How You Can Make $1,000 Every Month Trading Forex

I talk to a lot of traders throughout the week and most of these traders have a major goal to become a full-time trader. The traders who are not looking to become full-time, normally either love their job or are of the retirement age already.

Most others generally who trade have their end goal as leaving what they are doing and becoming their own boss. These traders have this vision in their mind and constantly visualize how it will be when it happens.

These traders visualize not getting up early in the morning to go to a job they no longer want to go to, not listening to a boss they no longer want to listen to, and being able to do whatever the heck they want to do for the whole day, the whole year – and their whole life for that matter.

They will also be able to make as much money as they want to based on how good (or bad) they are in front of the charts.

Barcelona to London!

A little while ago, I was down in the city of Adelaide and I saw a heap of cars waiting outside an above ground car park that was full. This car park clearly had all it’s lights and signs “Flashing” that it was full and these drivers were waiting 45 minutes at a time for one car to come out, so that one car could go in. At one point, there were cars parked on the busy road with traffic. (If you are wondering what on earth was he doing watching parked cars for 45 minutes, I was at the hospital visiting someone).

It is these sorts of incidents, as well as really long daily commute times, that push peoples’ limits and to start asking the big questions, such as “there really must be more to all this than sitting in a car for 45 minutes waiting for one to come out.”

I mean just read about this guy here, Sam Cookney, who commutes daily from Barcelona to London because he has worked it out that it is a lot cheaper for him to fly daily from Barcelona and rent a 2 bed flat, than stay in London and rent a 1 bed. That’s NUTS! Someone needs to teach him how to trade.

Whilst becoming a full-time trader is the major goal and end state for the majority of traders, to get there takes a couple of things.

The first thing is obviously experience. To become a full-time trader, you need to have a certain amount of experience and time in the markets under your belt. The last thing you want is to be trading full-time for an income without a bank and experience to call on. What does experience give you? It gives you perspective.

You have been through the ups and downs and most importantly, you know how to deal with them when they come because of previous experiences. You also learn other things leading up to going full-time, such as how you should be dealing with your money outside of your trading and how your trading accounts should be set up. All these others little things that are just as important for you to become a success are things that you will learn along that way and cannot be short-cut.

The other thing you need is a decent trading account balance. This is something that traders often WAY underestimate time and again and are never realistic with. If you have a $5,000 trading account balance and you want to make $50,000 that year, you would have to make x10 account. Realistic? No.

Obviously, the bigger the trading balance, the easier it becomes because of the smaller returns you need to make serious cash. This means you need to find less and less trades to make really good cash.

For example, if I have a $5,000 account and am risking 2% on each trade and I make a 1 risk reward winner, then I would make $100. It would take a lot of these winners to make $50,000. However, if I have a $1 million dollar account and I risk 2% and have a 1 risk reward winner, then I would make $20,000.

What if You Could Make $1,000 Per Month?

What if, before we got to full-time trader stage, we could make $1,000 per month? $1,000 is a lot of money. $1,000 per month is a mortgage repayment or savings for an end of the year holiday. It could go toward helping to buy a car at the end of the year or education each month for the kids.

You could also keep every cent of the money and continue to snowball it, building it larger and larger for your full-time trading fund. This is the quickest way to move from this stage to the next full-time stage. You can just use the magical power of compounding interest and continue to build.

This is the in-between stage. It is the stage where you have picked a method and you know you want to stick with it. You know this method is for you. It suits your style and now, it is just about crafting and perfecting it to make it your own.

Often, in this stage you are profitable, but you are lacking the two key ingredients that I discussed above to move into the final stages or the end state of becoming a full-time trader at this point, so you can aim to move into this stage which is consistently banking away $1,000 per month.

NOTE: You don’t have to have $1,000 as your target or the figure you want to make each month, it is just the premise and discussion for this lesson. As we know; we are all at different stages in our trading. Everyone started their trading journey at different times, everyone has different amounts of money available to them to trade with and everyone has different personal situations which also makes a huge difference because some people have to work and have families, whilst others can spend a lot more time concentrating on their trading.

You might set your figure at $100 per month to start with or you could go the other way and set it at $2,000 per month. Once again; we need to keep in mind things like; what one person would need to make trading each year to live comfortable is completely different to what someone else would need in another part of the world

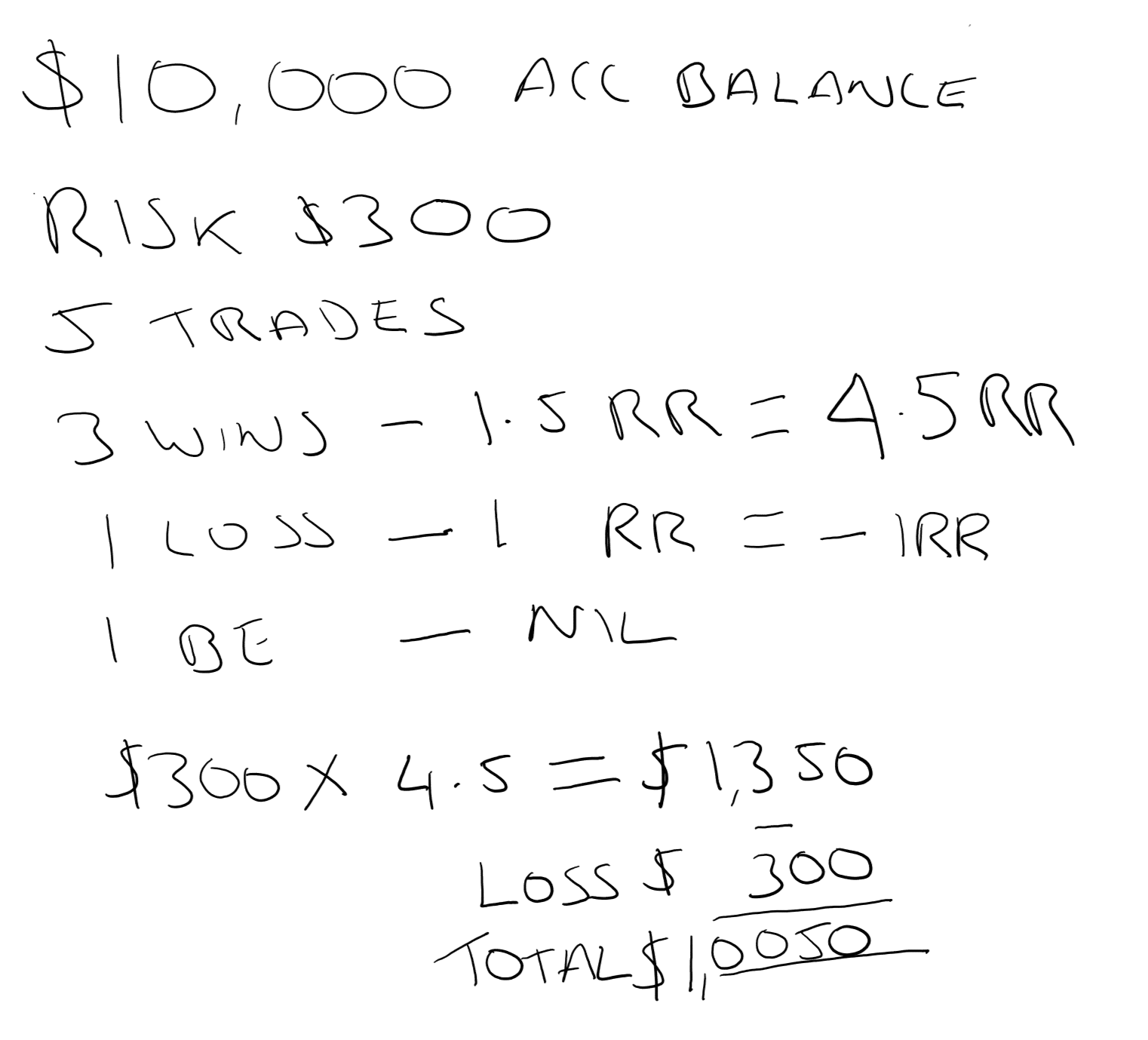

Below is a super rough drawing, which shows how $1,000 could be made per month using a $10,000 account. This is obviously very hypothetical and not taking into account a lot of factors. Some months, you may not be able to make many trades; some months there may be lots of trades. Some months, you may have a losing streak. Some of you out there will have bigger accounts than others, which will make it easier to make $1,000 per month.

Rough Figures Using $10,000 Trading Account

The trader above has a $10,000 trading account and for the month, made 5 trades. For these 5 trades, there were 3 winners, 1 loss, and 1 break even (BE). Each of the winners resulted in a 1.5 risk reward.

You can see from the above figures that a trader with a $10,000 account could make only 5 trades per month and still make $1,000 per month. This is highlighting that it is not about how many trades you are making, but the trades that you make when you make them.

These trades could all be found on higher time frame charts such as the daily, 8 hour and 4 hour charts without going anywhere near smaller time frames and they could all be found whilst still having a day job. Once you are profitable and comfortable on the higher time frame charts, you could then look at adding in extra time frames which would then add more trades per month which is obviously extra potential profit or loss. I discuss how important it is to do the process correctly and not jump the gun in the trading lesson;

Trading Daily Chart Price Action Trading Strategies Down to Intraday Time Frames

What really hurts traders accounts is losses because they are then trying to scramble back to positive territory and these figures highlight this. Some of the best positions you will be in are neutral – in other words, flicking past a chart and onto another setup.

If you do have a smaller account, don’t fall into the trap of over trading and trying to force the market. Whatever you do, don’t fall into the trap of over trading like a huge proportion of traders do every single trading session, which causes them to give others their trading balances.

If you have a smaller account, you should use that as motivation to build it and use the power of compounding. Compounding is what I call magic because it works just the same. The longer you let it work, the more powerful it becomes.

Fixed Percentage or Fixed Money?

The Forex money management method you choose to use for your trades will determine how much money you make or lose each month or year. The two most common methods that are used and that I teach are the fixed percentage method and the fixed money methods. I personally used the fixed money method with continual goals.

I have an in-depth lesson on this where you can learn a lot more at Forex Money Management That Actually Works.

Both methods have their positives and drawbacks. The fixes percentage does not mathematically make much sense, but it is very sound from the point of view that it decreases a traders trade size as they are losing (which is also why I don’t like it).

Basically, it will keep a trader in the game for a long time if they are losing, but if a trader is losing, they should not be trading a live account and they should not need 50 losing trades in a row to find that out.

The downside of the fixed money is that you don’t get the compound interest effect when you start winning like you do with the fixed percentage. To counter that, we set regular and fixed monetary goals, so that the amount risked keeps increasing.

Becoming a Full-time Trader

If your goal is to become a full-time trader, then this in-between stage could be your stepping stone to your end state of trading full-time. You could use this period to build your bank with the power and magic of compound interest whilst gaining the necessary experience and learning the required lessons that you are going to need when trading full-time.

You could also build your bank because the bigger your trading account balance is when you do make the big leap, the better chance you are going to have of making a long-term success of staying a full-time trader in the long-haul.

If you want to get help with your goal of becoming a full-time trader, then check out our Lifetime Membership Price Action Course where we will teach you how to trade price action trading strategies that trade with high probability & low risk so that you have a method that you can have confidence in.

After becoming a student, you will learn to trade a method that you can stick & commit to, which will allow you to perfect it to your strengths and personal style. For example, you can style it to the personal time you need to be at the charts. Check it out here: Become a Price Action Course Student

Tell me what your goals are! Do you dream of leaving your job or what you are doing and your boss? Are you planning on becoming a full-time trader? Until then, what would you do with $1,000 every month? I would really love to hear your thoughts and ideas in the comments below!

Hi Johnnathon, great article, very straight forward, but also doesn’t kill that dream:). I just wanted to add that most novice traders fail to understand that those internet “gurus” showing and posting $1000, $3000 traders are using very large accounts. So yes, $1000/month is doable, but only with decent size account. Almost unreal to expect such returns on a $500 account lets say, in a short term. Good luck traders! Make it green.

Heya Peter,

yeah you are correct and it then turns into an issue where the trader is trying to make such large an unrealistic gains through either far too many trades, or risking far too much money to reach goals they think they should they blow their money.

Safe trading,

Johnathon

Becoming a full Time Trader is,indeed,my final Goal.And keeping my Money in the Account is the BEST OPTION.

how can i earn 10000 usd per month

Follow the rules in this lesson.

Hey Johnathon,

Excellent article along with the one on Support and Resistance from the Daily Charts. Thank you.

Hi Yogarajah,

thanks for your comments and super kind words!

Yes there is a big learning curve, but it is well worth it and just like all things that are worthwhile in life; we only get out what we put in!

Keep up the hard work and all the success,

Johnathon

Thank you Johnathon. It is a very interesting article. I do want to become a full time trader and to give up my full time job once I am confident enough that I can make the equal or more in trading full time. Of course there is a big leaning curve and I am learning and experiencing it every day. I can proudly say that there are a few people who honestly try to teach others in order to overcome the hurdles and make money and you are one of them. That is why I always read your articles. Keep up your good work. God bless you.

Yogarajah