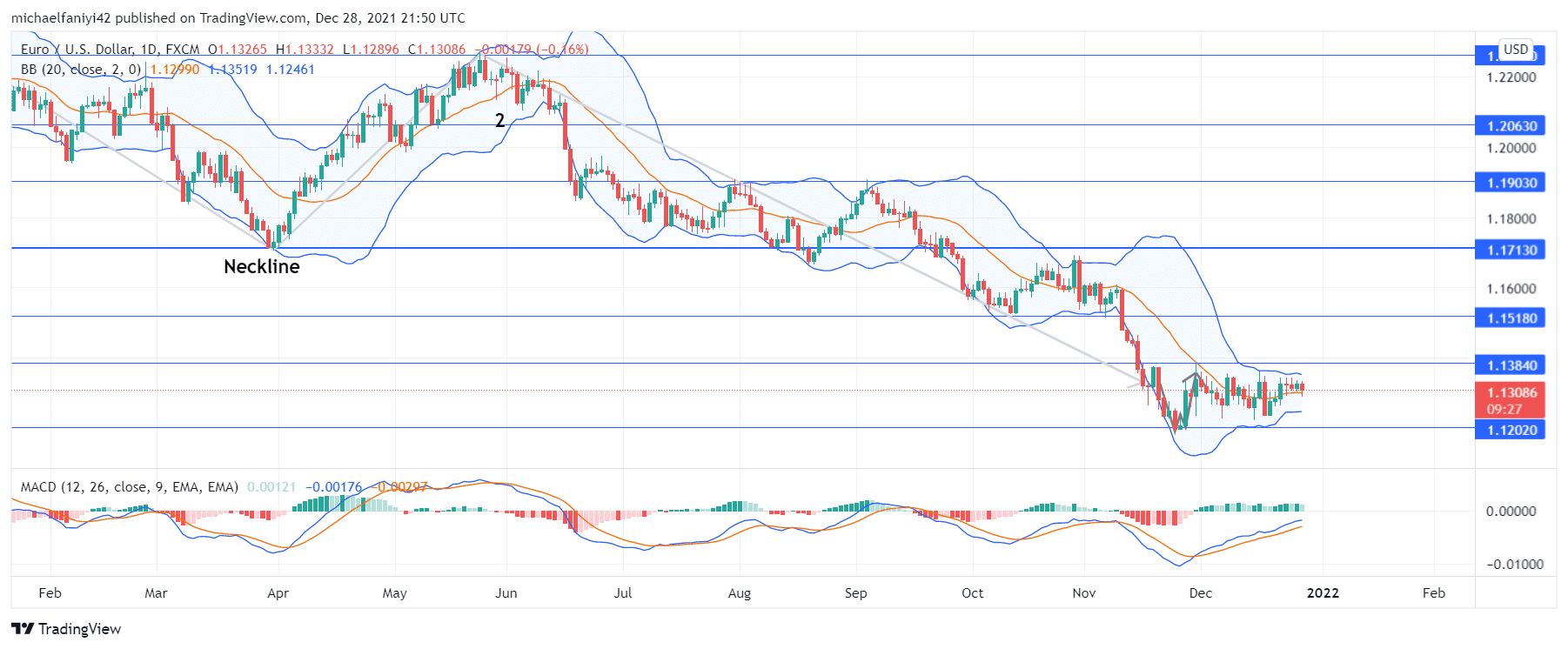

EURUSD Analysis – Price Maintains Equilibrium Above 1.12020

EURUSD maintains equilibrium as it awaits market forces to toss the balance in price upward or downward. The key levels at which the market is kept in confinement are 1.13840 as resistance and 1.12020 as support. EURUSD dropped into this zone on the 16th of November and has been undulating within it for up to six weeks. Price momentum is low, and therefore an outside market force is required to nudge the market.

EURUSD Key Levels

Resistance Levels: 1.13840, 1.17130

Support Levels: 1.12020, 1.09900 Bearish forces were in the driving seat before EURUSD was brought down to equilibrium. After rebounding off 1.17130, the market rose beyond several key levels till it found stiff resistance at 1.22620. This resulted in a major drop in the market for the year. EURUSD maintains the downtrend for several days from May until it drops below 1.13840 in November. It was at this level that price geared into equilibrium.

Bearish forces were in the driving seat before EURUSD was brought down to equilibrium. After rebounding off 1.17130, the market rose beyond several key levels till it found stiff resistance at 1.22620. This resulted in a major drop in the market for the year. EURUSD maintains the downtrend for several days from May until it drops below 1.13840 in November. It was at this level that price geared into equilibrium.

The support level at 1.12020 had to be very strong to withstand the initial drop in the market. Following that, the price can be seen moving freely in a sideways fashion. The MACD (Moving Average Convergence Divergence) emphasizes the bearish nature of the market below it geared into equilibrium. Its bullish histogram bars maintain an average height as the MACD lines have crossed upward.

Market Prospects

Market Prospects

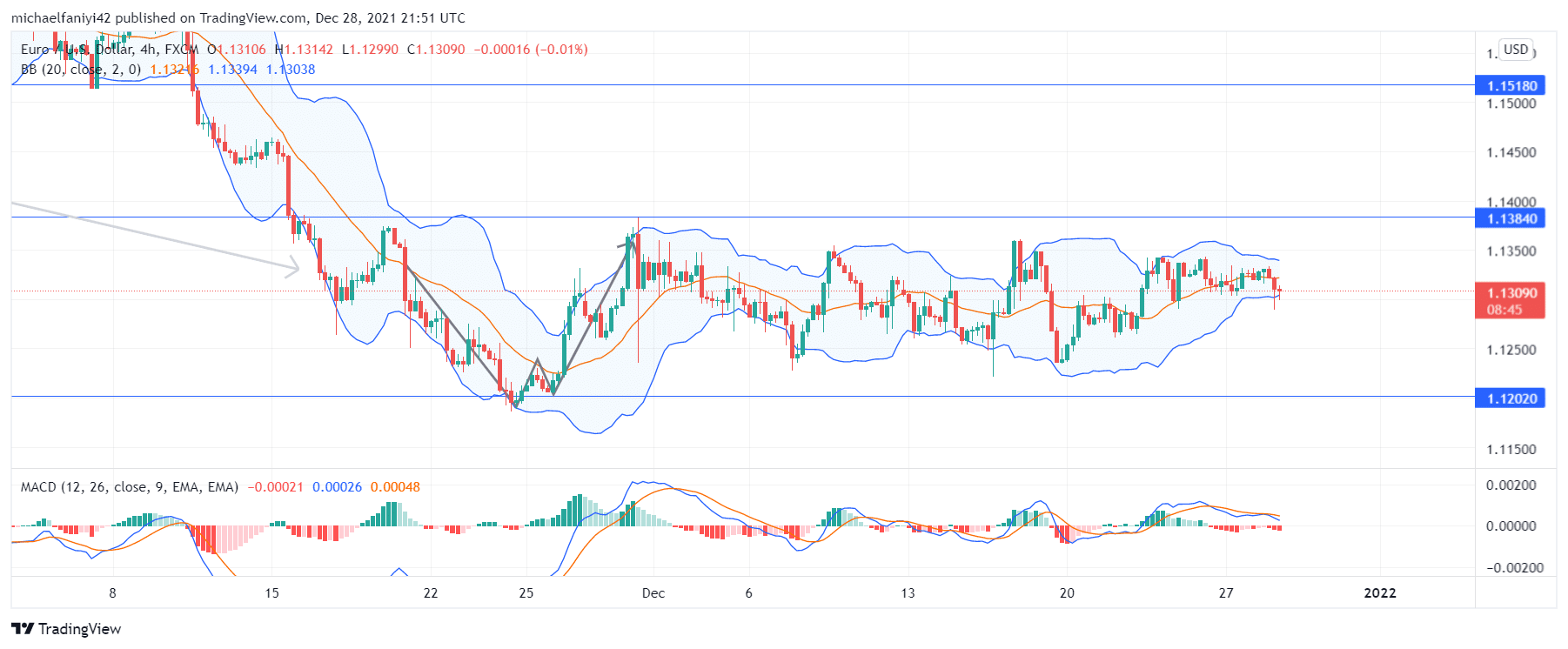

The 4-hour chart magnifies the consolidating state of the market. On the MACD chart, there is an alternate increase of the histogram bars as the MACD lines undulate upward and downward. There can also be seen a squeeze of the Bollinger Bands around the 4-hour candlesticks as the price awaits market forces to set it in motion. The price could move either way, but the strength of the 1.12020 support predisposes an uptrend.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply