Price on the daily chart of the NZDUSD fired off a high probability A+ Pin Bar Reversal at the New York close of play today. This high quality pin bar was sticking up and away from all other price and was way up at the swing high like all good pin bars are.

Nice job to Lifetime Price Action Course Member Zin who posted this trigger signal up live in the Members Price Action Setups Forum – Daily Live Setups Thread just as it had formed.

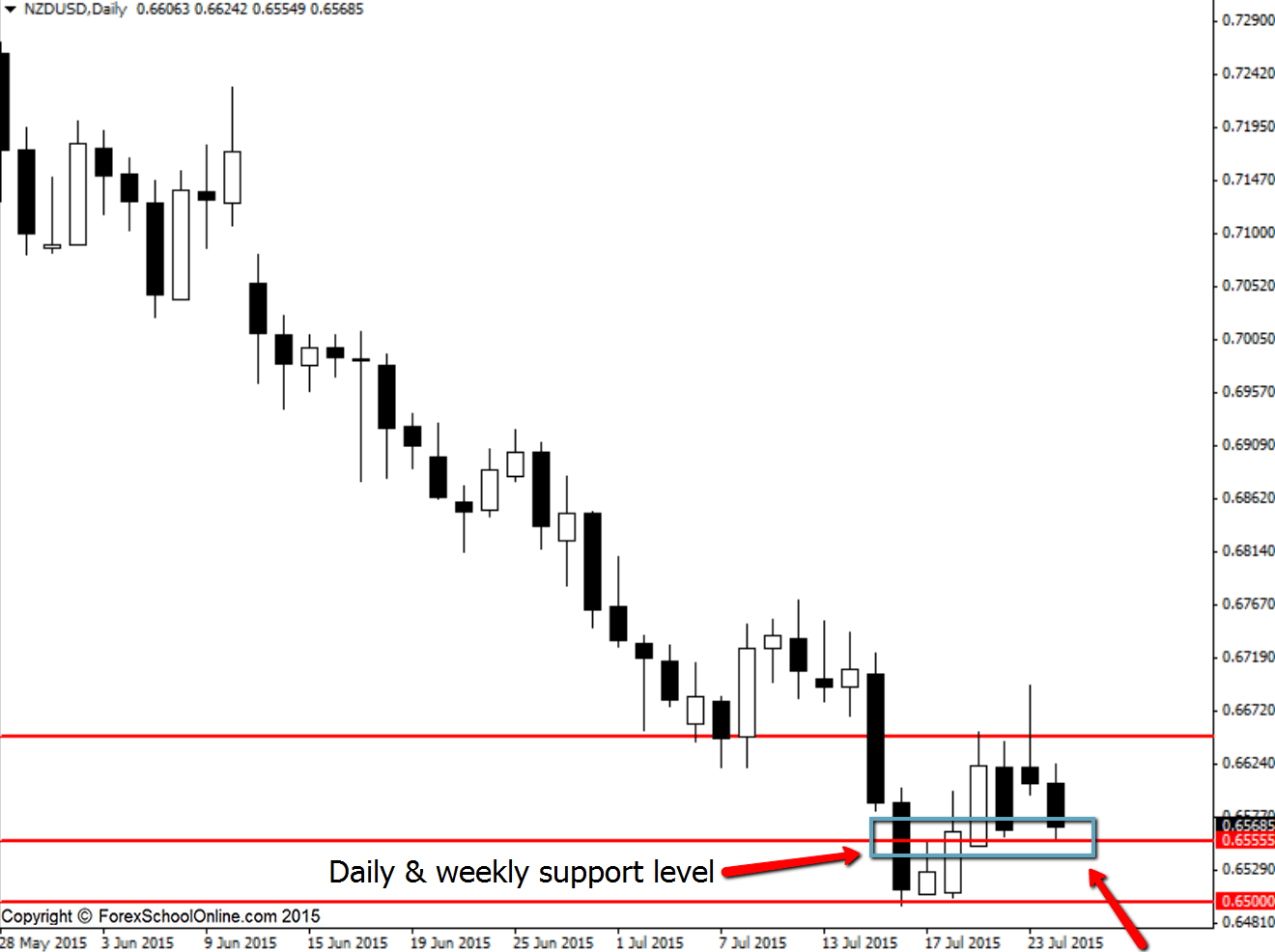

After breaking the pin bar low and confirming the setup, price has since broken lower and moved into the first minor support which is a weekly and daily support level. If you zoom your weekly chart out, you will notice that the level I have marked on my chart below (the first near term support where price is currently stalling) is a price flip level.

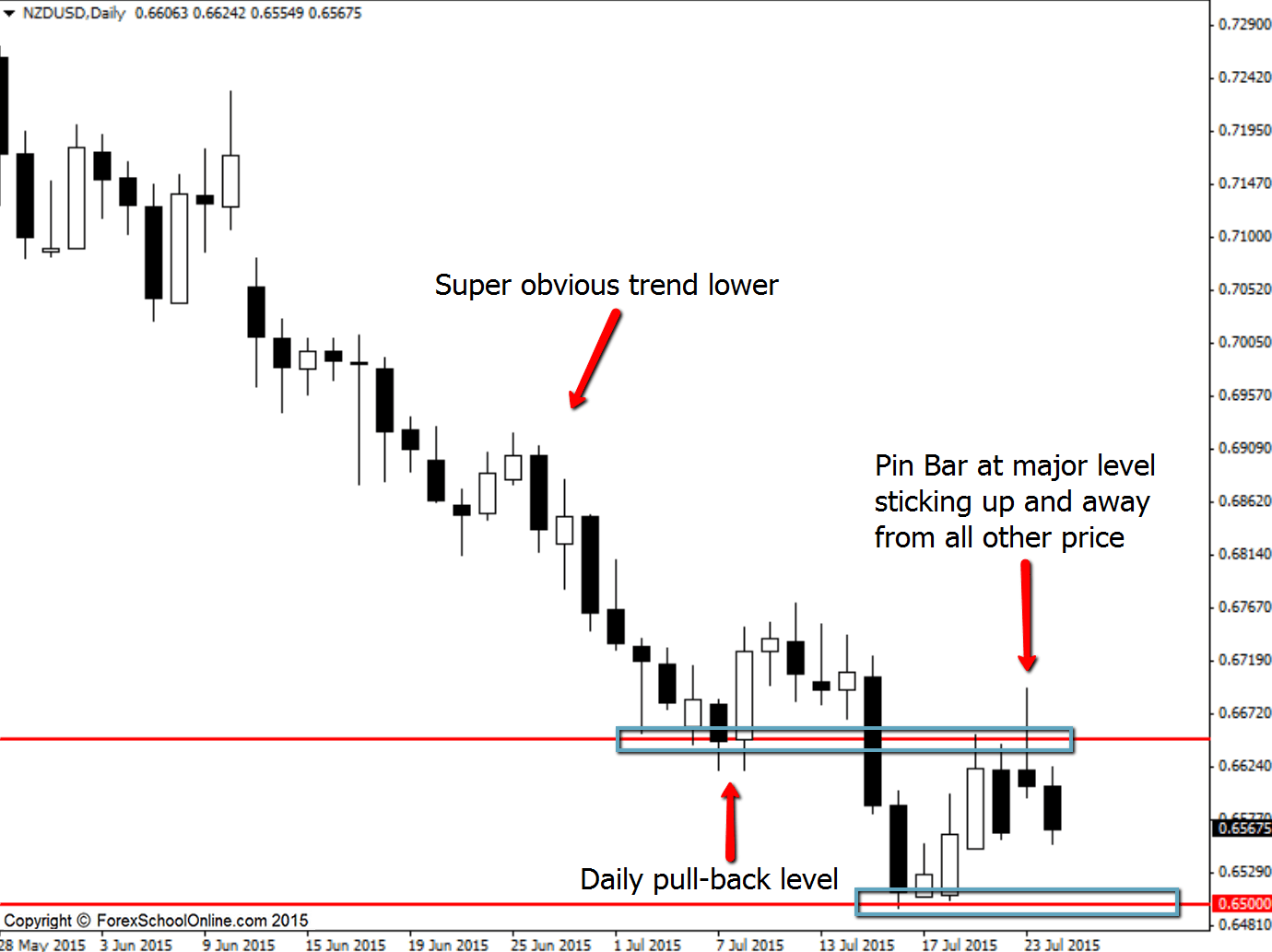

Why was this a high probability pin bar trigger signal? One of the biggest factors we can put in our favor is the trend, especially really obvious and strong trends and the daily chart of this market is one of the cleanest and strongest trends of all the Forex pairs just at the moment.

This pin bar was trading directly inline with the very strong down-trend. Not only that, but the pin bar was rejecting a major daily resistance. Price had moved back higher against the strong down-trend to make a retracement and a pull-back into value.

This means that anyone entering this pin bar was entering with the strong down-trend, trading away from a strong daily resistance and because price had just pulled back into a value area there was a bit of space to move back lower into.

Lastly; you will notice that I have the major swing point support level marked on the daily chart below. If price can continue with the strong trend lower there is a good chance it will be able to move into this level.

This swing low support is also a Very Big Round Number (VBRN). VBRN’s are psychological levels that price often hovers or reacts at. This support level is VBRN 0.6500. This is something to keep in mind if price does move lower and closer into it.

Daily Chart

Daily Chart

Related Forex Trading Education

– Where a Lot of Traders go Horribly Wrong With the Pin Bar Reversal

However the most recent shooting star is performing as per the plan, hope you followed up with that one!

Not an A+ anymore, and the high probability is gone.

Hey thanks for your post John,

yes, price has now moved into the near term weekly & daily support hat was discussed and highlighted in the post that was around the 0.6555 area and has since respected it and moved back higher.

Johnathon

Hello,

What time is the daily close of your broker because my day candle is not the same as yours. I have NY 5pm close. Anyway, trade is not yet in profit if even entered, hopefully drop more next week.

Thanks, John

Hi John,

even though two brokers may both be NY close, they will often have slight differences because of their own order flow and liquidity.

Because Forex is not a centralised market, where one broker gets their quotes from is different from the next broker which means that although they may both be NY close and their candles are closing at the same time, they have a completely different makeup in their markets, ie; the buyers and sellers are completely different.

This is not a huge deal and I would recommend just focusing on your broker if you are trading with a reputable broker.

Johnathon