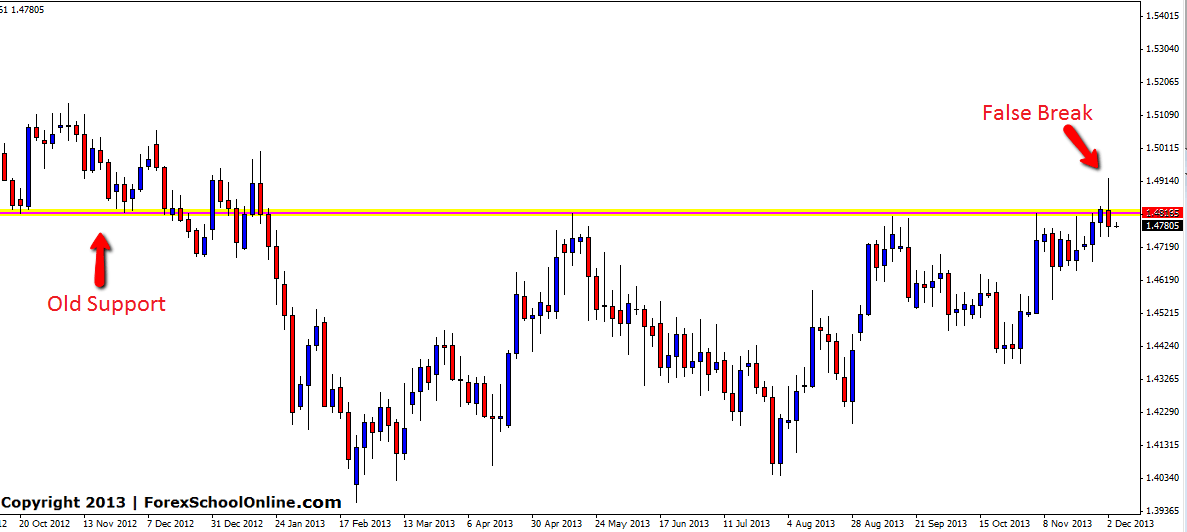

The GBPCHF has formed a false break pin bar on the 3 day price action chart. This pin bar has been formed making a clear false break of the recent resistance zone and is also rejecting the longer term resistance. The chart below shows price pushing higher and moving into the key area before snapping back lower to create the false break.

If you want to learn how to make any time frame chart with your MT4 platform so you can make 3 day charts like the 3 day chart below, read this tutorial here: Make Any MT4 You Want With Correct New York Close 5 day Charts

If price can move lower and confirm the pin bar, the very near term support comes in close around 1.4680. If price can break this level and make a major move lower the major support comes in around 1.4470. If price cannot confirm that pin bar and cannot move lower, price will have to break the solid resistance level. If price can break this key resistance it will then become a price flip level and act as a new support level where traders can start looking for it to act as a new support level and new trades to get long.

GBPCHF 3 Day Chart

Hi John, why you trade 3 days chart in this pair? Is it due to GBPCHF is not a popular pair and the trend seems to be erratic?

Hello Kc,

it is simply because I blended the candles to make the price action signal needed. I could see on the daily chart that by blending three candles together it would make a solid false break pin. GBPCHF whilst not one of the majors is still a very popular and heavily traded pair. I talk about how price action works in this article here under the heading “Why do Price Action Signals Work” which you may find interesting https://www.forexschoolonline.com//the-secrets-traders-can-read-from-candlesticks-price-action/

Johnathon