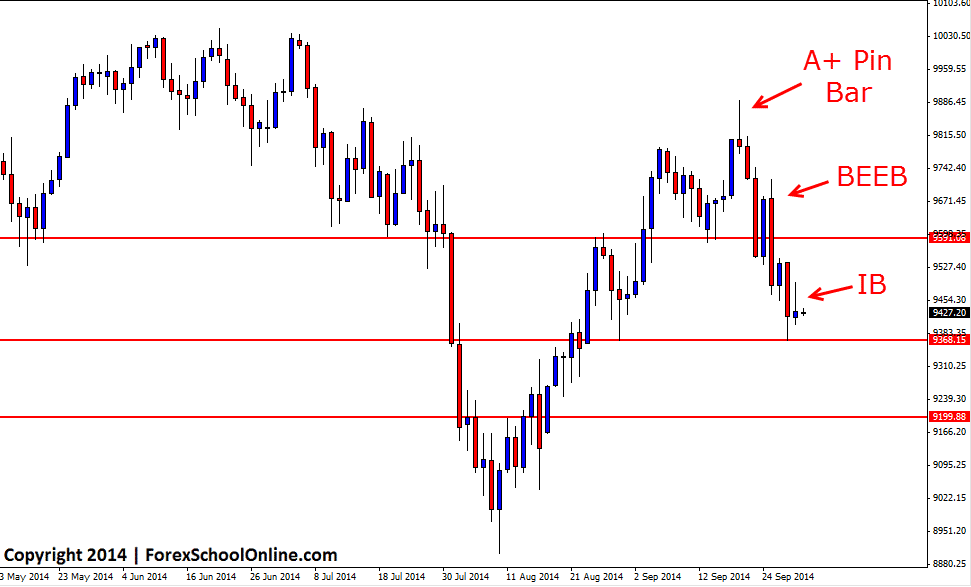

The Germany 30 Index or the DE30 as it is commonly known has fired off an inside bar (IB) on the daily price action chart. Price has recently made a strong leg lower after forming a killer A+ pin bar that was up at the swing high and rejecting both the longer and short term resistance levels. After breaking the pin bar low, price sold off and formed another bearish engulfing bar to be where it sits now with the inside bar.

This inside bar has formed as price takes a breather after the strong move lower and this is common after price makes a strong move. Price will often make a strong move either higher or lower and then make a pause just like price has done here with the inside bar.

Just below the inside bar is a near term support level. This market has been in a choppy sideways trading range for an extended period of time now and the levels become super important in these markets. For price to continue on it’s move lower this near term support level will have to break and price make a strong close below. If price can make a move lower, it may then be able to gain momentum and move into the next support level around the 9199.85 level. The important resistance overhead in this range looks to be around the 9591.085 at this stage which would present as a solid area to hunt short trades should price pop higher and into this daily resistance area over the next few days.

Germany 30 Daily Chart

Leave a Reply