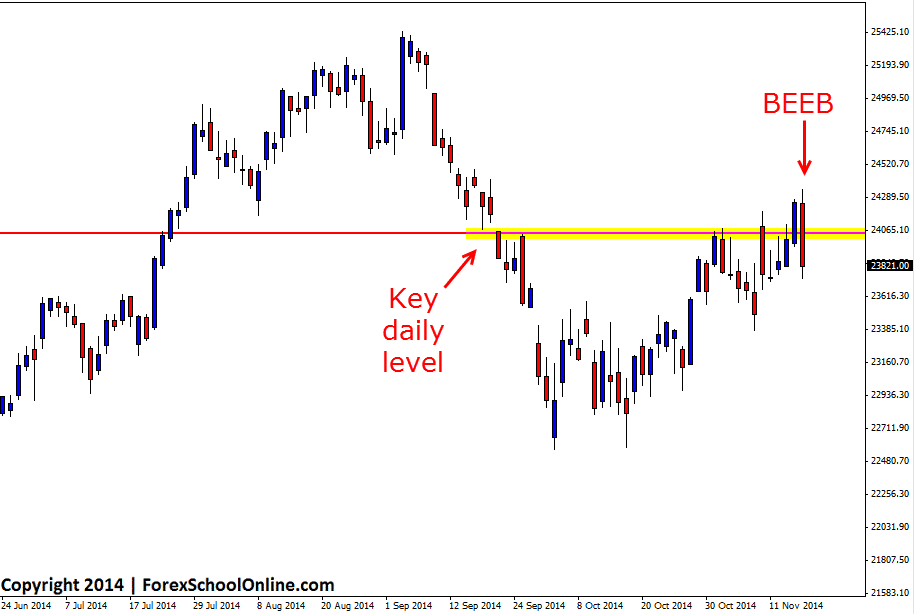

The Hong Kong 50 Index (Hang Seng) has fired off a Bearish Engulfing Bar (BEEB) on the daily price action chart. This engulfing bar is rejecting and popping through a major daily resistance level that in recent times has proven to be a real trouble area for price trying to move higher. Price had been stepping higher with price making higher highs and higher lows, but this resistance has proven to be a major roadblock to this point in time.

If price can break lower and confirm the BEEB, the near term support comes in around the Big Round Number (BRN) of 23,600. This support has been a key level in the stepping up process that I spoke of above with price rejecting this level as a resistance and then flipping to test it as a support area. Under this near term support level there are a lot of minor levels and sideways trading that could be real trouble areas if price breaks lower.

If price moves and makes a break higher there looks to be space until around the 24590 level. If this level then gives way price could possibly move into the major swing highs if price can carry on the momentum higher.

NOTE: If you want to have the correct New York close 5 day charts that you can trade products such as the Hong Kong 50 Index discussed in today’s post, other major stock index’s, commodity markets such as Oil, Gold, Silver as well as all your Forex pairs, then check out the trading article;

Recommended Charts and Broker Forex Price Action Traders

Hong Kong Daily Chart

Related Forex Trading Education

– Switching on Your Body & Mind For Better Forex Trading | Part 1

Leave a Reply