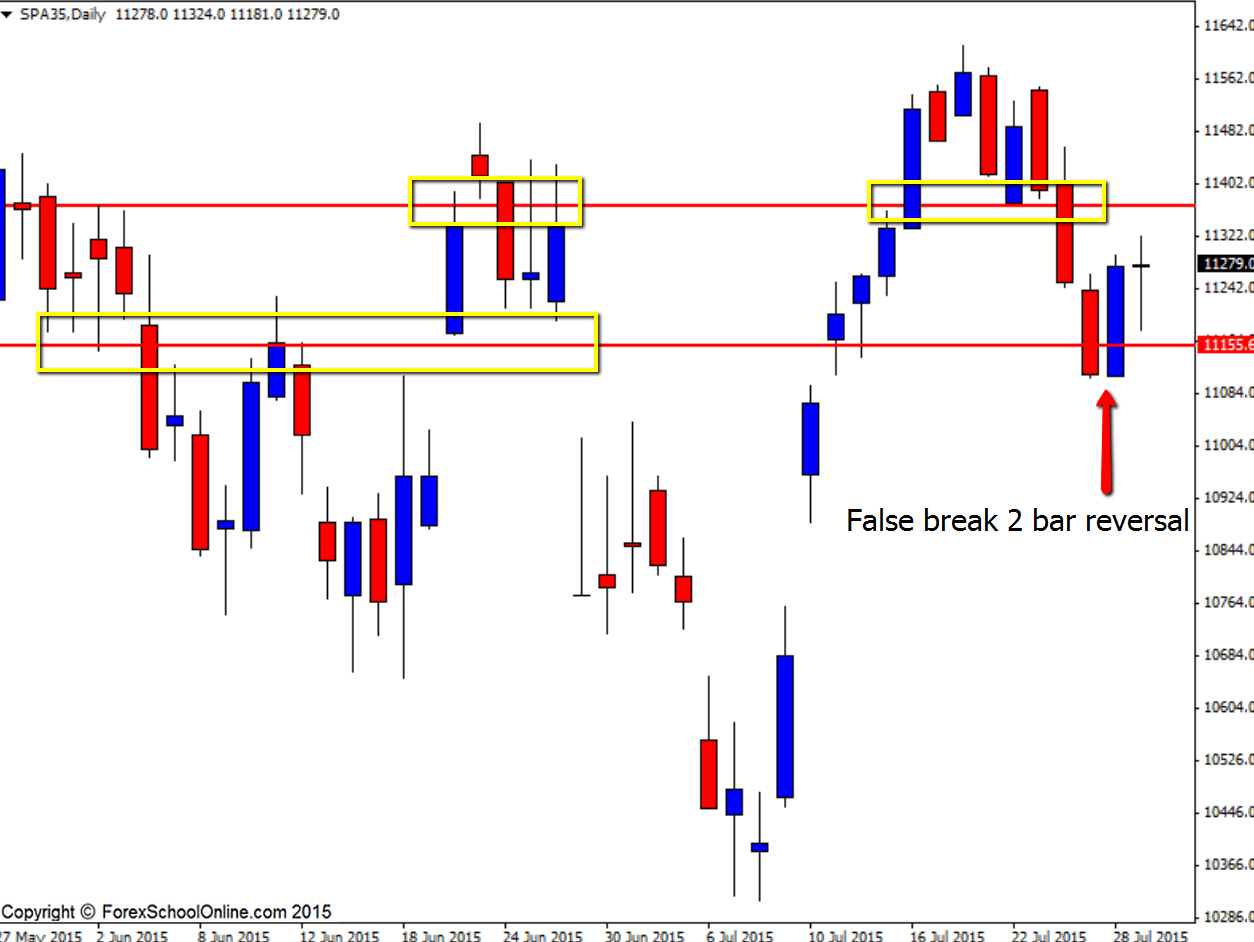

Price on the daily price action chart of the Spain 35 (SPA35) has fired off a false break 2 bar reversal that is rejecting a major daily support level within an overall sideways range. This 2 bar reversal is sticking out and away from all other price and is down at a swing low which is super important for a bullish reversal signal.

It is crucial for reversal signals that they form at the correct swing points. In other words; if we are to play a bullish reversal signal we need to enter it at a swing low and a bearish reversal signal from swing high. A 2 bar reversal should only ever be played as a reversal and never as a continuation because it is picking price to reverse.

I discuss this more in-depth, what exactly swing points are and why they are so important in the trading lesson;

How to Make Money Trading Price Action Reversals

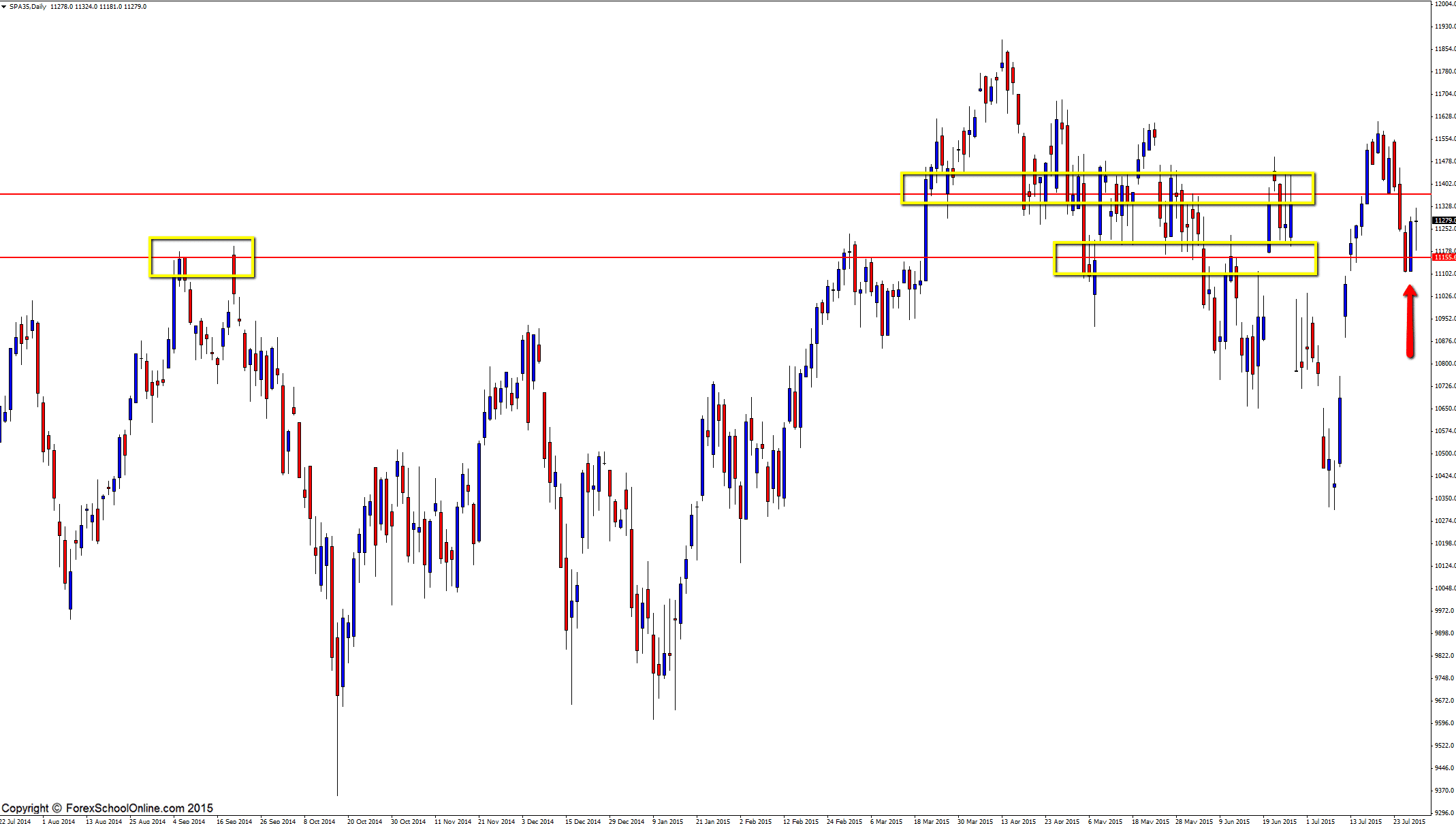

Price in recent times in this market has been very choppy with the overall movement in a sideways range. As shown on the daily chart below; there has been no clear trend for some time now and price has been bouncing in between the major support and resistance level without any clear direction or bias.

Price has already broken the high of the daily 2 bar reversal and moved slightly higher into a minor resistance overhead, where it was rejected and bounced back lower. The major issue and what you always have to keep in mind when trading in these ranging markets is that price is a lot more likely to respect the minor levels than if it was trading in a strongly trending market.

If price can re-gather momentum and make a move back higher, the next major resistance comes in around the 11368.90 area. If price moves back lower, then we are watching to see if price can close below the daily support level that price is making a false break of with the 2 bar reversal. If price can break and close below the daily support level, then a strong move lower could ensue.

Daily Chart

Daily Chart – Zoomed Out

Leave a Reply