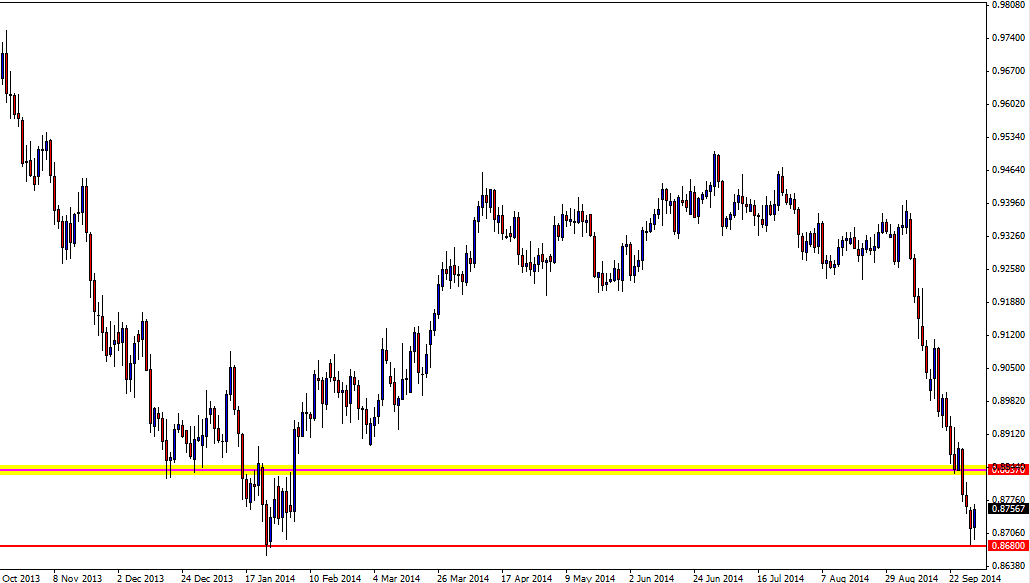

The AUDUSD or Aussie as it is commonly known has been absolutely smashed in recent times with price falling over 600 pips in just the last 3 weeks on the daily price action chart. From a high at the round number of 0.9400, price fell of a cliff and in the past few weeks there has been very few retraces or rotations back higher into value, with price making a large, aggressive and sustained move lower as the daily chart shows below.

With these obvious strong moves it is best to normally try and trade with them, rather than try and pick the top or in this case the bottom. A huge, but very common mistake retail traders make is often trying to fight these very obvious moves and trying to pick the tops and bottoms. The retail trader goes in with the mindset of that “price is overextended and it just has to reverse at some stage” or that “because price has moved so far it just has to turn around”, but the market is based on fear and greed and not on logic.

The market can continue going in the same direction far longer than what most traders can continue to keep picking tops and bottoms and losing. In other words; Don’t underestimate the market and what it can do and play the trading probabilities. If there is an obvious move in place, then trade with it and keep trading with it until price shows signs of change and when price shows otherwise, then change tact.

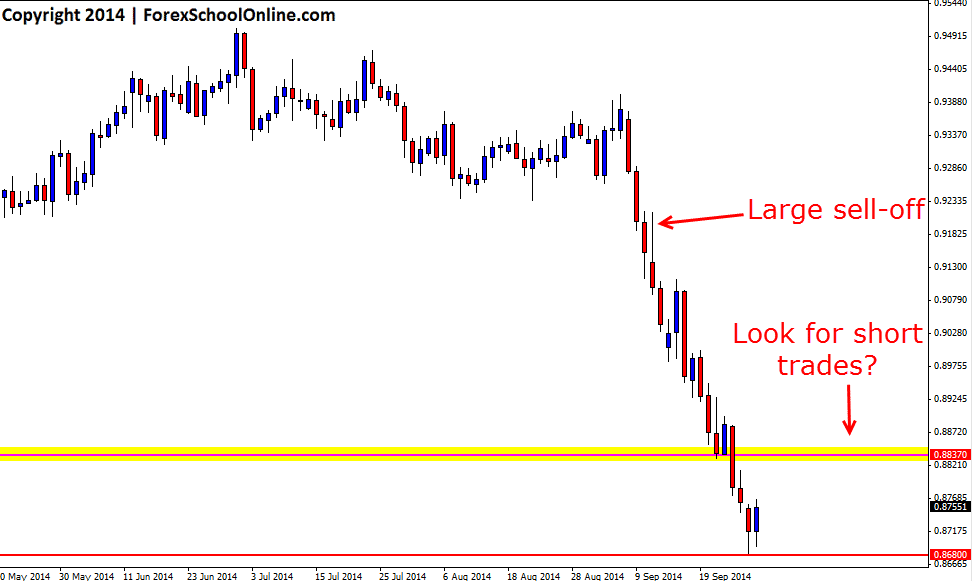

With this in mind; whilst this strong move stays in place traders could look to get into the move lower from points of value. For this to happen traders would need to target their trades from key levels within the down move and from key retrace points. As shown on the daily chart below, price is now making a move higher and could move into the near term daily resistance which could present traders with an opportunity to hunt short trades on both their daily and intraday charts. For any potential setups traders would need to see a high probability bearish trigger signal at their key levels.

Daily AUDUSD Price Action Chart – Zoomed Out

Daily AUDUSD Price Action Chart

Leave a Reply