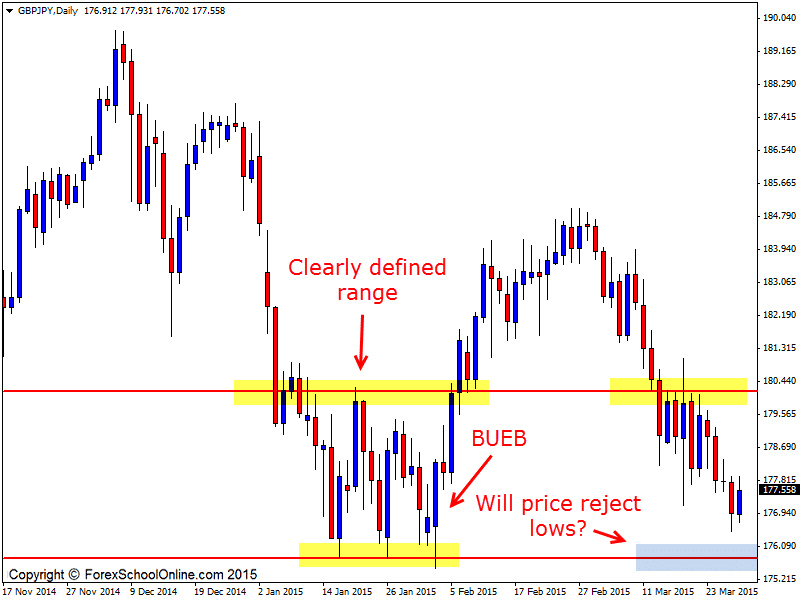

The GBPJPY has now moved back into a clearly defined range trading box on the daily price action chart with price now moving back down towards the low as I write this post. This ranging box area has been a strong boxing area in the past with a clear support and resistance.

If price moves lower it will move into the support of the box range area which has been a major trouble area in the past for price to try and break. As the daily chart shows below; the very last touch of this support level saw price burst higher with a large Bullish Engulfing Bar (BUEB). This move off of the range low went for over 900 pips.

Over the coming days traders could watch the price action behavior at this major support level for potential long trades to see if price is looking to fire off any bullish trigger signals.

Price could also break right through the support level like a hot knife through butter and if this is to occur, then traders could switch and start looking for short trades with an especially close eye on the range low looking to see if it will hold as a potential old support and new price flip resistance level.

Price may yet not move down into the support level of the range and if it doesn’t, then the high likelihood is that price will range and trade sideways as is often the case when price is in a range. This is often the case because when price is in a range there is a lot less room to move and there are a heck of a lot more minor support and resistance levels to negotiate. There is also no clear trend in place which means price tends to bounce up and down and all over the place.

You need to keep this in mind if you intend to hunt any trades whilst price is inside this sideways box.

Daily Chart

Leave a Reply