The Forex charts have formed many engulfing bars (EB’s) on the daily charts at New York close this morning with a lot of the JPY’s pairs and a couple of the AUD pairs all forming engulfing bars. Pairs such as AUDJPY, EURJPY, CHFJPY, EURAUD and GBPAUD have all fired off engulfing bars on the daily charts at the New York close.

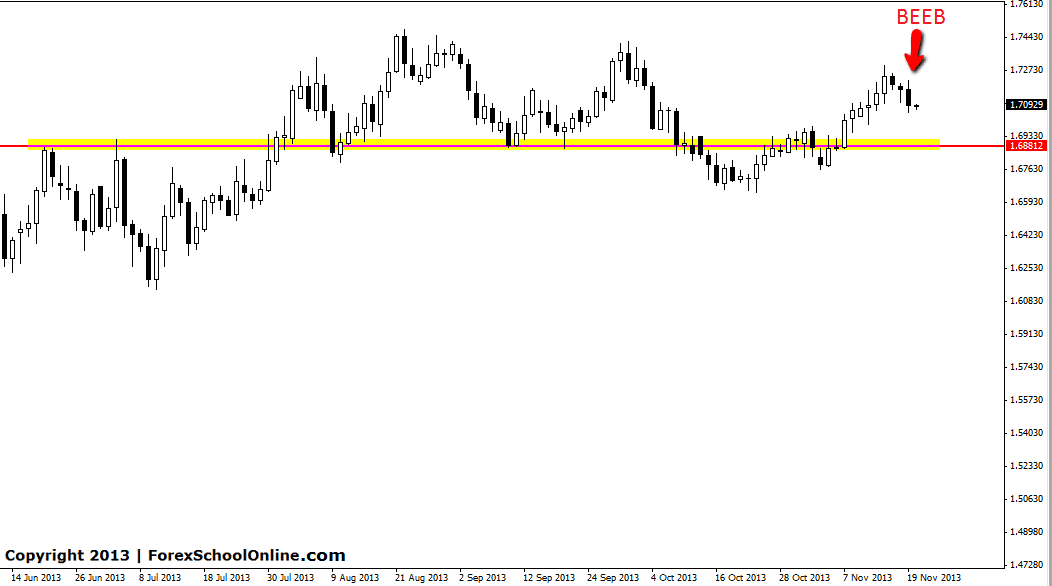

The GBPAUD has been in a tight range on the daily chart for the past five months, after being in a roaring up-trend. These ranges can be frustrating for traders because there are no clear direction to trade within. Trading within ranges can be successful when the range has clearly identifiable support or resistance levels to trade from and the chart is not just whipping in-between minor levels like the USDJPY has been recently.

The major problem with a lot of the engulfing bars that have formed today is that they have not formed from key levels and a lot of them are in the middle of no mans land. As we discuss in this article HERE the price action story is king and the signal is the confirmation to any successful price action trade.

If price can break the bearish engulfing bar (BEEB) low on the GBPAUD, it may then try to move lower and into the key support level on this pair. This level has been a key level time and time again for this pair as both a support and resistance level. Traders could keep an eye on this level and watch for price action clues should price move lower. If price moves back higher, traders should be mindful that price is range trading and the best reversal trades will be made from the extreme high of the range.

GBPAUD Daily Chart

Leave a Reply