Market Analysis: NZDUSD Anticipates a Potential Bullish Reversal

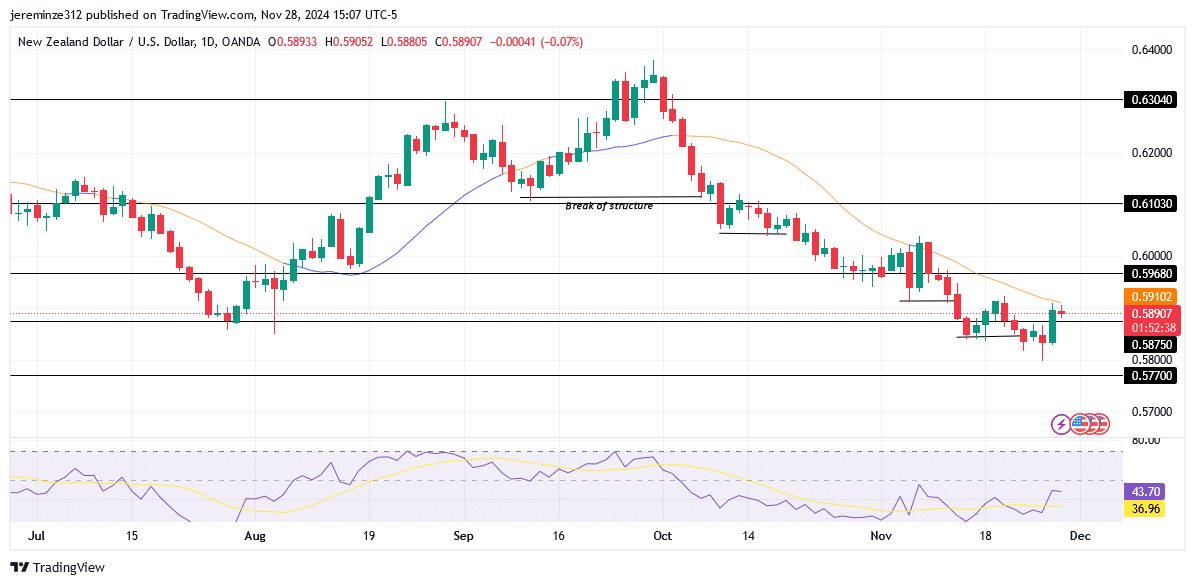

NZDUSD, in early October experienced a significant bearish shift in market structure, leading to a sharp decline in price. The downtrend continued as the pair formed successive lower lows, eventually breaking the critical 0.58750 demand level, which had previously acted as a key support. The breakdown of this level marked a crucial point in the continuation of bearish momentum.

NZDUSD Significant Zones

Resistance Levels: 0.59680, 0.61030

Support Levels: 0.58750, 0.57700

Following the breach of 0.58750, price action showed signs of recovery with a sharp upward movement, indicating the potential formation of a new major low. This recovery coincided with increased bullish momentum, as reflected by the daily Relative Strength Index (RSI). The RSI’s upward trajectory, coupled with a bullish candle, signals growing buyer interest at this stage of the market.

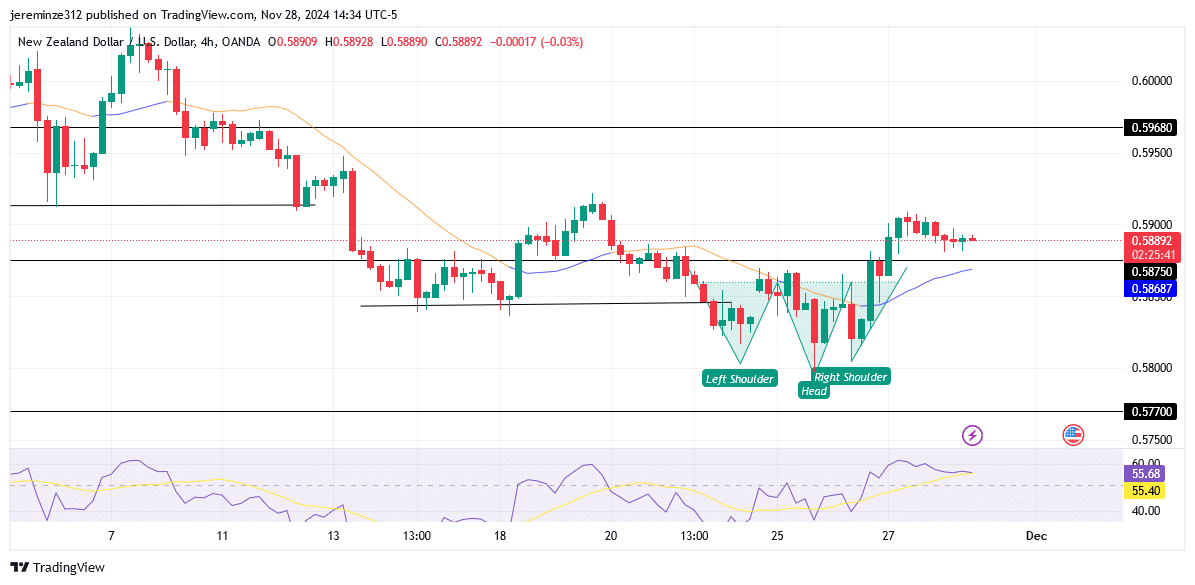

A closer look at the 4-hour chart reveals the development of a reverse head-and-shoulders pattern, a technical formation that often signals a potential short-term trend reversal. This emerging structure suggests a shift in price dynamics, with buyers gradually regaining control in the short term.

However, despite these bullish signals, the overall market trend remains bearish. The current upward move appears to be a significant retracement within the broader downtrend rather than the onset of a sustained bullish reversal.

Market Expectation

For a confirmed trend change, price action needs to decisively break and hold above the daily Moving Average, supported by sustained RSI strength on the daily timeframe. Such a move would bolster the case for a broader bullish shift. Price will face significant resistance levels along the way, but a successful breach of these areas would enhance the likelihood of a sustained bullish trend, as highlighted by forex signals indicating increased buyer activity.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not for your investing results.

Leave a Reply