The Islamic forex account is designed for Muslim traders that wish to trade currency pairs in accordance with the Islamic Shariah law. Here are the leading Islamic/Swap-free forex accounts available to traders.

4

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

€250

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

-

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

No

FCA

No

CySEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

€100

Spread min.

-

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

1

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

-

Regulation

No

FCA

Yes

CySEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

€100

Spread min.

1.3 pips

Leverage max

100:1

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECCFTCNFA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

1.5

EUR/USD

1.3

EUR/JPY

1.6

EUR/CHF

3.1

GBP/USD

1.9

GBP/JPY

3.6

GBP/CHF

4.2

USD/JPY

1.5

USD/CHF

2.0

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

1.3 pips

Regulation

No

FCA

No

CySEC

No

ASIC

Yes

CFTC

Yes

NFA

No

BAFIN

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Min.Deposit

€0

Spread min.

0.0 pips

Leverage max

2:1

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASIC

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

0.0

EUR/USD

0.0

EUR/JPY

0.0

EUR/CHF

0.0

GBP/USD

0.0

GBP/JPY

0.0

GBP/CHF

0.0

USD/JPY

0.0

USD/CHF

0.0

CHF/JPY

0.0

Additional Fee

Continuous rate

-

Conversión

0.0 pips

Regulation

No

FCA

No

CySEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

Trading leveraged products such as CFDs involves substantial risk of loss and may not be suitable for all investors. 83% of retail investor accounts lose money when trading CFDs with this provider. Trading such products is risky and you may lose all of your invested capital.

Compare Forex Brokers Fees:

Use our side-by-side comparison table to compare Forex broker accounts, spreads and fees.

Recommended

8cap

Visit Broker71% of retail investor accounts lose money when trading CFDs with this provider....

Forex.com

Visit BrokerCFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money....

VantageFX

Visit BrokerCFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money....

AvaTrade

Visit Broker71% of retail investor accounts lose money when trading CFDs with this provider....

Best 5 Islamic Forex Brokers 2022

Our best Islamic forex brokers for 2022 have been decided after in-depth research to make it easier for you to choose the best ones.

- Plus500 is a global Islamic forex broker that allows those running swap-free accounts to enjoy similar benefits to the primary account users, without the interest-related fees attached

- IC Markets is the best Islamic forex broker as Muslim traders don’t receive interest and are charged a flat fee for most services

- Pepperstone tops the ECN Islamic forex brokerage chart as the broker charges administrative fees, with no swaps or rollovers.

- FXTM is a CySec regulated broker that allows Muslim traders to use Islamic accounts with the full features available on other platforms.

Plus500 – Global Islamic Forex Broker

Plus500 has become an international forex broker, gaining numerous customers since it was founded in 2008. The broker offers Islamic/swap-free accounts for traders who wish to trade forex within the jurisdictions of Islamic law. Plus500 is a regulated broker as it is authorized by various regulatory agencies in numerous countries. Islamic account users on Plus500 enjoy similar benefits to the basic account users, without the interest-related fees attached.

On the Plus500 Islamic accounts, traders get to enjoy leverage up to 1:300, commission-free trading, spreads that start from 0.6 on EUR/USD, and access to a wide variety of financial instruments across numerous financial asset classes. Furthermore, they gain access to Plus500’s proprietary trading platform.

Plus 500 fees

| Type of fees | amount charged |

| Deposit fees | free |

| Withdrawal fee | free |

| Conversion fees | 0.5% of the profit |

| Inactivity fee | $10/month |

Your capital is at risk.

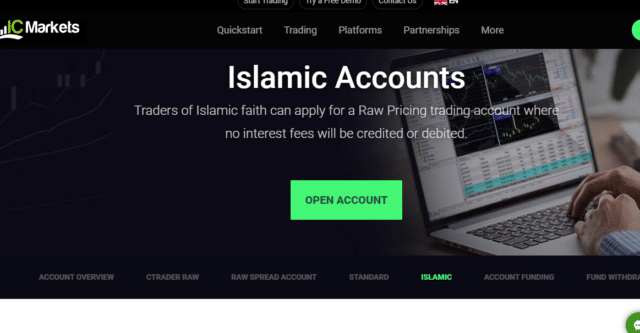

IC Markets – Best Islamic Forex Broker

IC Markets is one of the best Islamic forex brokers in the world. On this platform, Muslim traders cannot receive or charge interest. Thus, the broker charges a flat rate for most of the services it offers to Muslim traders on its platform. Similar to the other account type, Islamic forex accounts enjoy numerous features such as the MetaTrader platforms, trading tools, indicators, EAs, and more. As an ASIC-regulated broker, IC Markets has become a trusted source broker for people that wish to operate Islamic forex accounts.

The swap-free option on IC Markets is available on both our Raw Spread and Standard account types on the MT4, MT5, and cTrader platforms of the broker. IC Markets wants to provide its clients with Islamic accounts that offer state of the art trading infrastructure and execution speeds. Thus, giving Muslim traders a competitive edge in the marketplace.

IC Markets fees

| Type of fees | amount charged |

| Deposit fees | free |

| Withdrawal fee | free |

| Conversion fees | $3.5 per standard lot round turn |

| Inactivity fee | None |

Your capital is at risk.

Pepperstone – Leading ECN Islamic Broker

Pepperstone is an Australian ECN broker that is regulated by ASIC. Pepperstone Islamic accounts are available after a client opens a standard ECN account, where they will be given the option to operate an Islamic forex account. For Islamic accounts on Pepperstone, traders are not charged swaps or rollovers on overnight positions. Rather, the broker charges administrative fees, which is legal according to the Islamic Shariah law. The Islamic forex account operators enjoy all the benefits of regular accounts such as trading platforms, tools, indicators, news, technical analysis, and more.

The Swap-free account is available to traders in certain countries who can’t receive or pay swaps. The trading account is interest-free, enabling traders to take advantage of the cutting-edge trading technology and deep liquidity provided by Pepperstone

Pepperstone fees

| Type of fees | amount charged |

| Deposit fees | free |

| Withdrawal fee | free |

| Conversion fees | $3.50 per $100,000 bought |

| Inactivity fee | None |

Your capital is at risk.

FXTM – CySec Regulated Islamic Broker

FXTM is another leading Islamic broker. It is regulated by Cyprus Securities and Exchange Commission (CySec), and it offers a wide range of account types, including Islamic/Swap-free accounts. The Islamic account is available on all account types on FXTM. However, those running Islamic accounts have a limited number of currency pairs they can trade. The traders have access to the trading platforms and all the features that comes with them.

FXTM fees

| Type of fees | amount charged |

| Deposit fees | free |

| Withdrawal fee | $3 for bank transfer |

| Conversion fees | 4 units of the Base currency |

| Inactivity fee | $5/month |

Your capital is at risk.

What is an Islamic or Swap Free Forex Account?

Forex Islamic accounts are the swap-free accounts as they have no swap or rollover fees for overnight positions. Since interest is against the Shariah law, Muslims are prohibited from taking or giving interest in their business activities. Because of this rule, most forex brokers have separate Islamic accounts for Muslims that are in line with the Sharia law.

When it comes to Islamic accounts, there are no fees paid in the form of interests. The fee for rolling over a position overnight in the forex market is an example of an interest payment. The payment is made when a trader is carrying over a trading position to the next trading day. Since it is against the Islamic law, rollover fees and other interest-based fees are not charged on Islamic forex accounts.

A swap-free account is the same as an Islamic forex account. The two terms are used interchangeably, but they represent the same term. In both of them, interests are not paid for trading forex and other financial instruments.

Features of an Islamic Forex Account

There are not many differences between the Islamic forex account and the basic accounts. The only major difference is the absence of swap commissions. The lack of swap fees can be a huge advantage for traders as it allows them to open long-term trading positions without running the risk of reducing their profits because of the swap commissions.

Pros and Cons of Islamic Forex Account

Pros

- With Islamic forex accounts, there are no swap fees. Thus, traders can leave their positions open overnight for days without losing must of their profits to swap commissions

- Another advantage of the Islamic Forex account is that traders have the opportunity to open positions in currency pairs that usually have high swap costs. The exotic pairs usually have high swap fees. Thus, Islamic forex traders can trade the exotic currency pairs with ease and comfort.

Cons

- Halal traders won’t get to enjoy some perks of trading forex currencies, such as the positive interest payments that are often paid to short positions.

What to look for when choosing a Swap-Free Account

When opening an Islamic trading account, there are a few things to look at in a broker.

Customer support

One of the most important features to check in a forex broker is to see if it has good customer service. As an Islamic forex trader, your needs are different from those of regular traders, and a good broker should have a support team that is readily available to help you whenever you have a problem with your swap-free account

Regulation

You should check the regulatory status of a broker before you open an Islamic forex account with them. The regulated brokers can be held responsible for any misgivings, or they can play a role in solving any issue that affects their customers. Such brokers also provide adequate security measures to ensure the safety of your personal data and funds.

Deposit and withdrawals

The best Islamic forex brokers are those that offer a wide range of deposit and withdrawal options for clients. They allow people to deposit and withdraw funds using methods like bank transfer, credit/debit cards, and electronic wallets. They also process the payments instantly. Choose brokers that process payments within 1 to 2 days. This is important when withdrawing your earnings.

Global presence

Check to see if the forex broker has a presence on the international stage. Those available in multiple countries usually offer personalized services based on the needs of the traders in a certain country. If they have an international presence, they might offer local seminar presentations and training to help aspiring and active traders. The international brokers also hire customer support staff from various countries, which makes it easy for you to communicate with them in your local language.

Commissions and fees

Look at the commissions and fees for an Islamic account. Keep in mind that there are no interest-based fees and commissions like rollover fees when trading with an Islamic forex account.

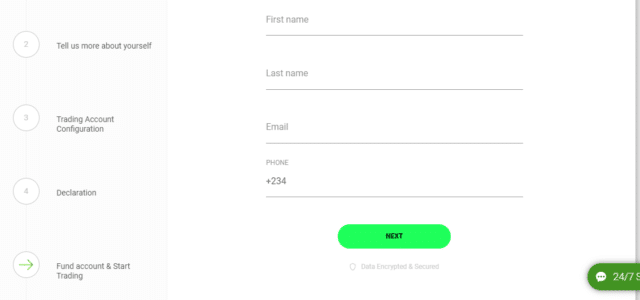

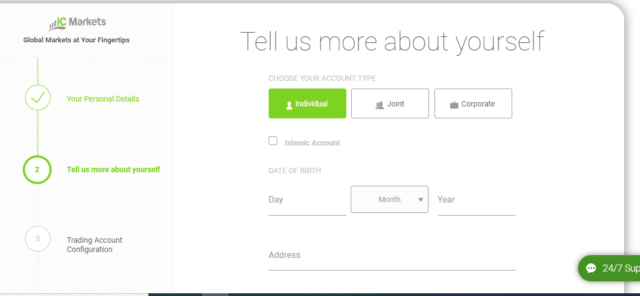

How to Open an Islamic/Swap-Free Account

To show how it is done, we will use the IC Markets platform.

- To open an Islamic forex trading account, visit the official website of the broker

- Navigate to account types and choose the Islamic account

- Click on Open and provide the needed information

- Choose the account type. This is where you will see the Islamic account type to choose and fill out the other details

- Complete the registration process and start trading the Islamic account.

FAQs

Why does sharia law prohibit dealing with interest?

According to the Islamic faith, interest leads to negative growth. While it may increase money quantitatively, there is no progression in social wealth. Islamic law stipulates that interest corrupts the society.

What is the Swap Free Forex account?

Swap-free is another term for interest-free. A crucial part of forex trading is paying various interests like Rollover fees. With Islamic forex accounts, there are no such interest fees. Thus, the reason why it is called the swap-free forex account.

What did the Muslim scholars rule about Forex trading?

Similar to stocks and other financial markets, there is an ongoing debate amongst Islamic scholars regarding forex trading. However, most scholars believe forex trading is good if Muslims follow a set of conditions, such as eliminating interest fees.

What kinds of fees are eliminated in Forex Islamic accounts?

With Islamic forex accounts, all interest-based fees are waived. An example of this is the rollover fee, a payment conducted when a trade is left open overnight. Since they are interest-based, rollover fees are waved in Forex Islamic accounts.

What are rollover fees?

The forex market ends at the end of each day. If a trader decides to leave a position open overnight, they will attract Rollover fees. This is an interest payment made for leaving a position open overnight. The Rollover fees are not present in forex Islamic accounts.

What is Riba?

Riba is the Arabic word for interest. According to Shariah law, Riba is forbidden since Muslims are directed to give without expecting something extra in return, such as interest. Forex Islamic accounts are Riba free, otherwise known as interest-free or swap-free.

A comparison of the best Islamic forex brokers

| IC Markets | Pepperstone | FXTM | Plus500 | ||

| Features | |||||

| Demo account | Yes | Yes | Yes | Yes | |

| 24/7 customer support | Yes | Yes | Yes | Yes | |

| Mobile app | Yes | Yes | Yes | Yes | |

| Charting tools | Yes | Yes | Yes | Yes | |

| Real-time quotes | Yes | Yes | Yes | Yes | |

| Price alerts | Yes | Yes | Yes | Yes | |

| Numerous markets | Yes | Yes | Yes | Yes | |

| Social trading | No | No | No | No | |

| Copy-trading | No | Yes | Yes | No | |

| Free deposit and withdrawal | Yes | Yes | No | Yes |