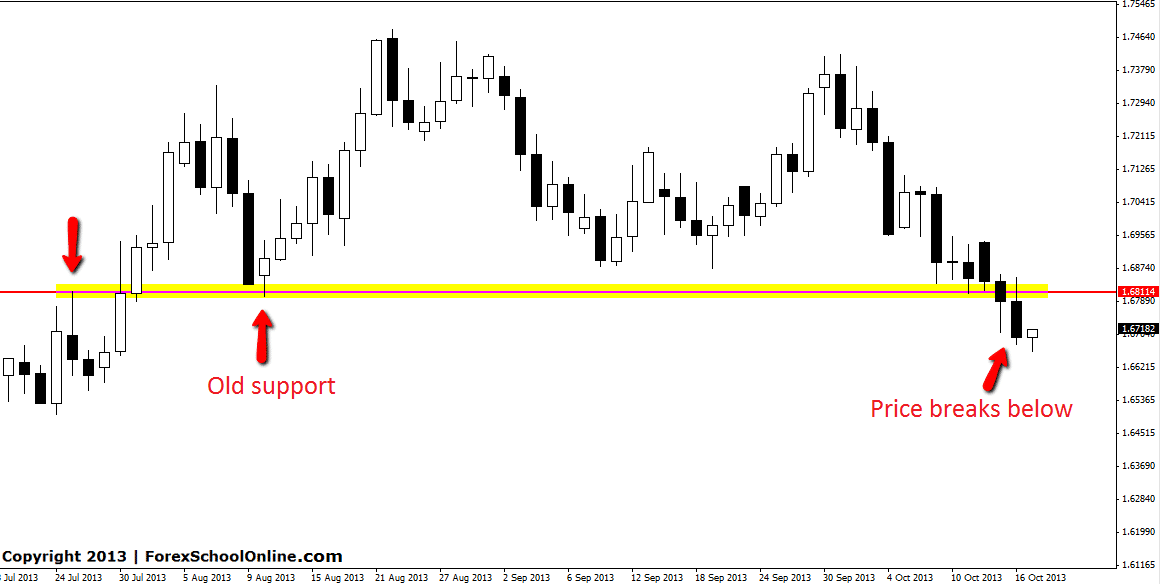

The GBPAUD has broken and closed below a key price action support level. This level could now look to act as an old support and new resistance level if price moves higher and back into it. This level has been a proven level many times for this pair and the key for price breaking this level was the daily candle closing below the key support level. Often key levels will have false breaks with candle wicks popping through before price will then make a move back the other way.

Now that this support level has broken it may act as a price flip level and traders could look to the new resistance area to target short trades. This new resistance could act as a high probability area to enter this pair at a key daily area with the new strong bearish momentum lower whilst price stays below the new resistance. If price moves back above the new resistance this level would look to act as a price flip again and become a new a support level. The next major support for this pair comes in around the Very Big Round Number of 1.6500.

GBPAUD Daily Chart

Special Note: I have just released a new article on the secrets traders can learn from candlesticks and price action. This article takes an in depth look at what price action is really about, why it actually works and the secrets traders can learn when they are well educated in reading the charts. You can find this new article here: The Secrets Traders Can Learn From Candlesticks and Price Action

Leave a Reply