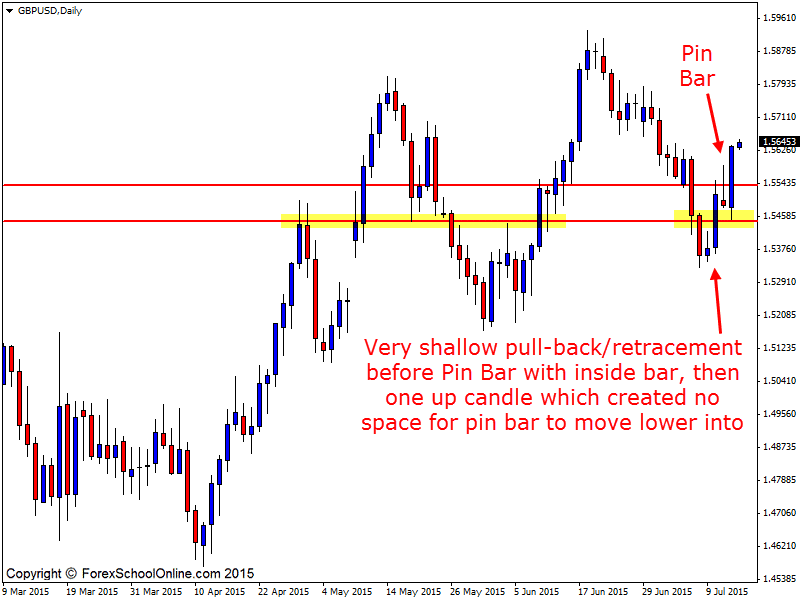

Yesterday the GBPUSD fired off a bearish pin bar reversal on the daily price action chart. The pin bar was rejecting a very important daily resistance level and it was also formed quite nicely.

The major issue with this pin bar and what I made a note of when posting in the Members Only Market Summary for members is that this pin bar has formed after a very shallow pull-back or in other words; there is not much of a swing higher before the pin bar is formed.

Pin bars are reversals and because of this it is absolutely critical we play them from the correct swing points. For bearish pin bars we need to play them from swing highs whilst bullish pin bars need to be taken from swing lows. I discuss this in-depth and how you can find the correct swing points for your trade setups in my trading lesson;

Trading Reversal Trigger Signals From Swing Points

When price is not at a correct swing point it will often mean we are trading back into an important support or resistance area or we are entering into the market just as the major players are just getting out which is obviously not what we want to do.

As you can see from the daily GBPUSD chart below; price had formed a pin bar. The pin bar on it’s own is fine. As we know however, the price action is king and it is the price action story that makes a high probability trade setup. The pin bar had formed after price had made an inside bar and then only one up candle higher. That is not much of a pull-back or retracement to have been formed before a pin bar reversal.

Because there is a very small retracement it is going to mean there is very little space to trade into after entering the pin bar. This is how it will always work when there is a small pull-back. The bigger the pull-back, the more space you will have to trade into. You will notice that the pin bar had a very close first support level. Combined with the small retracement, there was a high chance that this first support level was going to hold.

With all that in mind; this pin bar was a high risk setup. Whether it is on the daily chart or 15 minute chart we need to be finding pin bars that have pulled back into value areas and then that stick out and away from all other price. We need to also ensure that when we enter our pin bars we have room to manage them after we get into the trade.

If you want to learn exactly how to start hunting high probability trade setups and how to manage those trade setups with price action, then check out our Lifetime Membership that comes with 2 x Price Action Courses.

GBPUSD Daily Chart

Leave a Reply