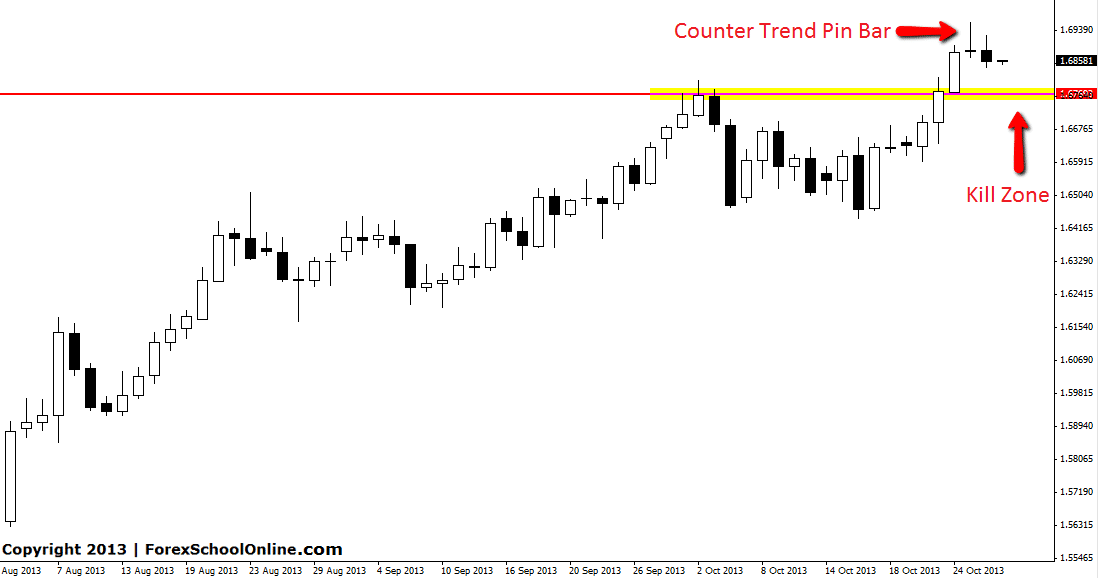

The GBPCAD has fired off a small counter trend pin bar on the daily price action chart. This daily pin bar is against the very strong recent up-trend and is small when put in comparison to some of the very large and commanding candles that were made in the up-trend on the move higher. Whilst trading small pin bars against the very strong trends at extreme highs and lows are very low probability trades, we can still use these price action clues to get into other high probability price action trades.

Below this pin bar is a key support level and what could be a key level for traders to target long trades within this up-trend. This level is what is known as a kill zone. To learn more read here: Trading Price Action With Kill Zones. If price does break lower and move into this level, traders could target long trades on both daily and intraday trades. Getting long at this kill zone would be trading with the obvious daily up-trend. For any possible trades to be confirmed a high probability price action signal would be need to form at this key support level similar to the other price action trades posted in this blog.

GBPCAD Daily Chart

but is it safe to enter the trade since the pullback too small?