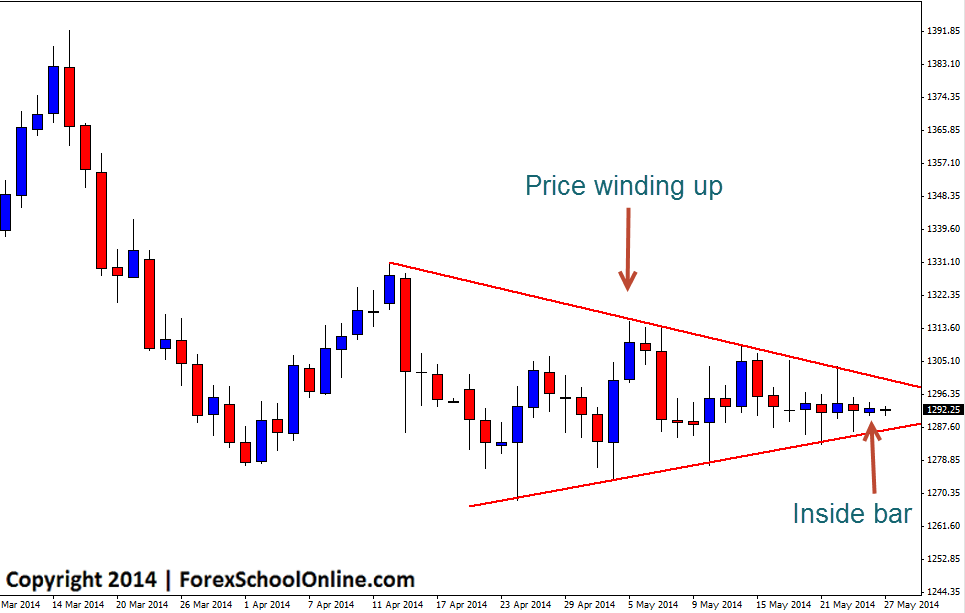

The Gold price is winding up tighter and tighter on the daily price action chart and in the most recent session fired off an inside bar. Price in recent times has come from a wide base to be now squeezing in a super tight range and as we often talk about in this blog, the longer these tight winds-ups go on, normally the stronger and more explosive the breakouts are when they occur.

Traders need to be mindful of this and not look to play trades when price is caught in the really tight wind-up with very little room to move, but rather look for trades once price has shown its hand and made a clear break either higher or lower. I discuss how traders can look for the higher probability trades when price moves into tight ranging markets in my latest trading lesson How to Trade in Ranging & Sideways Trading Markets

Because there was no really obvious trend in either direction before price started to wind-up, traders can now look for a breakout in either direction. Often when price breaks out of an area that it has been contained within such as a strong wind up area, it will make a strong break and then want to test the same area before continuing in the same direction of the breakout. This is known as a breakout and retrace setup because price is breaking the key level or range or whatever the level is and then quickly re-testing the level before continuing. It is at these levels that traders can look for high probability trades and when Gold does break out, traders could look to use this method. For more on this method read the above lesson on how to trade in ranges. If traders want to learn how they can use other more advanced techniques such as how they could apply breakout trading, check out the Price Action Course Page.

Gold Daily Chart

Leave a Reply