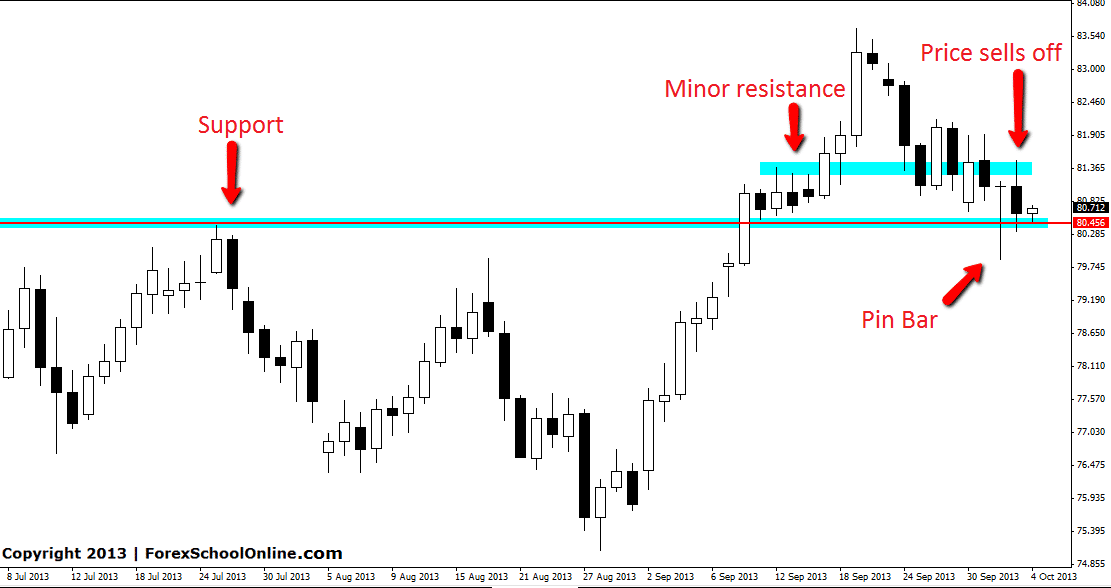

In yesterdays commentary we posted about a Pin Bar that had formed on the daily price action chart of the NZDJPY. You can read the original post here: NZDJPY Fires Off Pin Bar Reversal. As discussed in that post there was a minor resistance level that was sitting overhead this pin bar that was a major concern for any push in price moving higher.

Price did move higher and into this first resistance area before rejecting and selling off. These levels can often cause headaches for traders if the traders are not educated enough to understand where they in the markets and how they work. Price action trades are often trading into minor support or resistance levels such as these and a solid education is needed.

Price has now closed well lower and close to the session lows, but still above the daily support level. Price is now caught in between the resistance that price has just sold off from and the support level that the pin bar found support at. The best play could be to sit on the sidelines and let price break either way before then looking for trades in the direction that price breaks.

NZDJPY Daily Chart

Not just that minor resistance area you have mentioned is a concern but also the choppy boxing area overhead is a threat .Such trades are no no .