I wanted to start today’s post by addressing a few of the emails and comments I have received from the regular readers of this blog who have been asking questions over the previous week or two as I have not been putting out as much content as normal and I have not posted a longer form lesson in a little while.

I have been working harder and longer hours than ever before on my own trading, the members of this site and looking for a new way to simplify and increase my profits that would also help you and your trading.

It’s the classic catch 22 however, the more I work to figure something out, test it and put it into action, it means I am not building content, writing lessons or shooting videos.

I am looking to share this all with you though super soon and a heap of content will flow from it very, very soon that will help your trading a lot, so keep an eye out on this space.

Germany 30 – 4 Hour Chart Bearish Engulfing Bar

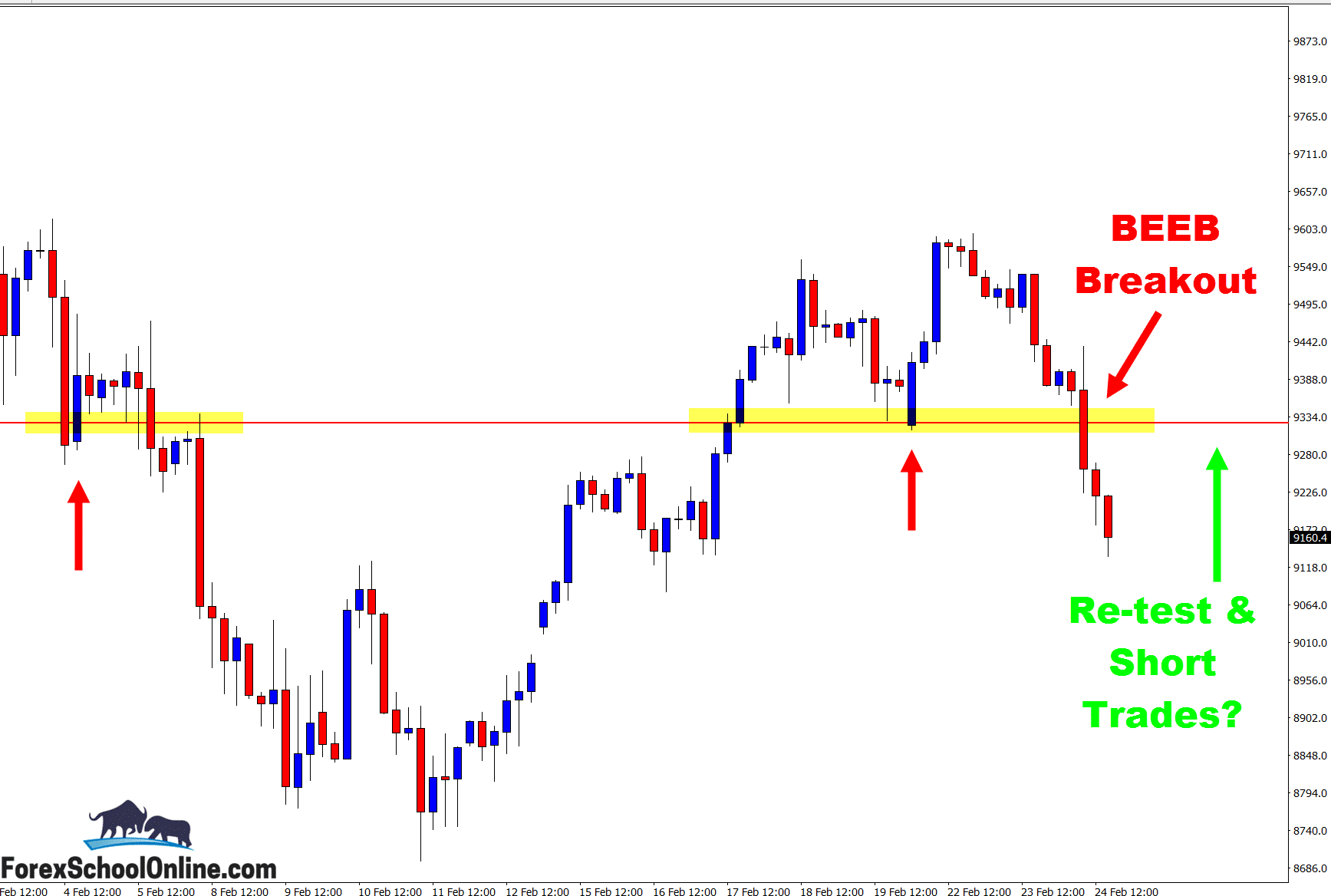

Price on the Germany 30 major index market has just broken out on the 4 hour chart with a large momentum 4 hour Bearish Engulfing Bar = BEEB as shown on the 4 hour price action chart below; As the 4 hour chart shows, this bearish engulfing bar is crashing through and closing below the major support level that is also a major support level on the daily price action chart.

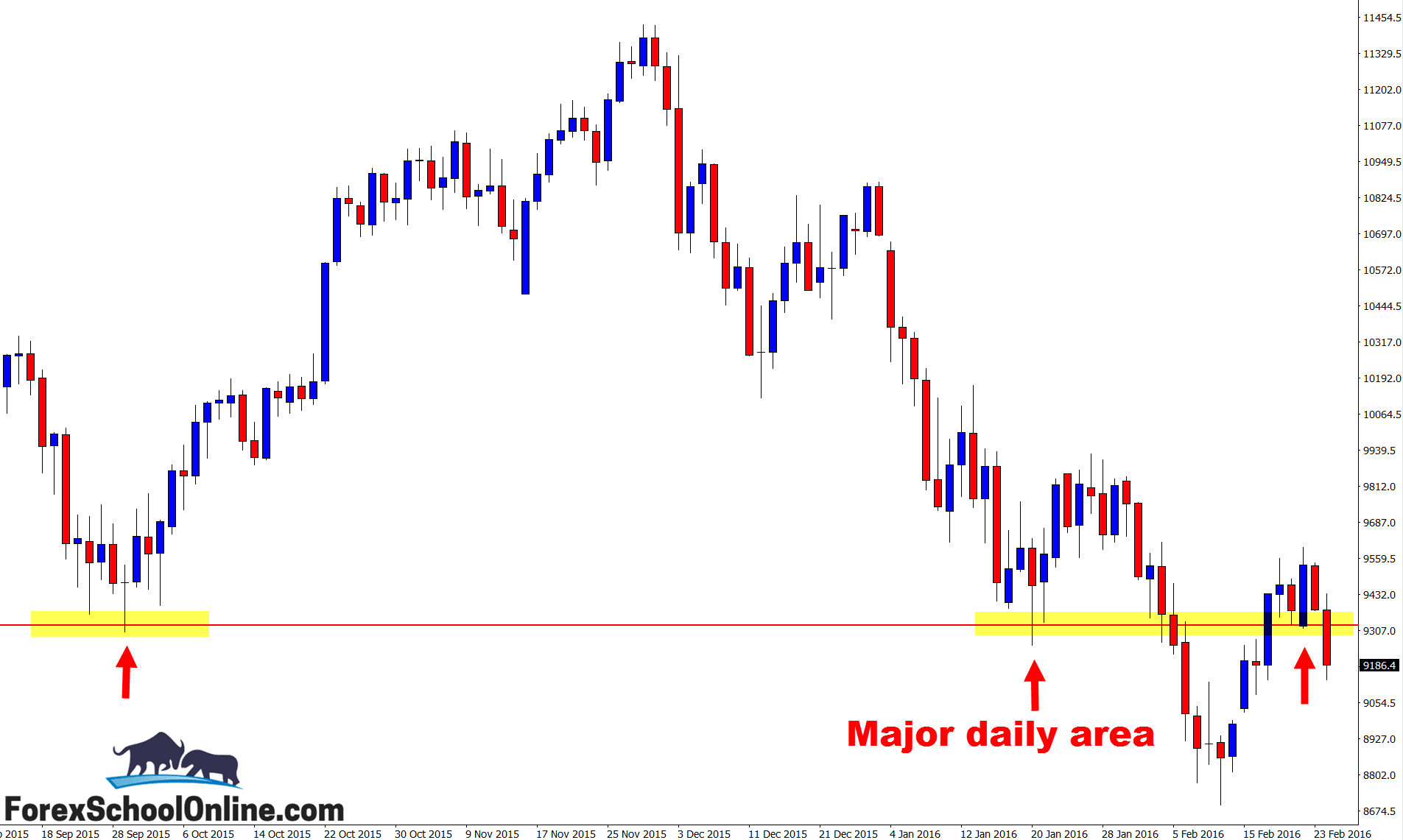

All the strong momentum in recent months has been lower with price on the daily chart making lower highs and lower lows. This new move back lower is trying to keep with that pattern of making a new lower high and potential fresh lower low.

When these major daily levels are broken with really large momentum candles, often engulfing bars that close really strongly indicating that price was strong at the close of the candle, they can potentially be really solid levels to hunt trigger signals at.

This is an often occurring scenario if you know what you are looking for, but if you don’t know about it, it is like a lot of things; if you don’t know it exists, you obviously can’t find it!

Take a look at the Germany 30 – 4 hour chart and the large BEEB breaking out and closing lower. This is a large momentum candle that closes strongly towards the bottom of the candle indicating the bears or sellers were still in control when the candle closed. If price can retrace back higher and into the old support and new resistance, it could be a solid level to hunt for short price action trigger signals.

There is a good chance that at this new resistance there will be a solid amount of fresh sellers waiting to get short and re-enter the market. Obviously we would need to use an A+ high probability price action trigger signal like the ones taught in the Lifetime Members Price Action Course, but it is these types of levels that we can find and use time and time again.

Germany 30 Daily Chart

Germany 30 4 Hour Chart

Related Forex Trading Education

Leave a Reply