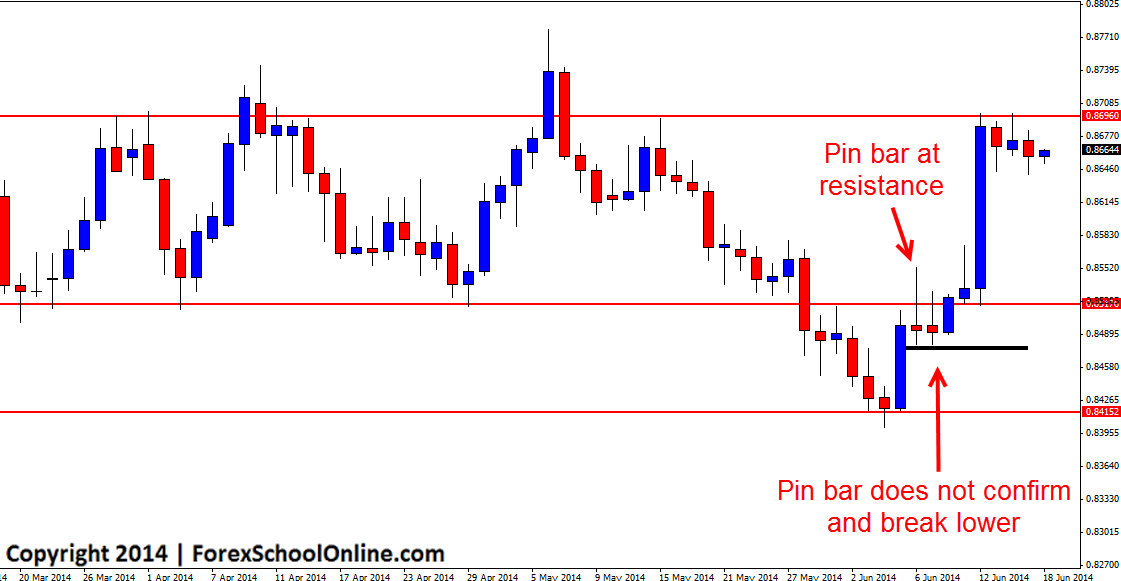

The NZDUSD fired off a pin bar reversal that we discussed in this blog in our 10th June Forex Daily Market Summary. This pin bar was a solid pin bar that was up at the high and sticking out and away and rejecting the key daily resistance level. This pin was also a decent size and if price could have made a break lower, there was space to move into for traders to make solid potential profits.

As we often discuss in this blog and as I teach in the trading tutorial Using Confirmation With Your Price Action Entry Signals price action signals and in particular the pin bar need to be taken at the break, or in other words for entry confirmation, price needs to make a break in the direction of the trade which in this pin bars case would have been a break below the low of the pin bar. If a trader was looking to take this pin bar, they would have had their orders set up with a pending order so that they did’t even have to be at the computer and if price broke below the low of the pin bar they would be activated into the trade.

If price does not confirm the price action signal, then the trader is not entered. When taking the entry at the break, not only are traders trading with confirmation and ensuring that they will not be entered into a lot of losing trades that never go onto break, they are also trading with the momentum on their side because price is trading in their direction. When a retrace is taken, price is trading away from the direction of the traders targets and the direction the trader wants price to go. When the trader takes the retrace entry, they have to hope price turns around to make them a winner. When a trader takes entry at the break, price is already breaking in their direction.

NZDUSD Daily Chart

Leave a Reply