It has been a huge week in the markets with price making a lot of moves. With tension and uncertainty in the world, brings the same thing to the markets.

If people are uncertain or they are scared they tend to react and do the same in their trading positions and move into safer positions. You see this in the markets and this is EXACTLY why we trade the price action and NOT the NEWS.

We can learn and trade what we need from the price action. If something happens, say for example; an announcement comes out, price will move fast, and aggressive and we will see this in the price action.

The question around this I get all the time is; if I don’t watch the news and don’t follow announcements; won’t I get stopped out all the time because I won’t be following when the president makes the next announcement or some other news drops? To make money you need to have an edge over the market.

A price action traders edge is the live price as it is coming out onto the charts… this is the information from other traders. These traders are moving price higher and lower, buying and selling.

This is what moves price and that’s why you use it to create your trading strategy and hunt trades.

The reason why price can often go in an odd direction to what you may expect at times to an announcement is because announcements or news do not push price, traders do and you are trading this information direct from your price action charts.

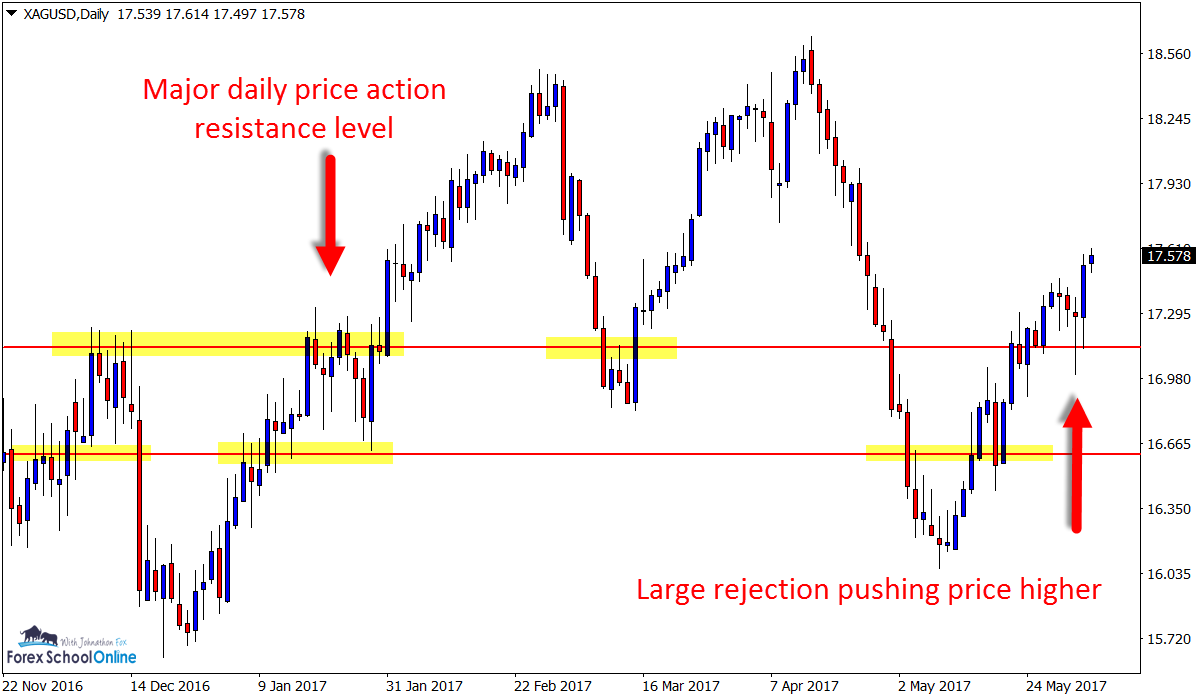

Silver Daily and 4 Hour Chart

The first chart (the daily chart) below shows this picture pretty clearly in this market and how after moving down to the extreme lows price has then rebounded back higher with aggression.

On the daily chart we have a mini 1,2,3 pattern and I say it is a mini pattern because there is no real swings in the middle part. The move has been so strong price just turned and continued on.

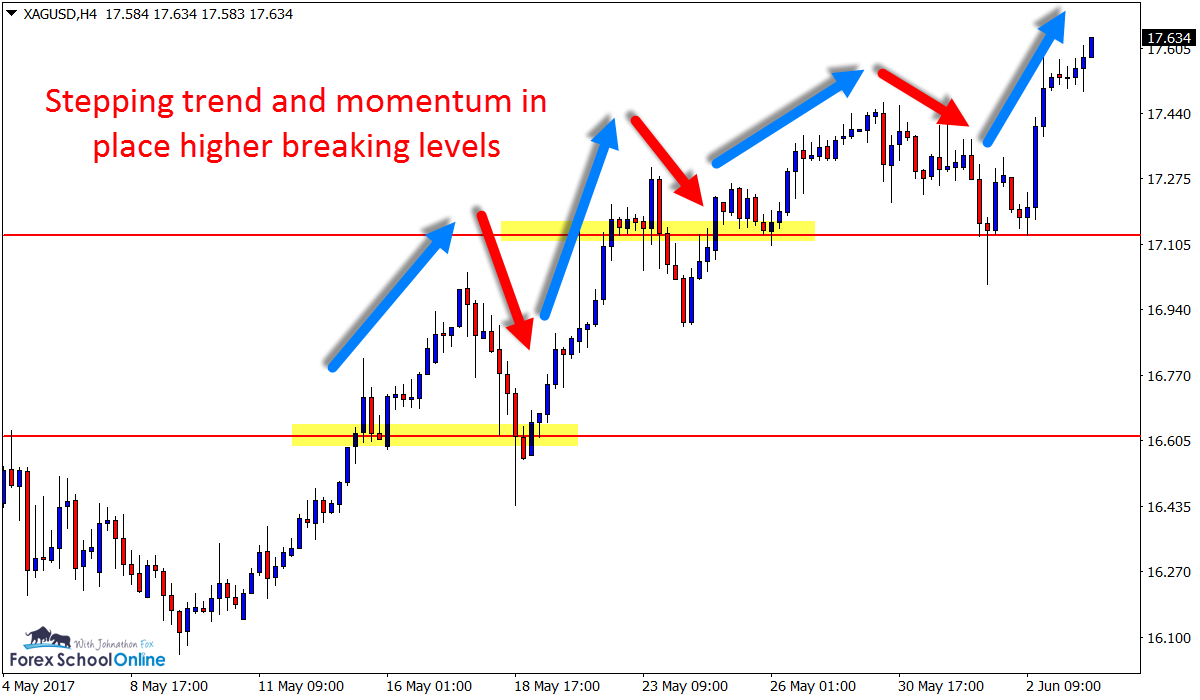

As so often happens if you check out the 4 hour intraday it shows a great picture and trade setup at the major support that is also inline with this momentum higher.

This pin bar is sticking out and away and has a large nose clearly rejecting lower price making an A+ trade setup.

Silver Daily Chart

Silver 4 Hour Chart – Showing Stepping Trend Higher

Silver 4 Hour Chart

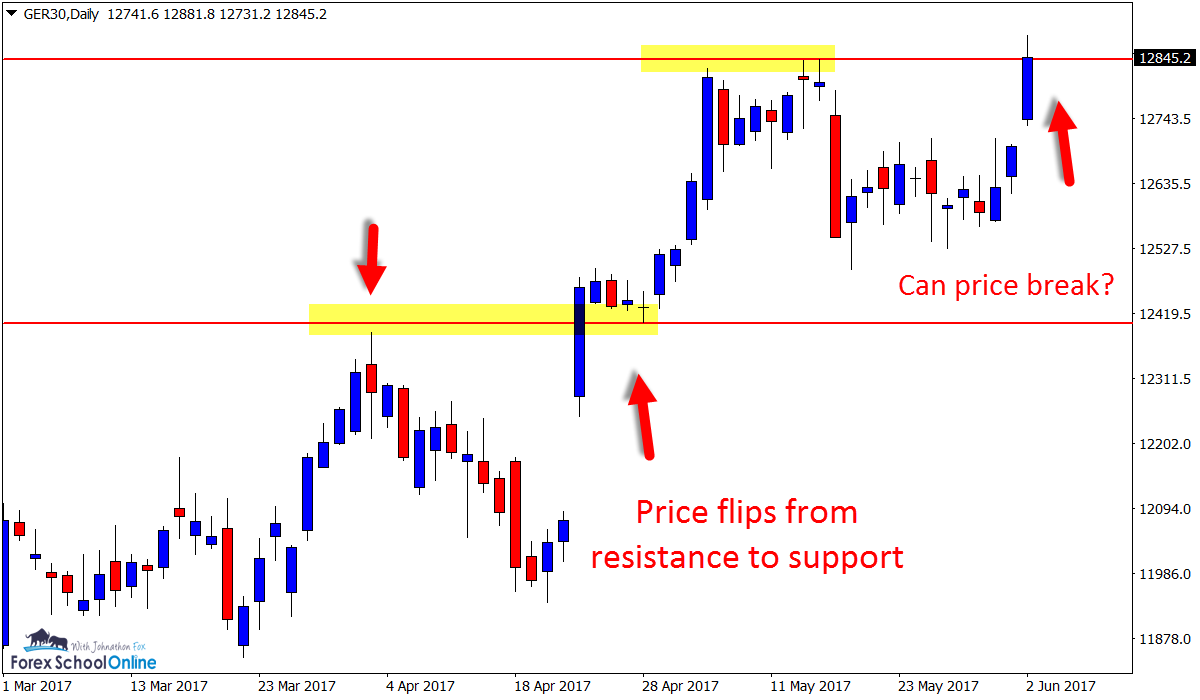

Germany 30 Daily Chart

I rarely discuss this market in the public ‘charts in focus’ and normally keep it for the summary in the student’s area. However; as you can see from the chart below I have created for you; price action is making a huge attempt at breaking this major daily resistance level.

If price can breakout and close above this level, then looking for long trades – especially with this breakout momentum could be a potentially high probability play. Looking for quick pullback and retrace setups back into this level to go long could be a real watch this week…

Germany 30 Daily Chart

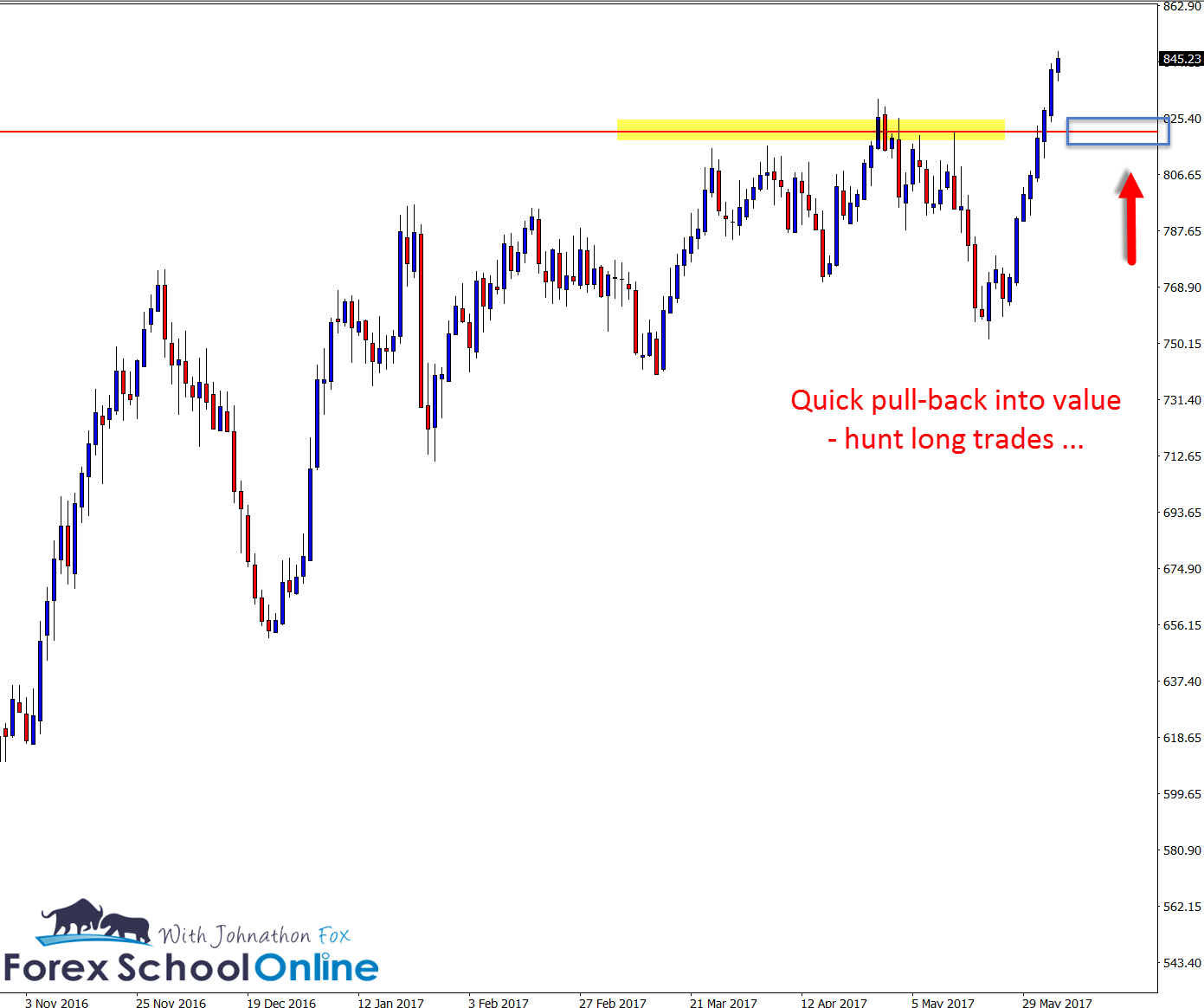

Palladium v US Daily Chart

This last market is a straightforward watch and trade market.

A strategy we often deploy because it is a super high probability strategy is the first test price action strategy and it could be used here if price makes a retrace back into the old resistance and potential new support.

If that happens, then we could look for A+ trigger signals to get long with the recent strong leg higher as you can see on the chart below;

Read about the first test strategy here: Making A+ Trades at the First Test of Support or Resistance

Palladium V US Daily Chart

I really want to join trading but my problem i’m running out of moola but i heard that their is scheme that loan or borrow u money to start ur business aftr u improve u pay them back so my question is which one can i used it that it loans me?