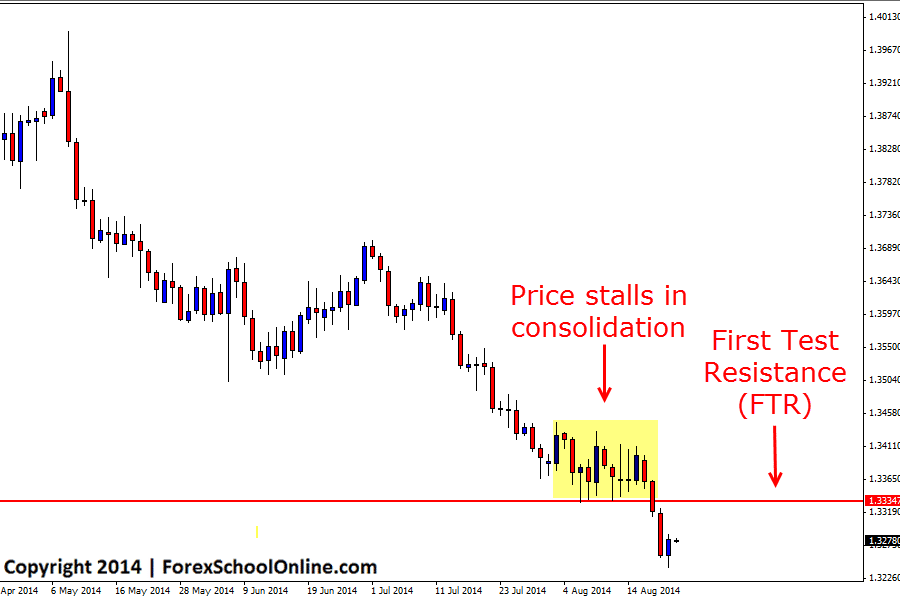

The EURUSD has recently broken through a major support level. Price had been consolidating above this support level for two weeks with price trading in a very small range. Price had moved into a pause or consolidation after a large and sustained move lower that had started back in April. As we often discuss in this blog; price will often pause like it has done on this pair before continuing on in the same direction. Like the daily chart shows below; price will often make a large move in either direction and in this case lower and then profit takers will come in which causes price to take a breather and pause. Because the overall momentum and trend is still lower, the order flow price action balance will normally roll back over in-line with the direction that price was trading in before price moved into the consolidation.

If price can now move back higher and into the old support area that price was consolidating at, it could now act as a solid area to hunt for short trades should any high probability A+ bearish price action trigger signals present such as the ones taught in the Forex School Online Advanced Price Action Courses. A trigger signal at this level would be a First Test Resistance which traders could then watch for setups on both their daily and intraday charts.

The Forex Market State of Play

The Forex market at the moment is going through a slow period with the volatility at a low point which is very common for this period of the year. Why is this important? Because volatility is a Forex traders best friend. To make money traders need the volatility to be high because then when the volatitlity is high it means the market is making large moves and price is free flowing and when the volatility is low it means price is making smaller moves and even when it does make it’s moves, instead of making free flowing moves, it makes moves slowly and by grinding with price whipsawing.

For traders to make money they obviously need price to be moving and the more price moves, the more opportunities they have to make trades and profit. A lot of traders are afraid of volatitlity, but they should see it as the opposite and see it as their friend because a low volatitlity market means a lot of sideways trading and very difficult trading. As I discuss in the trading tutorial Trading Price Action in Sideways Trading Markets traders have to know exactly what they are doing and be extra switched on in periods such as these when price is going through slower periods and periods of extra consolidation and sideways trading on a lot of Forex pairs. Traders need to be aware of it and make sure they don’t go burning their accounts looking for trades that are not there.

The traders that will always come out on top are those traders who stockpile their cash through the slow periods, whilst the other traders that cannot control their emotions, overtrade and blow their money on trades they should not be in. The traders who saved their cash can then pounce when the next high probability trading setup comes around and make further profits, whereas the other traders are fighting just to get back to break even because they have taken on losses on trades they “just had to play”.

EURUSD Daily Chart

Related Forex Trading Articles & Videos

– Trading High Probability Setups From First Test Resistance/Support

Leave a Reply