Forex Trading Signals to Avoid

In most of the articles we make at Forex School Online we discuss the best setups for price action traders to find and how to trade them. What’s often overlooked is what traders should be avoiding and steering clear off.

Just as important as knowing what the best setups look like is knowing what the rubbish trades look like so they can be avoided.

I have updated today’s lesson and refreshed it because traders regularly ask about the trades and markets that need to be avoided.

This lesson is going to cover the four most common trades I see traders make that they would be better off leaving alone. If you are a price action trader these setups will be familiar to you and after reading this, you will hopefully have a better understanding off how to avoid them in the future.

#1: The Inverted Pin Bar

This is a setup that commonly sucks traders in that are new to learning the Pin Bar.

The Pin Bar can be confusing when first learnt and the most confusing thing can be where the best spot to trade them from is. The Pin Bar can be a very powerful and reliable price action setup when played from the correct spots on the chart, but when played from incorrect positions, the Pin Bar loses its edge on the market.

NOTE: Valid Pin Bars have large noses that stick out and way from price. To re-hash on the pin bar read here: Pin Bar Reversal Tutorial.

The inverted Pin Bar is the Pin that forms pointing the wrong way. Looking at the price action chart the first thing that should be obvious is that instead of the nose of the Pin Bar sticking out and away from price, it is instead sticks back into the price.

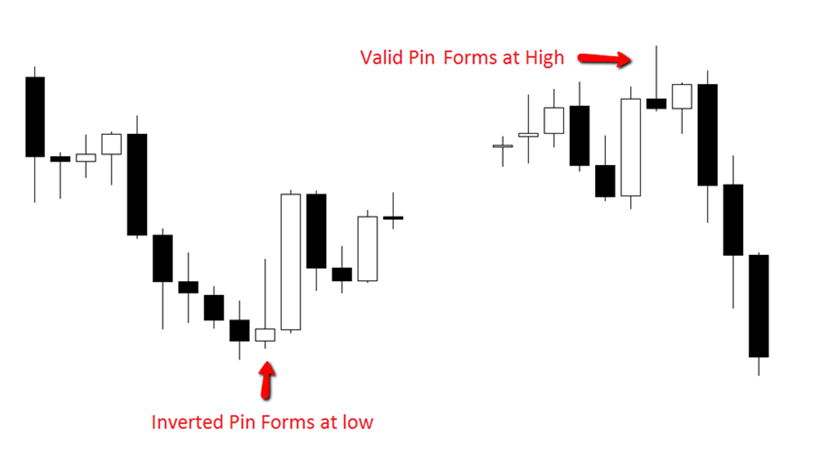

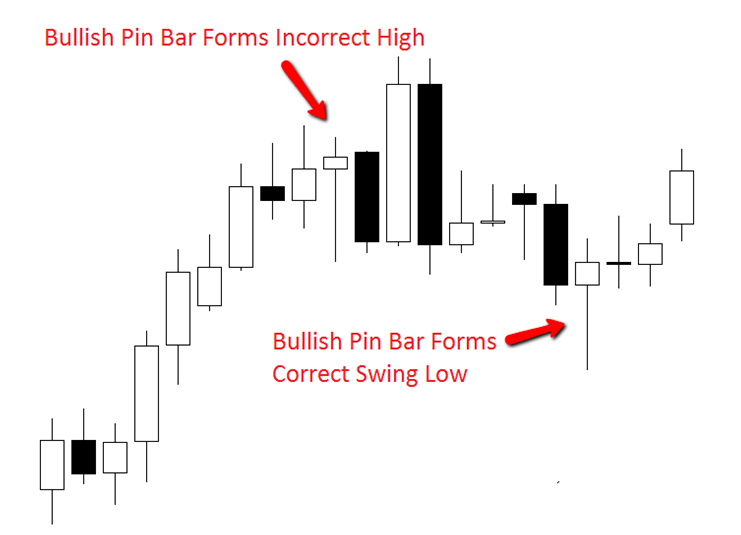

The chart below shows two bearish Pin Bars.

The first Pin Bar on the left is the inverted Pin Bar. Notice how this Pin Bar is down at the low and is not sticking out away from price, but rather the nose of the pin is sticking back into price. The valid pin bar on the other hand has a nose that is up at the high and sticking right up and away from all other price.

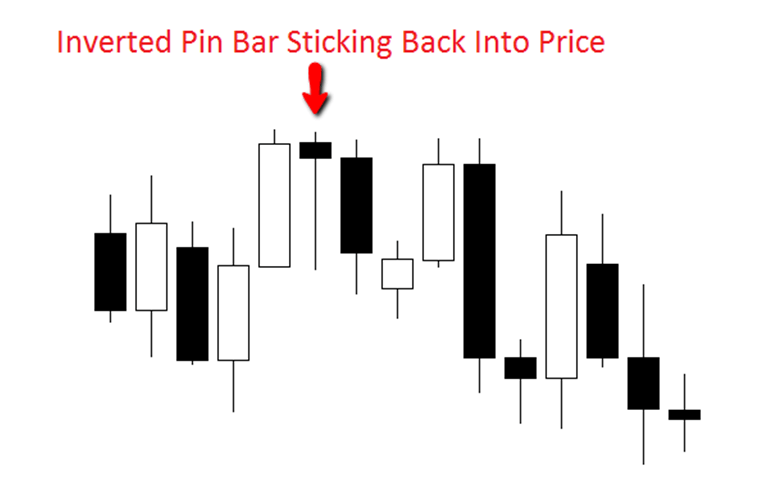

The chart below shows an inverted Pin Bar. Notice how instead of this bullish Pin Bar being down at a low and sticking down and away from price it is instead up at the high which then makes it stuck and sticking back in at price making it look “inverted”.

Quite often the inverted Pin Bar is hinting at price moving in the opposite direction to what the Pin Bars normally indicates and this is why they are so often sucker trades.

For example; Bearish Pin Bars are normally a clue that price is about to move back lower, but the inverted Pin Bar, like the first example on the chart above is actually a price action signal for price to move back higher.

Traders looking to trade that Pin Bar lower would be entering a signal that is actually hinting at higher prices! It is extremely important that when looking to trade all Pin Bars they are traded form the correct areas on the charts.

Checkout the current chart daily chart of the AUDCAD and the inverted pin bar price printed off in the image below;

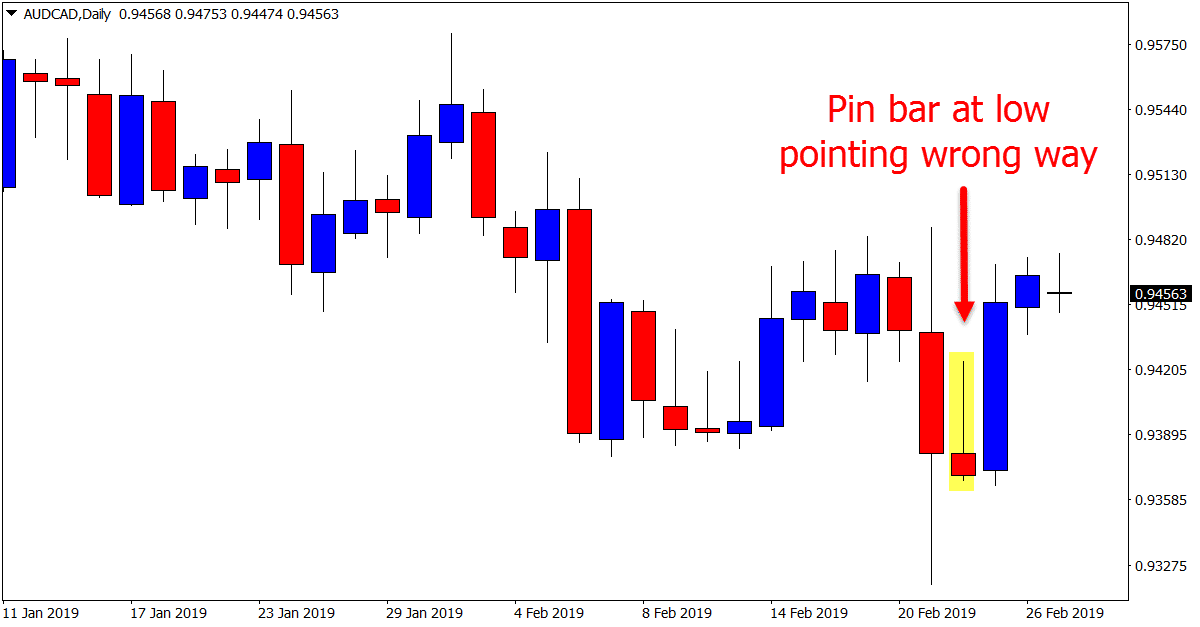

#2: The Reversal Signal Buried Away in Price

The reversal signal that forms in traffic is a price action signal that can cause quite a lot of frustration for traders who take them as they tend to bounce around from level to level rather than moving in the desired direction.

The major problem with entering trading signals that are buried away in price is that they don’t have the same edge on the market that the large signals that are sticking out and away from the market do.

Below we have highlighted two different charts. The first chart on the left shows two bullish engulfing bars that are both buried away in price. Both of these setups are low probability setups.

The setups on the right is also a bullish engulfing bar, but this setups is sticking out, is large and is not stuck back in and hiding away in the previous price. This third bullish engulfing bar is by far the best of the setups because it is formed in by far the best position on the chart.

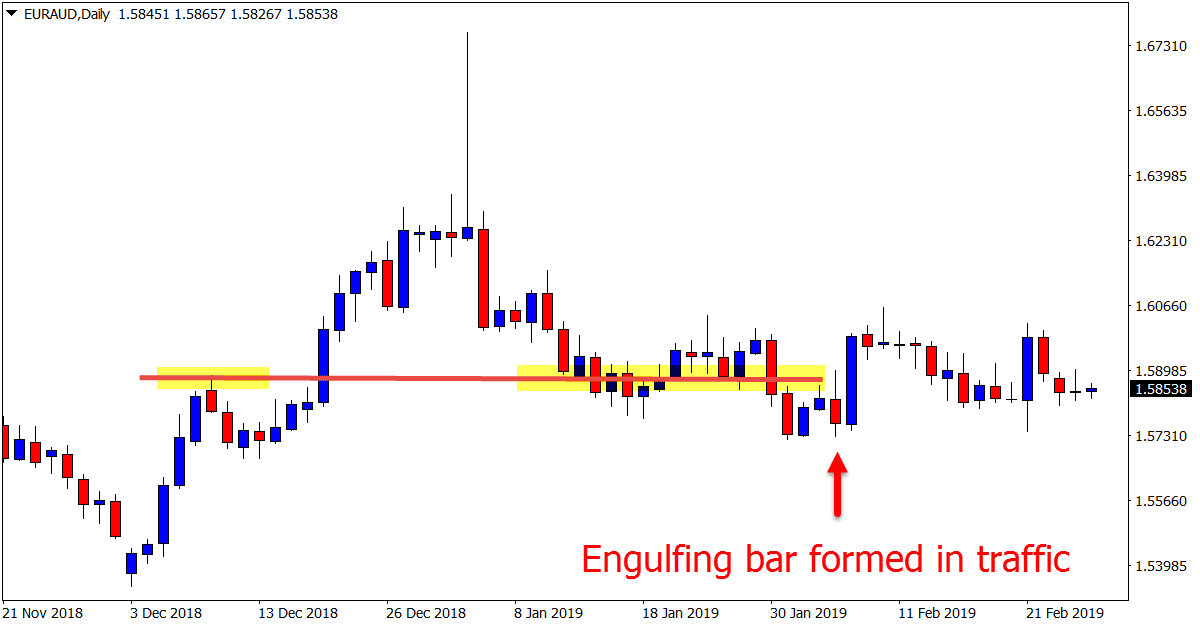

The chart below is the current EURAUD chart showing a recent bearish engulfing bar that was not at a swing high as we will discuss below, and because of this was stuck in ‘traffic’ making it hard to move.

#3: The Signal From the Incorrect Swing

This is without a doubt one of the main hurdles that price action traders struggle with when first learning to the art of trading reversal price action trading signals.

It is also one of the most important keys to finding high probability reversal trade setups.

There are a few key points that traders need to keep in mind when trading reversal signals that will hold them in good stead which are;

- When trading reversals you must enter trades picking price to “reverse” (explained more fully below)

- Reversals cannot be traded as continuations

- There is no set amount of candles to that makes a price swing

- One candle is NOT a price swing

The main problem with trading reversal signals from the incorrect swing points is that traders are entering from areas in the markets where they big guys are just taking their profits. In other words entering at the incorrect swing points is entering at the point of least value rather than the best.

To learn more about what exactly swing points are you can read an in-depth tutorial here: Trading Price Action Swing Points

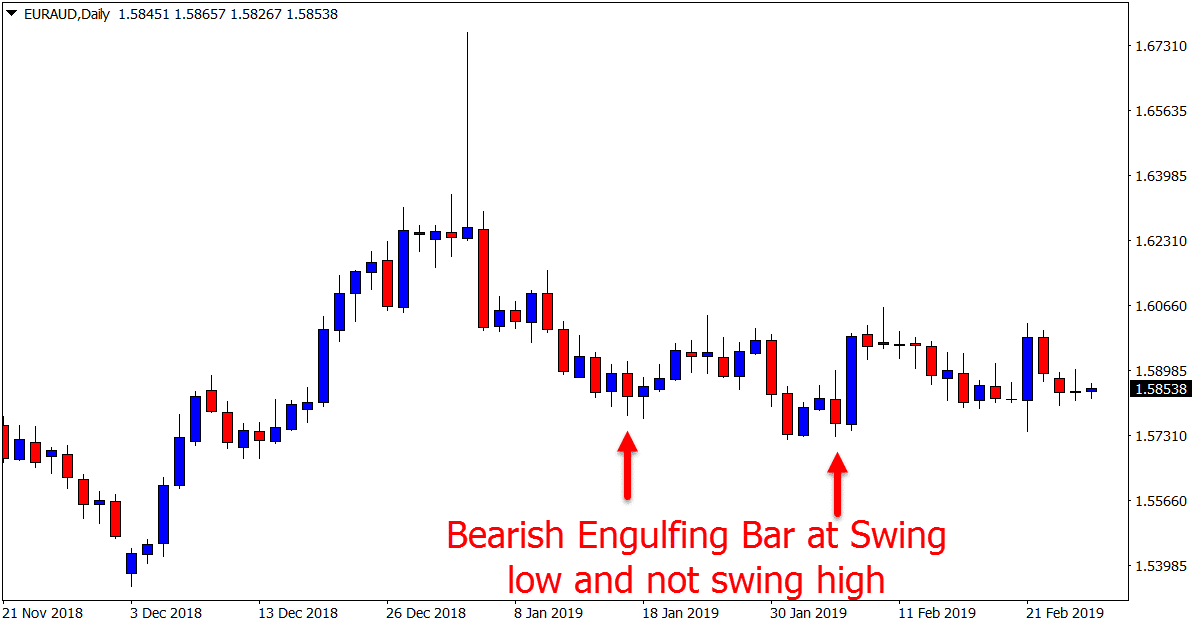

Below is an example of the EURAUD chart this time showing a bearish engulfing bar that is formed at an incorrect swing low. To make a bearish reversal trade we would need to see it form up at a high.

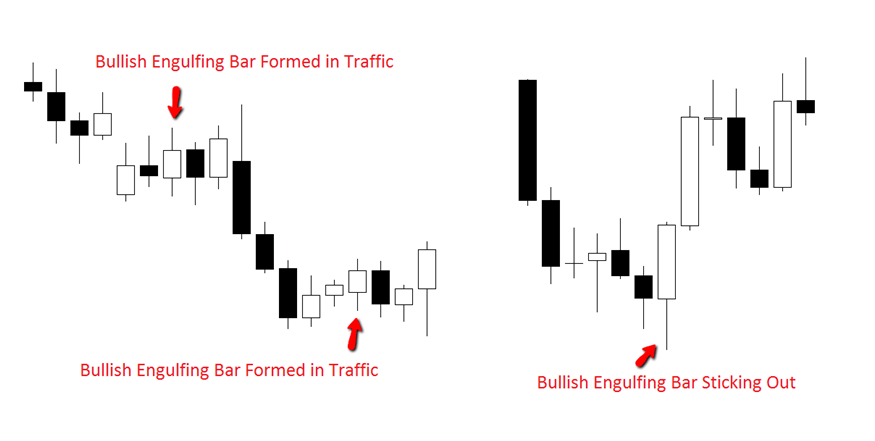

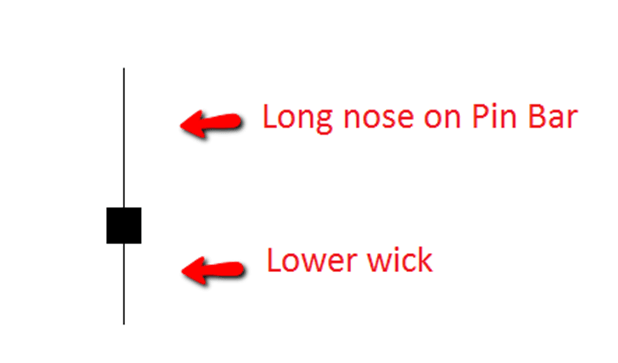

#4: Pin Bars With Wicks on the Other End

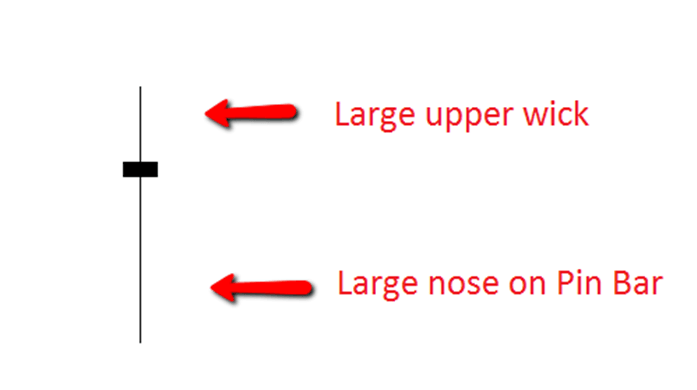

The best Pin Bars are the Pin Bars with big long noses or wicks that stick out, but what we don’t want on the good Pin Bar’s is wicks on the other end of the candle. See the chart below for further explanation:

The bullish Pin Bar example above has a great long nose that is exactly what traders are looking for when hunting bullish Pin Bars, but the upper wick can create problems and because of these wicks, traders should often avoid pins with large upper or lower wicks on them.

The danger with the upper or lower wicks on Pin Bars is how they were created. Often the wicks on candles are created from the order flow price action rejecting a level.

For example; price moves up higher to a level and the bears (Sellers) jump in to push price back lower and an upper wick is created. In this example we can see that resistance came in from higher prices and this is why the upper wick was created. The risk that if price goes higher again this resistance may well hold again and trading straight into an area of support or resistance is never a smart play.

In the example below we have a bearish Pin Bar.

The bearish Pin Bar is created in the first place from price moving higher and the bears (sellers) jumping in and smashing price back lower. The nose on the Pin Bar is created because price found resistance from higher prices and rejected it moving lower creating the higher nose on the Pin Bar.

On this Pin Bar below you can also see a lower wick. This wick is created using the same process and this is why wicks on the other ends of Pin Bars can be tricky and at times dangerous.

Price in the example below has tried to move lower, but has found support and the bulls (buyers) have held firm and managed to push price back higher which has created the lower wick on the Pin Bar.

The risk with the upper and lower wicks comes when you go to enter a trade with the Pin Bar. If you were to trade the example Pin Bar above you would be going short.

The danger with selling in this position is that we can see from the lower wick that price has already tried to push lower and has not been able to. Price tried to move lower and the bulls (buyers) jumped in and pushed price back higher. If you enter this Pin Bar, you run the risk of entering the trade and the bulls pushing price straight back higher and being stopped out.

Finally

In this article we have covered the not so much talked about subject of what not to look for. I have found this to be surprisingly what a lot of traders want to learn about. Price Action trading is something that is continually learned and perfected. As the markets adapt and change it is our job as traders to continually adapt and change with them.

Make sure you start with a demo trading account and practice the heck out of your strategies so when you trade with real cash you know what trades to avoid, and what to jump into.

I would love to hear your comments and any questions in the comments below.

Safe trading,

Johnathon

I like your articles, but be anew trader, I still need more to read .

HI Daramola,

I suggest checking out both; https://www.forexschoolonline.com//forex-strategies/ and; https://www.forexschoolonline.com//forex-videos

Whilst not everything is under these two categories, quite a lot and many, many hours of study.

Safe trading,

Johnathon

Hi Johnathon,

This was an amazing lesson. I think you have the best forex website, bar none. I have recommended so many people to your site. I am trying to make sure that I am reading my charts properly and this was a big help. I am going to go over some of the other lessons on chart reading

again. My big problem is not having enough confidence in my trades and wait to long to get in. Then they usually end up going in other direction. I think I will go back to demo trading. I never lose a lot, and always have a 2R or more S/L & profit. But if you keep losing trades that does no good. I thank you for all your knowledge.

hi another great post I have look at other price action courses on the pin bar an none of them come close to your post on them once again thank you for a great post

Heya William,

thanks for your great comment!

Keep an eye out this week for the latest lesson we are bringing out that I think you will enjoy as well.

Johnathon

sir,

i am a middle class trader, i want to earm 10000 usd,

what should i do?

Hi there, everything is going well here and ofcourse

every one is sharing data, that’s in fact fine,

keep up writing.

You ought to be a part of a contest for one of the most useful websites on the

web. I most certainly will recommend this website!

You have made some really good points there.

First off I want to say great blog! I had a quick

question in which I’d like to ask if you don’t mind. I was

curious to find out how you center yourself and clear your head prior to writing.

I have had a tough time clearing my mind in getting my

thoughts out there. I truly do take pleasure in writing but

it just seems like the first 10 to 15 minutes are wasted simply just trying to figure out how

to begin. Any suggestions or hints? Thanks!

As long as the knowledge here talks about price action it is a true knowledge of nitty gritty of FX.PA is the only and reliable key that unlock the hidden success in the business. However, Prof Johnathon and the likes that teach PA give the power to be a successful trader.Thanks.

it's really a very helpful article for all traders.i have practically tested it & it's working very well.

Thank you very much. I've been trawling the internet for months, on how to trade the above pinbars. Now I know. AWESOME………

I know, this solution is lazy n inelegant, it is much better to watch the trend, if any, that led you to this pin bar and virtually in every example given, the pin bar was fighting or opposing the trend, thus being a low probability trade. cheers.

Great Article… wise warnings,… not to be ignored. No doubt you should not enter unless you get confirmation. Confirmation may come in either waiting for next bar for direction or equally by placing 2 orders, one long above and one short below the pin bar. If either one triggers, do not cancel the other, it will be your stop loss. If neither trigger then next day you had an inside bar, just wait or reassess later on. Your price action is invaluable. keep doing it. thankyou.

It is really important to wait until confirmation arrives after you see possible pin bar setup.

Confirmation will save you a lot of money because pin bars can sometimes be fake on some trading pairs.

Important:

-if you want to trade pin bar setup you need to backtest how trading pair is doing when pin bar appears.

1. Do you need to wait confirmation bar

2. Does pin bar revers trend on swings

3. Does pin bar rejects on resistance or support line

buat tutorial forex plok ke lening…

Hi Johnathon.

Congrats on this article.

It’s very interesting and always helps everybody to learn more about price action.

Thanks.

Great article! Thanks!