation….

For example; if we get a pin in a range that just touches a level and not really push up and into it, then this could be a real concern.

Think of it this way; when price such as a pin bar moves up and then snaps back from an area it is activating a bunch of either buyers or sellers depending on whether it is coming from higher or lower and so when we see the reversal signal reject right up and into an area it is a really good thing.

Safe trading,

Johnathon