How Much Money Can be Made Forex Trading?

I have been asked a lot of the same sort of questions over the years in similar formats, but the one that continues to come through is regularly is “how much money can I expect to make trading”?

Many traders come to trading with dollar signs in their eyes and dreams of docking at the Bahamas. Whilst this dream is not unattainable, the percentage of traders that are ever going to make that type of money is extremely small.

The thrill of chasing huge wins and reaching large goals is why most lose their first and often second accounts.

However; after the gambling is out of the way, a trader can then set out to achieve consistent gains with a solid market understanding.

Do you have to blow your first trading accounts to get started? Of course not.

The reason so many do is because of the mindset that they start with; find as many trades as possible and make as much money as humanly possible. This is what we all trade for, but more trading on the wrong trades equals more losing, not more winning.

What Can Realistically be Achieved?

What you will be able to gain out of the market is largely based on the amount of money your trading account has in it to start with.

Probably not what you wanted to hear right? Well that is the truth.

Someone with $1,000 is going to struggle to make a decent living and ride out what are the inevitable losses that will come, compared to someone with $100,000 who is going to have a far better chance.

It is simple math that the more money in the trading account, the less percentage the trader has to make, to make a decent living.

Two Quick Example Accounts

Are you expecting to open an account with $1,000 and quit your job?

If so, I think you need to realistically assess your situation.

Here is a quick example;

Let’s say that you need to make $50,000 per year to make a living, keeping in mind that some people will need far more to support their families and will have more expensive living situations compared to some others.

Account balance A) $10,000 to make $50,000 profit. You will need to make 500% every year just to keep your account steady and paying the bills.

Account balance B) $200,000 to make $50,000. You will need 25% profit per year and anything on top of this will be adding extra to your account and increasing your profit potential moving forward because your account is growing.

As you can see from the above example; trader A needs to make 500% yearly to make a living, whilst trader B only needs 25%.

This is obviously not including compound interest from within that year.

However; trading on the assumption that you need to make any more that 5% a month is very risky.

Some people will say, “only 5% a month”. 5% per month is 60% per year, and if you add compound interest into the growth of your account it is 80% per year! This is not taking into account bigger months, smaller months or losing months.

If you can average 80% per year account growth you are doing extremely well.

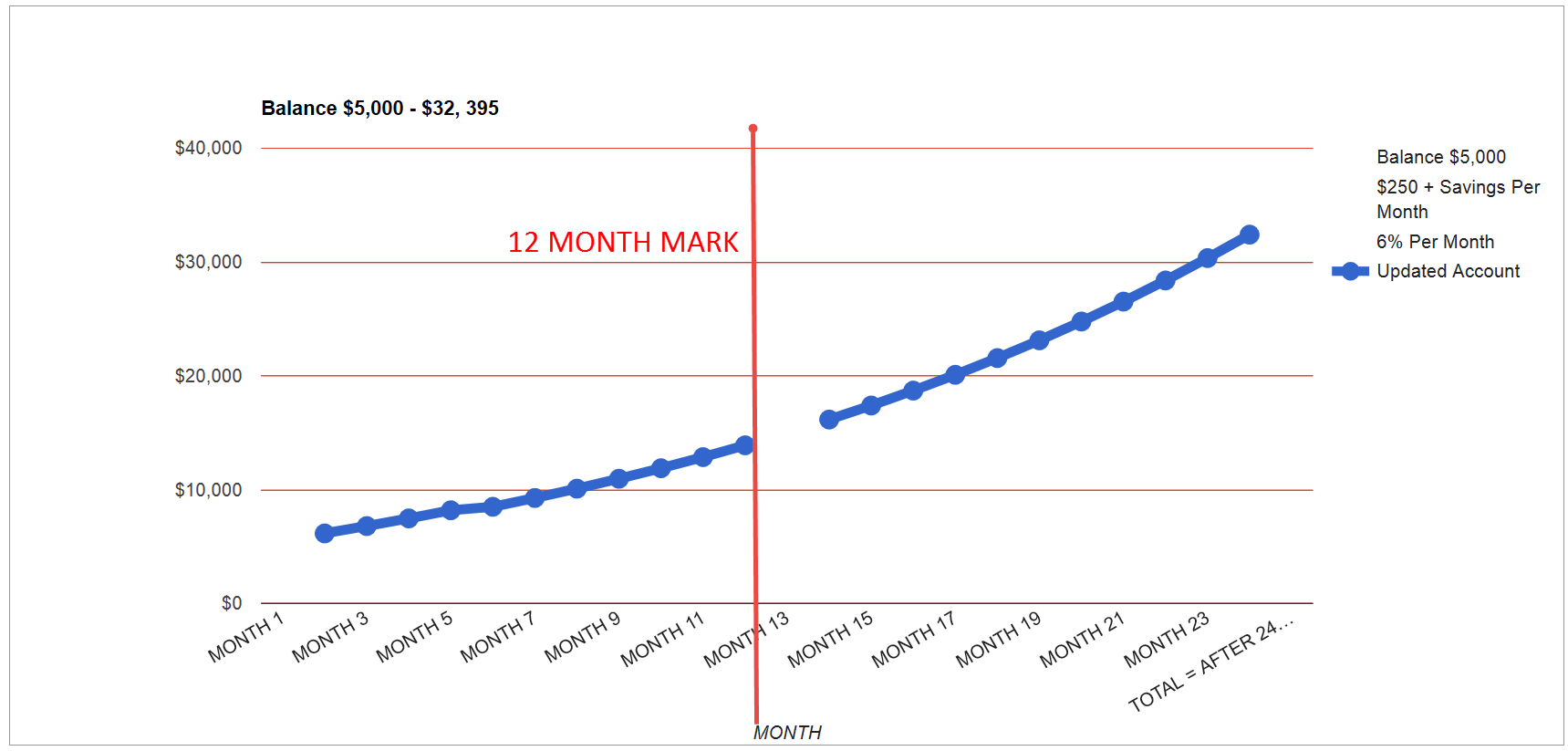

Checkout the detailed cheat sheet showing how accounts can grow with profitable trading and regular saving.

How Does Having Unrealistic Expectations Hurt my Account?

Getting rid of unrealistic goals will help you with the mental application of your trading plan.

Traders that are trying to reach percentage gains that are far too large will in most cases do two things;

#1: Overtrade

#2: Risk too much money per trade

Overtrading is a very common mistake made by many traders who are unrealistic in what they think they can achieve. They operate on the assumption that trading more will make them more. The complete opposite is often true.

Trading more will lead them to taking setups that are not worth taking and they will begin to lose.

Risking too much will in most cases lead to an account being blown. Occasionally a trader will get lucky and pull off a large winner. Over time however, the same trader can’t keep it up and when the losses come their account is crippled.

Should You Try to Reach Daily, Weekly and Monthly Pip / Money Goals?

The first crucial element to making real profits is knowing how much you are either winning or losing. This is done by knowing in real terms how much money you are either making or losing.

Pips are both extremely deceptive, and do not pay the bills. You can be positive in pips, and down in real cash.

Read why we work out profits in dollars and not pips.

The other reason we do not set daily or any other sort of target, either weekly or monthly is for the simple fact that we have no control over the market.

Trying to take control over something we will never have control over will cause trading mistakes.

These types of mistakes lead to over-trading and looking to make more and more trades because we have set goals for ourselves we now need to reach. If we want to make $xx dollars this week, but we are losing, then taking more rubbish trades is not going to help us make any profits.

We can only take trades as they form and the market presents them. Trying to force the market never works and is a huge mistake.

Are You Better Off Saving Whilst Practicing?

Having a small account will often mean a trader is far more likely to risk a higher percentage of their account, use a high amount of leverage, and overtrade looking to make larger gains.

With that said; a lot of traders begin with small account sizes. Often the best way is to use a small portion of the amount you intend to trade with, and put the rest aside in savings.

As you continue to save and build a bigger base trading account, you can use the other portion to perfect your trading method.

This gives you three added benefits;

#1: You are building and saving a bigger trading account for when you are 100% ready.

#2: You are perfecting your trading strategy ready for when you have a larger amount saved.

#3: If something does go wrong, you have not blown all of your capital.

What is Needed to Become Consistently Profitable?

To become profitable a trader needs to realistically assess their situation.

Every trader is different. How they trade and what method they use will vary greatly from trader to trader. Learning a method such as price action trading and perfecting that method will greatly increase your chance of making consistent returns in the market.

If you can learn to trade price action and start using strict money management principles, you will set yourself apart from the pack and give yourself a good chance of becoming consistently profitable.

I hope you have enjoyed this lesson. It is designed to show you what is possible, but at the same time bring you into the correct mindset that is needed in such a competitive market such as Forex trading.

Safe trading,

Johnathon Fox

Leave Your Comments and Questions in Section Below;

This is something I have started looking into over the last 24 hours, I’m finding it all abit confusing. Any advice will help thank you.

Hi Martin,

not sure of your exact question or what specifically you would like more info on.

Let me know if you still need further help.

Johnathon

Depending on how much of your account you risked per trade ofcourse.

If you started with just £1000, it is completely do able to make £50,000 over 12 months. If you were to make 260 trades over a 1 year period, with a risk/reward ratio of 1 (risk) to 1.5 (reward), with a win ratio of 60% or higher, you will make that money.

Hi Matt,

there is a big difference between what could be possible, and what could be made probable.

Attempting to turn small accounts into large ones extremely quickly will normally end in over risking the account to a point where a string of losses will cause huge dents, if not blow the account.

All the success.