NZDUSD Analysis – Price Makes a Fresh Bullish Move Out of Depression

NZDUSD makes a fresh bullish move to counter bearish activities and drive price back through to the consolidation zone.

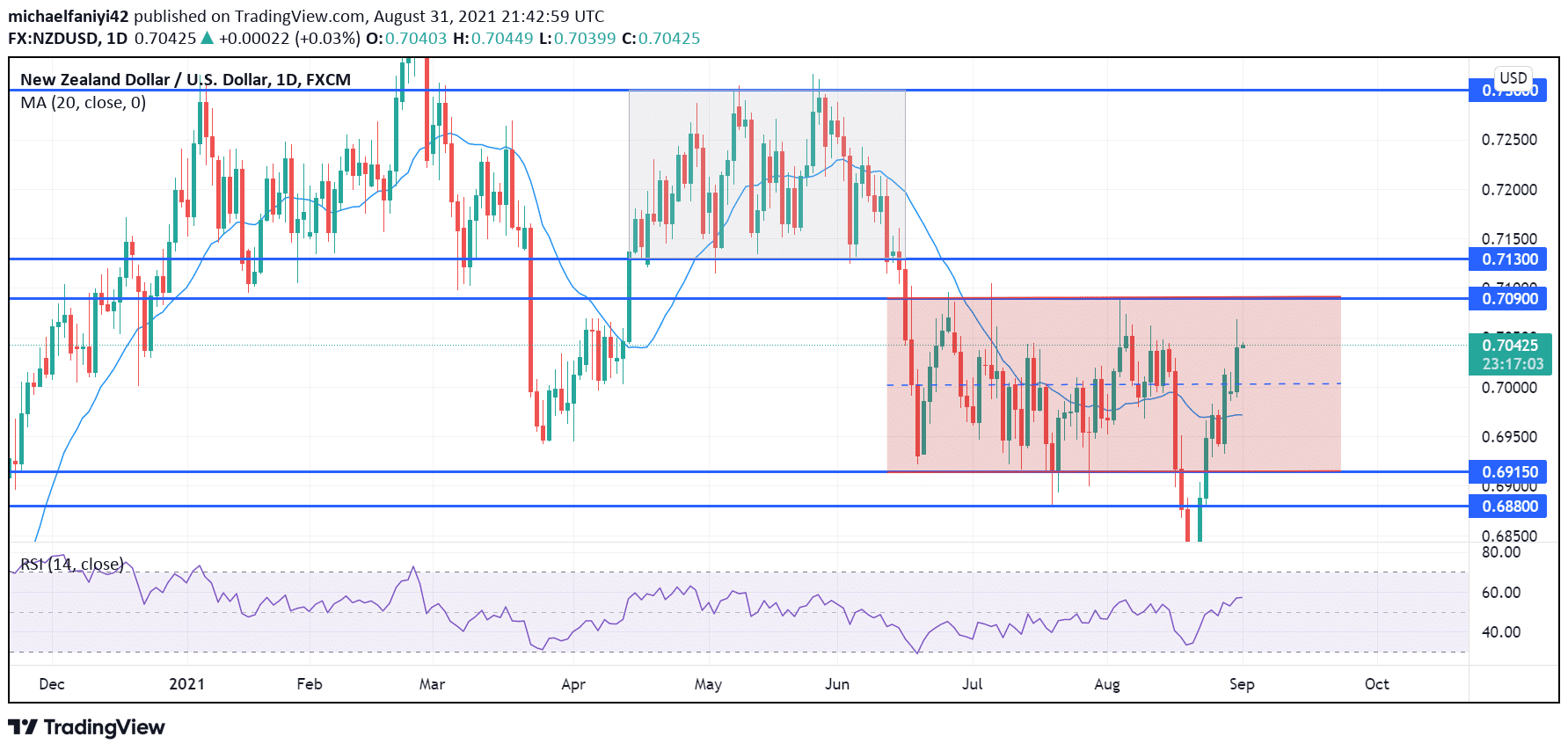

The market has been submerged in consolidation for up to 9 weeks before sellers plummeted the market beyond the consolidation zone. Price thus slumped below the 0.69150 and 0.68800 support levels. But the 0.68080 support was on hand to halt and reverse the market upwards.

NZDUSD Significant Zones

Resistance Levels: 0.70900, 0.71300

Support Levels: 0.69150, 0.68800 Sellers always had the upper hand as price cranked in the consolidation zone. The market traded more in the lower half of the ranging zone than in the upper half. The pressure eventually made the consolidation support bulge and on the 17th of August, bears drilled through a weakness to go lower. The falling intensity of the market was so great that it drilled through the two supports that kept price up.

Sellers always had the upper hand as price cranked in the consolidation zone. The market traded more in the lower half of the ranging zone than in the upper half. The pressure eventually made the consolidation support bulge and on the 17th of August, bears drilled through a weakness to go lower. The falling intensity of the market was so great that it drilled through the two supports that kept price up.

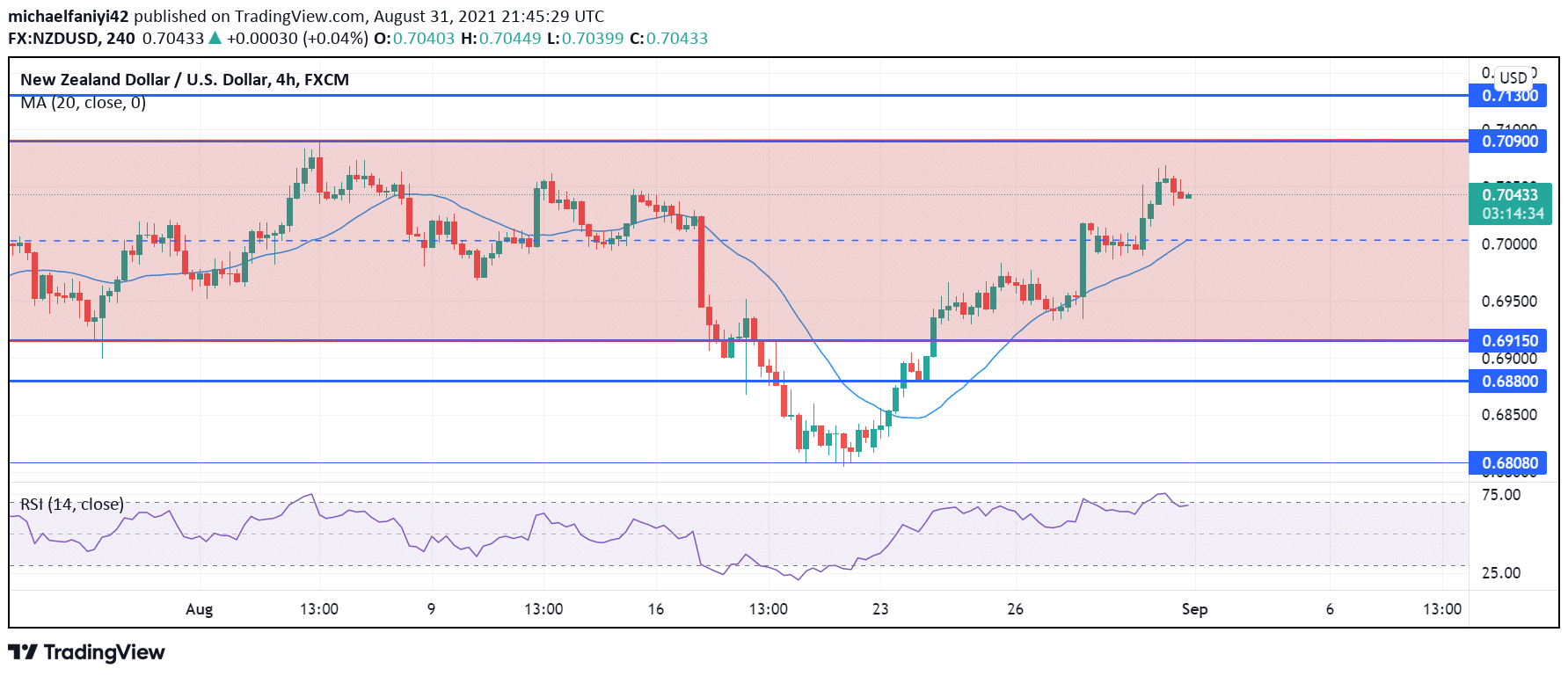

By the time the market dropped to the 0.68080 key level, the intensity of the market had reduced, which made it easier for price to be driven back. There is now a fresh trial by the buyers on the market. The market sprung up from 0.68080 and has now almost reached the upper border of the consolidation zone. The signal line of the Relative Strength Index has also surged up from the selling half of the chart to the 58.50 mark in an upturn of bullish vigor.

Market Anticipation

Market Anticipation

NZDUSD, therefore, makes a fresh bullish move in response to bears plummeting the market. On its way up, the market rebounded from 0.68800. There was also some disturbance at the channel’s mid-level, but price has overcome that to continue the bullish movement. NZDUSD will increase to 0.70900, where bears will also react to the market.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply