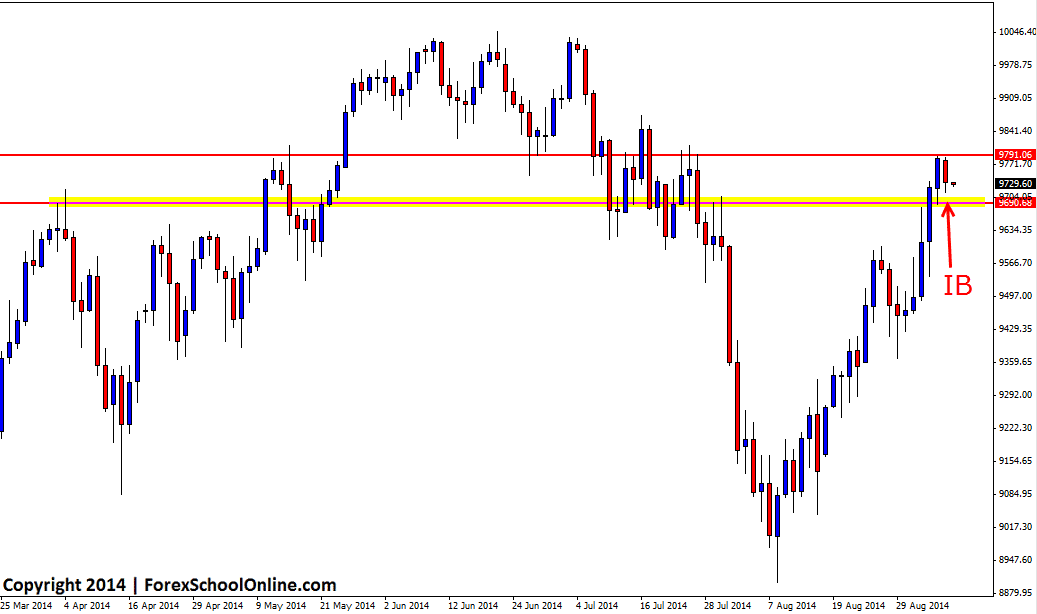

The DE30 or Germany 30 Index is a stock market index of the 30 major German stocks listed on the Frankfurt Stock Exchange. Price on the daily chart has formed an inside bar (IB) just above the key daily support level. Price in recent times has been roaring higher and after making only a slight retrace lower has made a sustained move higher with very strong momentum.

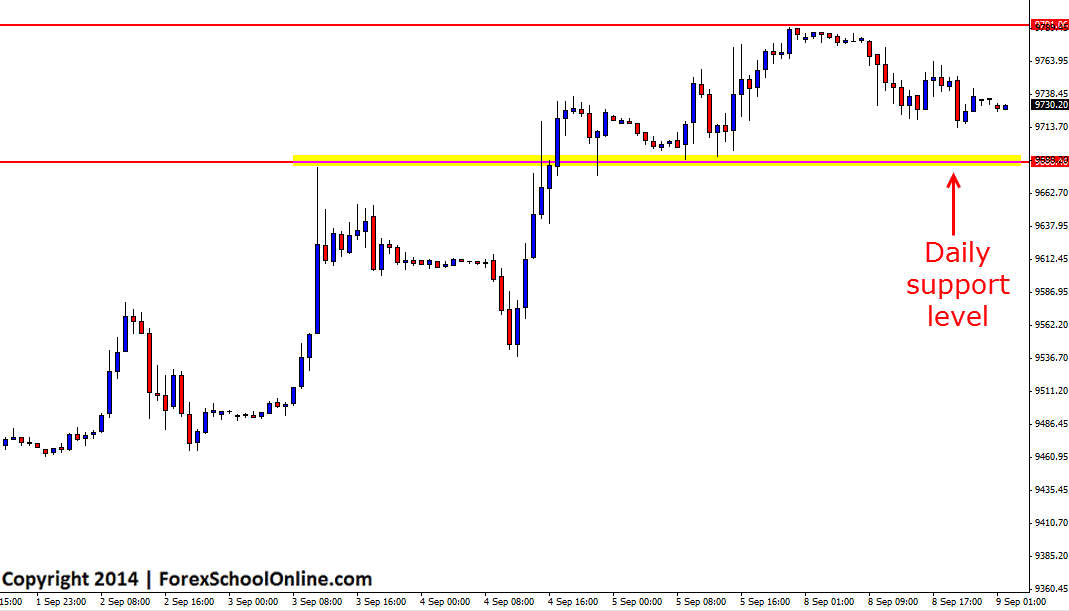

This inside bar is inline with the strong move and momentum higher. If price is to rotate just a little lower, the daily support level will then come right into play. This level could look to act as a price flip and potential new resistance level. If this is the case traders could look to hunt for long trades with the recent strong momentum higher on their intraday charts such as the 4 hour or even 1 hour charts.

If price breaks higher and through the resistance, traders could use the strategies I recently outlined in the trading tutorial Trading Daily Chart Strategies Down to Intraday Time Frames to get into trades. This could involve looking for price to break the key resistance level and then watching smaller intraday time frames even as low as the 30 minute or 15 minute chart to get long should price rotate back lower and into the key support level.

If price makes a move lower and falls through support, traders would have to be careful looking for short trades until the market showed more confirmation for a continuation lower. Trading against strong momentum can be super high risk and so at this stage until the market gives a price action indication otherwise, the best play looks to be trading with the recent strong move higher.

Germany 30 Index Daily Chart

Germany 30 1 Hour Chart

Leave a Reply