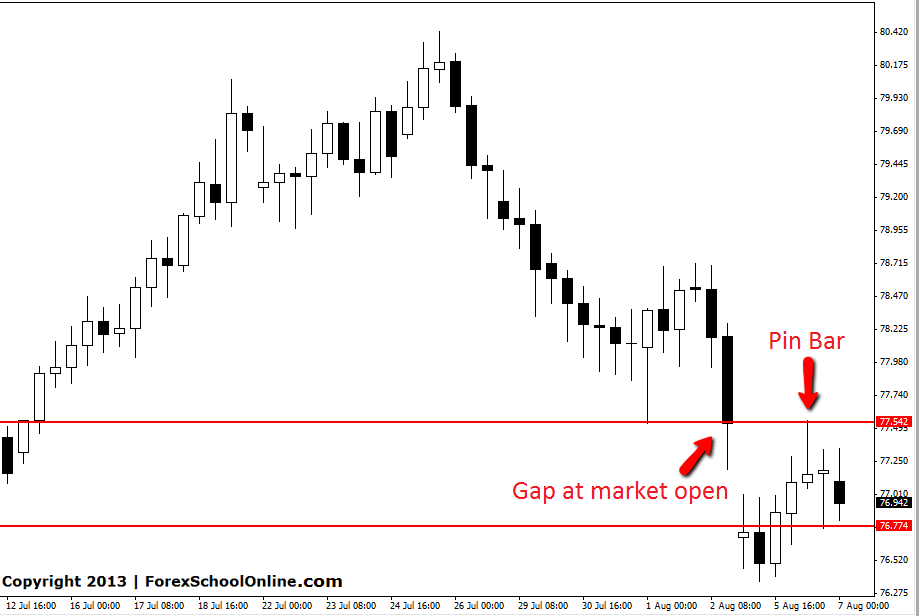

When the NZDJPY opened on Monday morning it had formed a large Gap lower. Gaps can quite often act as support and resistance. When price moves up to test gaps, price can often produce reversal candles rejecting the gap and moving in the opposite direction. In this case price moved higher to test the low of the gap and formed a solid Pin Bar reversal on the 8hr price action chart.

After forming this Pin Bar price moved lower and has now moved into the super close first support level on this pair. These sorts of gap closing trades can present high probability trades when they ling up with support and resistance. Traders reading this could in the future look for gaps on the Monday morning and when they are looking to be closed watch the price action on the intra-day charts to see if the price action is giving any hints that it wants to reject that gap and move back the other way.

NZDJPY 8HR CHART | 7TH AUG 2013

thanks jon