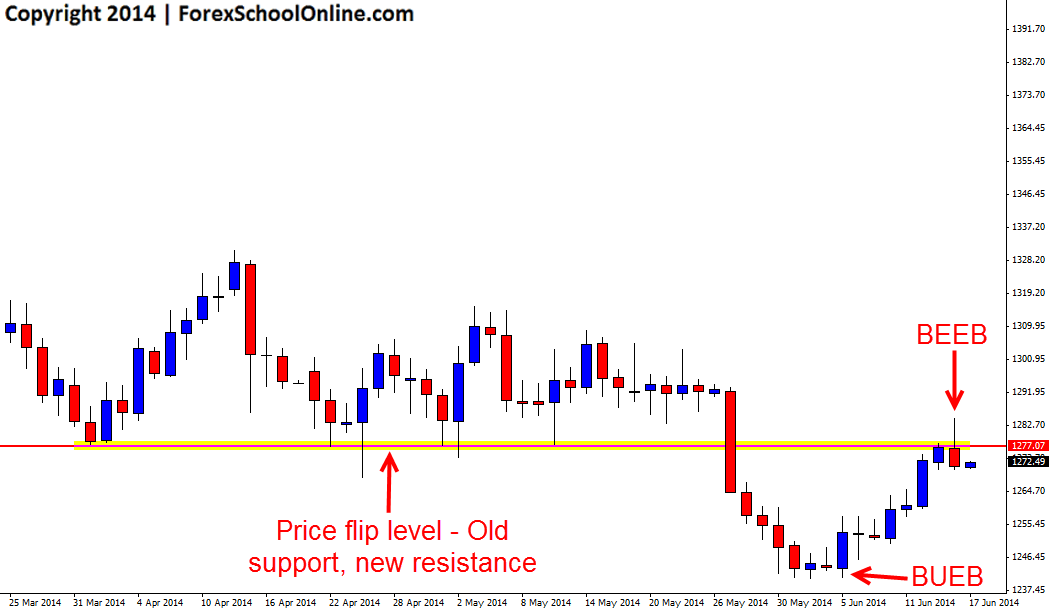

Gold has fired off a Bearish Engulfing Bar (BEEB) at a key daily resistance level that we discussed in our previous Forex Daily Market Commentary. In that previous market commentary we discussed how price was working it’s way higher and towards the key daily level and how price had formed a Bullish Engulfing Bar (BUEB) down at the low that was rejecting the daily support level. Whilst the Gold market had been in a steady move lower on the daily chart, price was over-extended and looking to make a retracement, which price has now carried out.

After confirming and breaking the high of the Bullish Engulfing Bar price has moved higher and into what is a key daily resistance level. At this stage this daily resistance level is looking to hold as a new price flip level with the level being an old support level and now looking to hold as a new resistance.

Should this Bearish Engulfing Bar confirm and price break lower, there are some minor support levels below with the first minor level coming in around 1264.00 area. If price can gain momentum and move back in-line with the move lower that was in place before this retracement back higher, it would not surprise to see price fall into the recent swing lows. If price cannot break lower and it moves back higher, this daily resistance level will prove to be an important level for where price moves in the short term. Should price move above and most importantly close above the daily resistance level, a new short term momentum/trend higher could be on the cards.

GOLD Daily Chart

Hi

after first pin bar on gold chart we had a bullish pin.so in this situation can we close sell orders before sl hits?

and how do you manage the situation in gold?(after bearish pin bar)

Hello Joe,

you need to be making a pre-trade plan and be aware of possible areas before price runs into them. As I spoke about in this post the first support level came in this market around the 1264.00 level where it was no surprise to see price reject and move back higher.

It is better to be aware of these areas and managing your trades with them, than over-managing your trade once price has moved the other way.

Johnathon

Thanks for ForexschoolOnline. I am confusing one thing that is how many pips away do i put on pending order, if price break low or high?

Hello Bingo,

it is up to you for how many pips the “buffer” has to be on each time frame between your entry and the confirmation for your entry. We normally have a different buffer or in other words a different amount of pips for each time frame for example you may use 2-3 on a 1hr chart, but 4-8 on a daily chart.

Johnathon