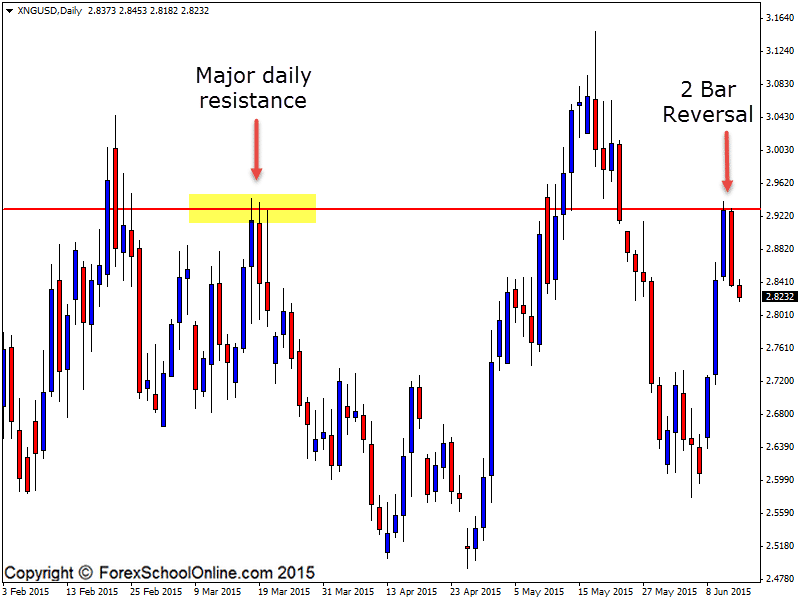

The Natural Gas or XNGUSD has fired off a Bearish 2 Bar Reversal on the daily price action chart. This 2 bar reversal is sticking right up and out higher away like the best 2 bar reversals should be.

A major mistake that a lot of traders make when trading reversal trigger signals is that they play them when they are not sticking out and away or they play them when they are not protruding out from all other price. Because reversal signals such as the 2 bar or pin bar are reversals, they need to be traded to ‘reverse’ and that means traders need to trade them from swing points. I discuss this in-depth and how traders can find the correct swing points in their trading in this trading lesson here;

Trading Reversal Signals From the Correct Swing Points

This 2 bar reversal is sticking up at the high and rejecting a major daily resistance level. As I am now writing this post up for you, price is trying to break a minor support level that it is sitting on top of.

If price can break lower and gain momentum, it could then fall lower and into the next major support around the 2.760 level. If price fails and rotates back higher, the high of the 2 bar reversal is going to be the main resistance that price will look to attack again and this would once again be a level that you could look at for more short trades.

Daily Chart

Leave a Reply