If we mark our major support and resistance levels and ‘kill zones’ correctly, then we can be presented with the potential to get into high probability trades on many different time frames including smaller time frames.

Whilst we are marking our major levels on the daily charts, we can use these same levels to hunt for trigger signals on smaller time frames such as the 8 hour, 4 hour, 2 hour, 1 hour or even smaller time frames like the 15 minute chart if you are comfortable and you have proved yourself profitable on the higher time frame charts.

I do not move to any charts smaller than the 15 minutes as I find that the 15 minutes still provides a happy medium of price action you can rely on and enough time to make quality decisions. If you have not yet proved yourself on higher time frames and are not yet making profits on higher time frames, then read this here;

Trading Daily Chart Price Action Strategies Down to the Intraday Time Frames

Hunting trades using levels from the daily charts ensures that no matter what time frame we are on whether it be the 8 hour chart of the 1 hour chart, we know we are making a trade from a major level. What I want to highlight today is something that a lot of traders get confused about.

Quick Lesson on Marking Levels More Precisely

The lesson on the routine, time frames and order of marking your major support and resistance levels if you need to quickly read over it can be found at; The Ultimate Guide to Support and Resistance

Whilst we are marking our major levels on the daily charts and then using these levels to hunt our trades on smaller time frames, we are not robots – we are price action traders. Our job is to read the price action story, put it altogether and then trade within it!

What will often happen is the level we mark on the daily chart will not be precise enough for a smaller time frame such as the 1 hour or especially 15 minute chart. If we just leave this level there we will more often than not just watch price move away from our level without us on the trade.

Remember; we are price action traders – our job is to read the story. When we get to the smaller chart, we should adjust the level slightly to make it more precise. You want to ensure that the level is STILL the daily level, but you will often notice that you can make it more relevant to where price is actually going to reject or the recent price flip.

You will often notice matching candle highs and lows all rejecting the same area. So place your level more precisely there.

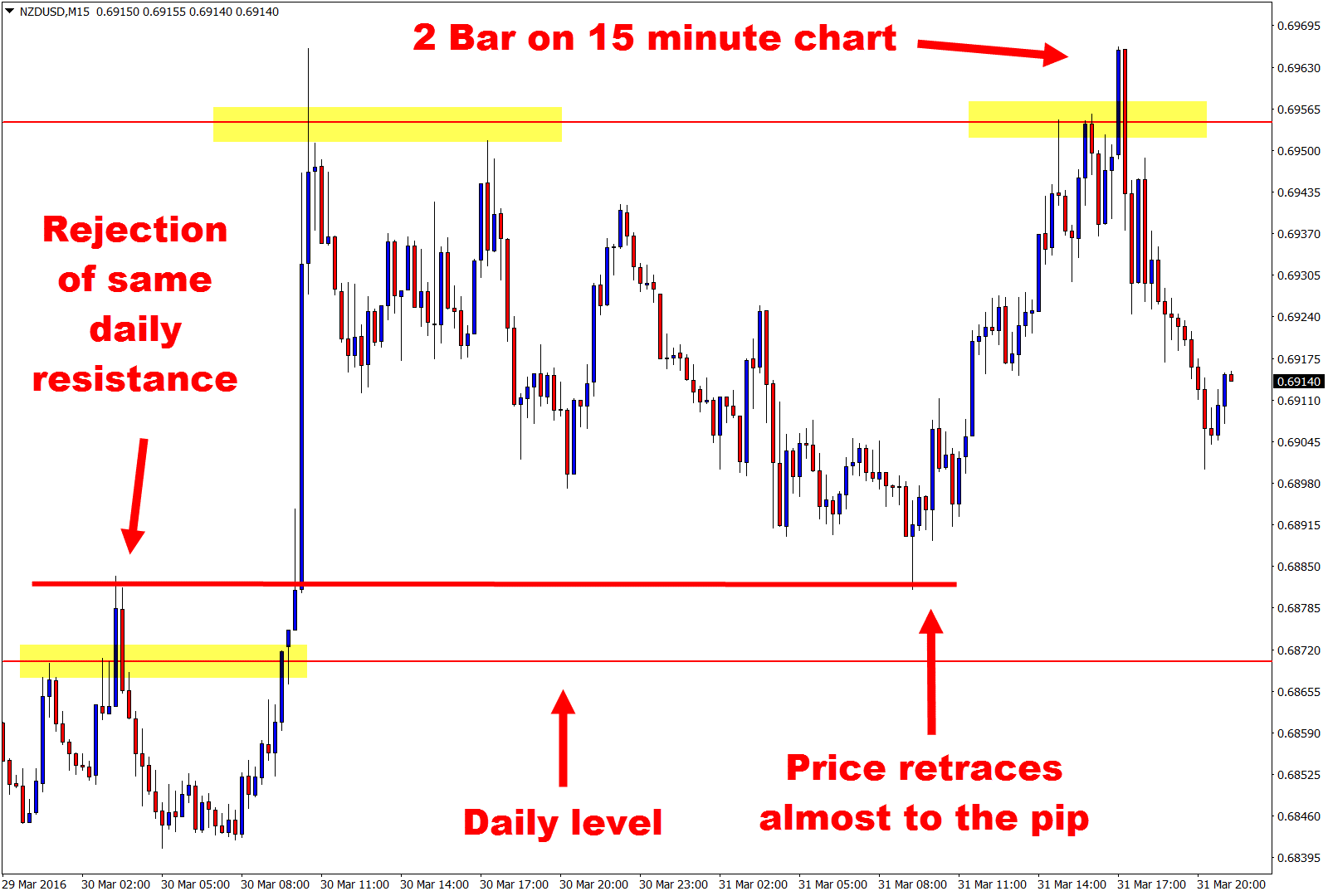

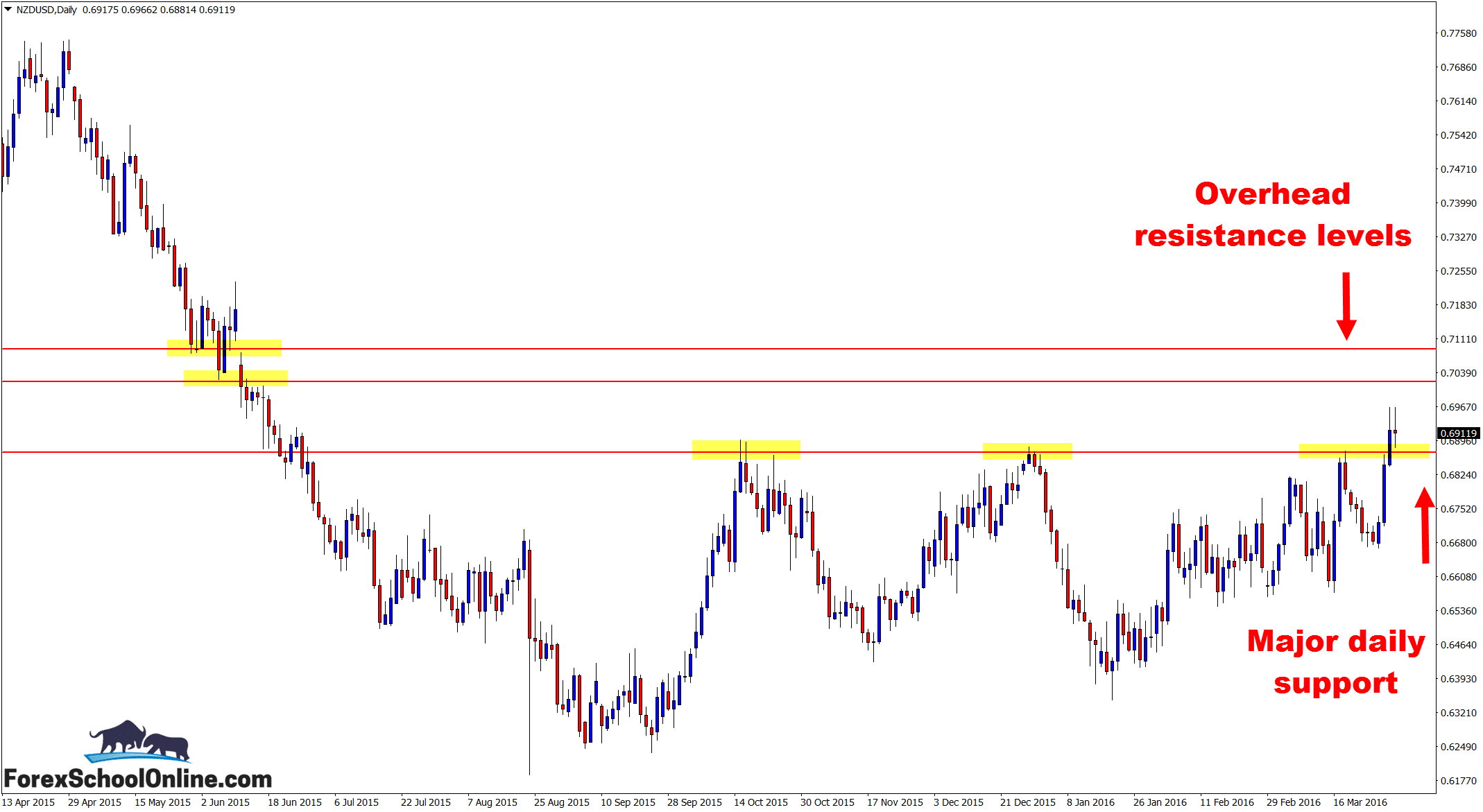

Notice how this works on the 15 minute chart of the NZDUSD; Price broke through the resistance with a strong break, before returning to the new support price flip. You can see on the chart below there are two levels; the first is the daily level, and the second is the level where price retraced to almost to within a pip.

Daily NZDUSD Chart

15 Minute NZDUSD Chart

Related Forex Trading Education

Leave a Reply