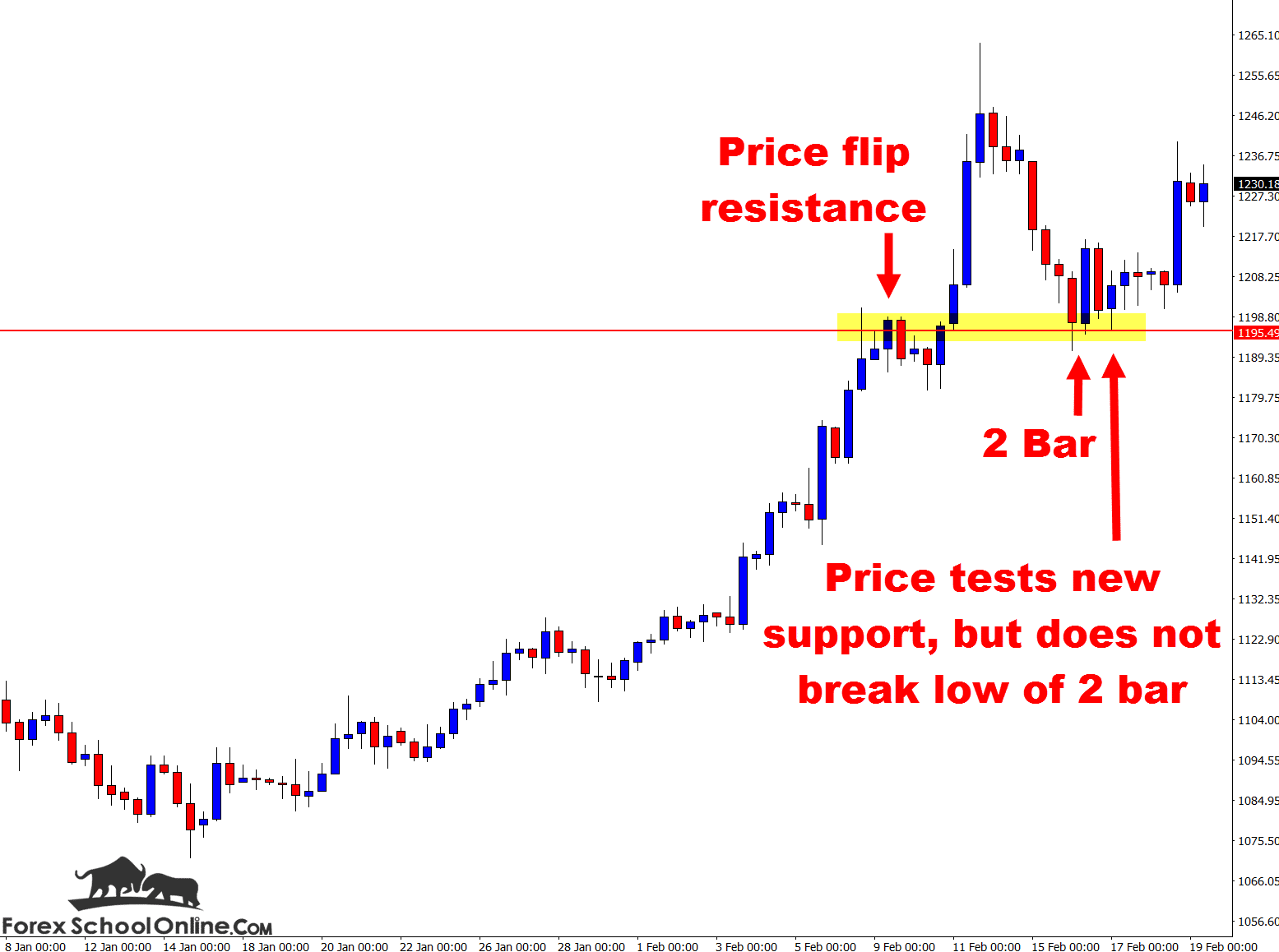

Just a few days ago I made a post in this blog for you about the two Bullish 2 Bar Reversals that had formed on the Gold v USD and Gold v EUR 8 hour price action charts. To recap and go through exactly how these setups had formed and why these 2 bar reversals were posted up in the daily Forex trade setups blog, then just go here; Potential Bullish Setups Forming on Gold 8 Hour Price Action Chart | 16th Feb 2016

I made this post looking at these two intraday trigger signals before they had finished forming and not quite knowing if they would definitely finish as 2 bar reversals. After finishing forming and closing as 2 bar reversals, rejecting the major support levels, price did not move higher straight away.

This is OFTEN THE CASE with reversal trigger signals and often why one trader walks away with a loss shaking their head, kicking themselves and anything in their path and the other trader walks away with a handy profit, pretty much every single time this same scenario plays out.

The only difference between the two traders is; one follows their plan and the other doesn’t (or they don’t have one).

By now you would have read the large quote I have at the top of today’s post. It is one of my favorites;

95% of the trading errors you are likely to make will stem from your attitudes about being wrong, losing money, missing out, and leaving money on the table – the four trading fears

Mark Douglas

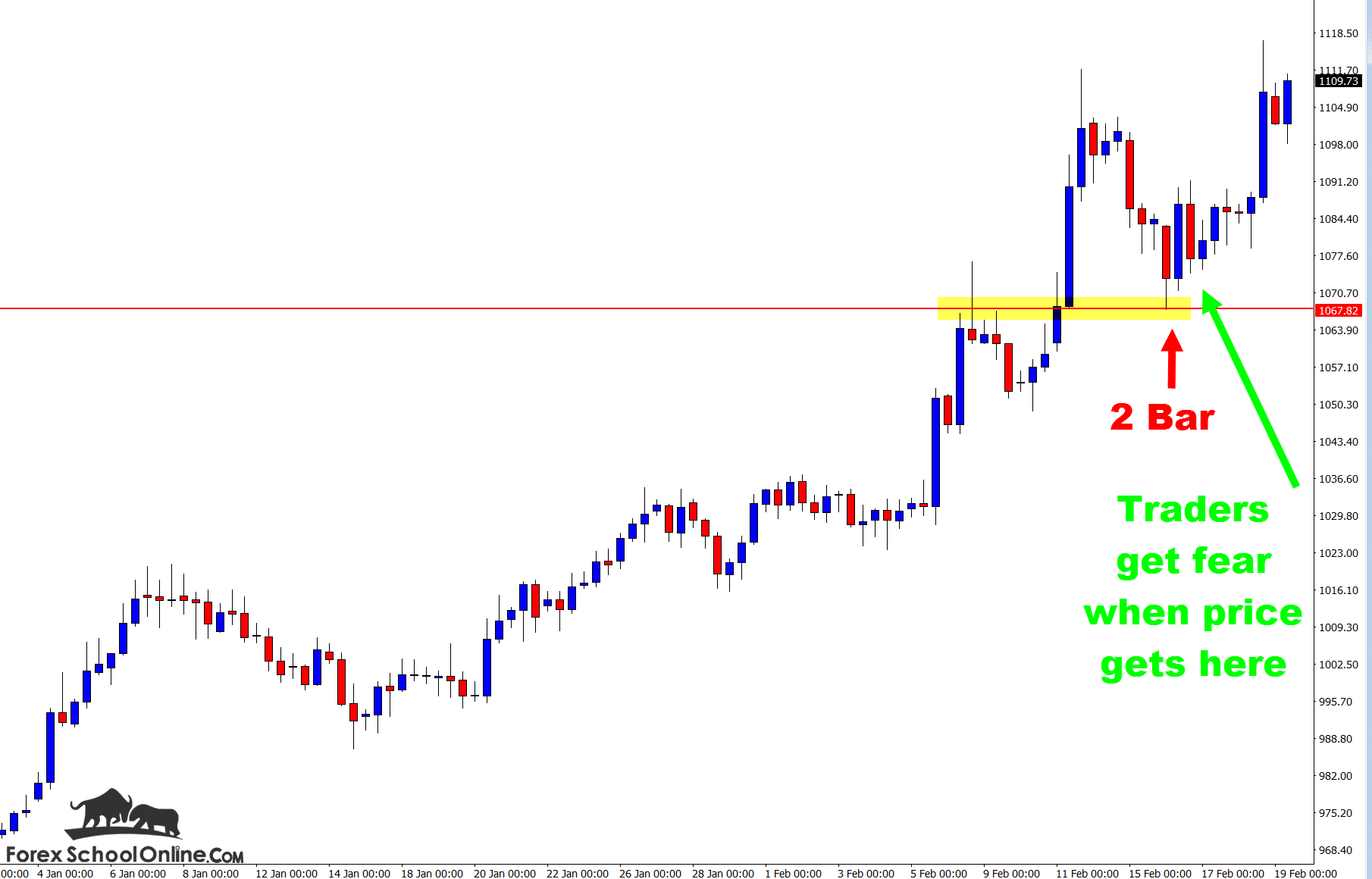

What does this mean? Basically; as I was going through in the scenario between the two traders, when price starts to go against you like in this Gold example, a lot of traders are going to start to get a lot of things pop into their head.

Such as; “I knew this was a bad trade. I should cut it now and cut my losses early. All the pro’s say cut your losses early don’t they? I will break my plan just this one time, and then from the next trade I will make better trades and never break it again! Just this once…”

The other trader is not concerned. This trade could lose and that would be fine with them. They are at complete ease with this trade losing. As a matter of fact, they have already accepted the fact that the trade could completely tank before they even put the trade on.

If they could not come to terms with this trade and they were not willing to risk money on it or happy to lose on it, they would not have entered it.

In other words; if this trade was not high probability and not worth them risking their money on, then they would not enter the trade, but if they enter a trade fully accepting any outcome, then taking a full loss is not going to have anywhere near the affect emotionally or psychologically on this trader who has already accepted it. SUPER IMPORTANT!

GOLD V USD 8 Hour Chart – Test New Support and Does Not Break

GOLD V EUR 8 Hour Chart – Traders Universal Fear

Related Forex Trading Education

Leave a Reply