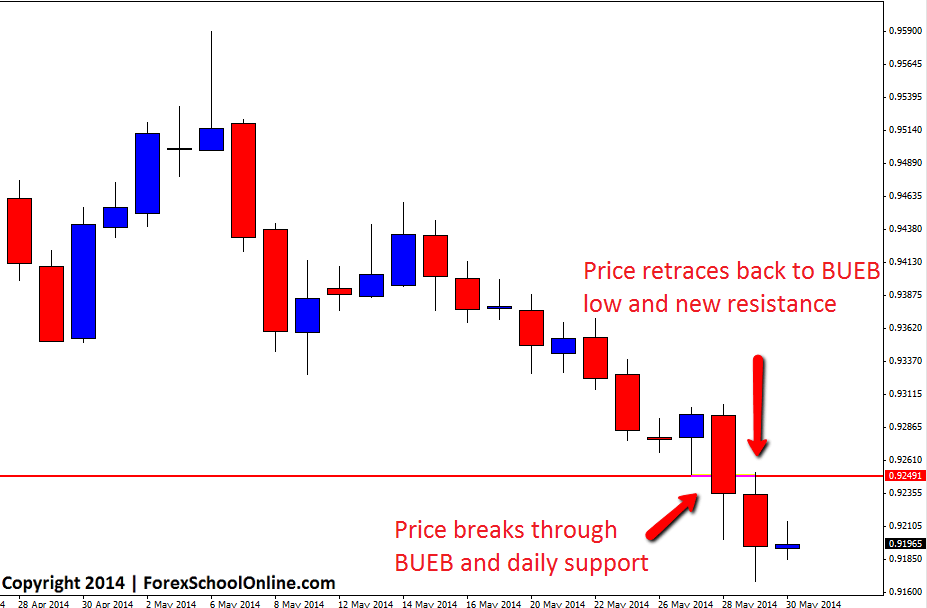

After posting in our 28th May Daily Forex Market Commentary about the Price Action Engulfing Bar on the NZDCAD that had set up, price went on to breakout lower with the current momentum and through the low of the bullish engulfing bar. As we suggested in that commentary; that engulfing bar was a very small and weak setup and traders were best advised to either look for price to pull back higher into the near term resistance and look for short trades, or for price to breakout lower through the low of the Bullish Engulfing Bar (BUEB) and then hunt for short trades with a breakout/retrace setup on their intraday charts.

Once price broke the low of the BUEB, price did make a quick retracement back higher and into the old daily support level which was also the low of the BUEB. This is a very common high probability pattern in the Forex markets that repeats time and time again where price breaks a key level and then quickly retraces to test it again before continuing in the same direction.

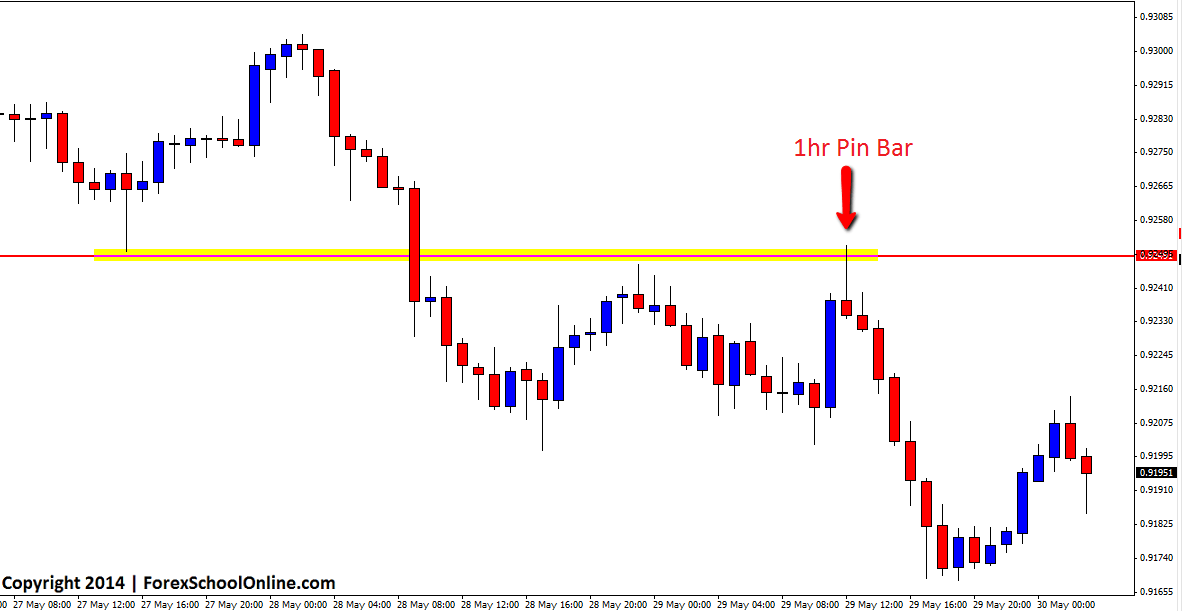

At this old support/new resistance price action flip level, price formed a textbook pin bar on the 1hr chart. As the 1hr chart shows below; this pin bar was sticking up and away from all other price like the best pin bars do and was from a clear swing high. After confirming the pin bar by breaking through the lows, price has since made a substantial move lower.

NZDCAD Daily Chart

NZDCAD 1hr Chart

Related Forex Trading Articles & Videos

– Start Using Smart Forex Money Management That Actually Works

nice good job