The EURJPY is now retracing the 142.52 price level after poking through that same level about six trading sessions ago. Should price action attain this level, it may have gathered enough momentum to rise considerably above it this time around. Let’s further examine this market to get more concrete insights.

Major Price Levels:

Top Levels: 142.25, 142.53, and 143.00

Floor Levels: 142.00, 141.65, and 141.25

EURJPY Climbs Towards Resistance at 142.53

The EURJPY daily chart reveals that price action in this market is extending its upside move toward an important price resistance level of 142.53. Meanwhile, trading indicators are simultaneously showing positive signs that price activity may break through this level. The Moving Average Convergence Divergence (MACD) indicator curves are showing that downward forces are exhausted. This is seen as the indicator bars have vanished into the 0.00 level and their lines are now converging for a bullish crossover. Meanwhile, the Stochastic Relative Strength Index (SRSI) indicator curves keep ramping up toward the overbought area of the indicator. Consequently, signs here are aligned to predict that upside momentum may be strong enough to rise significantly above the mentioned resistance.

EURJPY Price Activity Continues to Gain More Upside Momentum

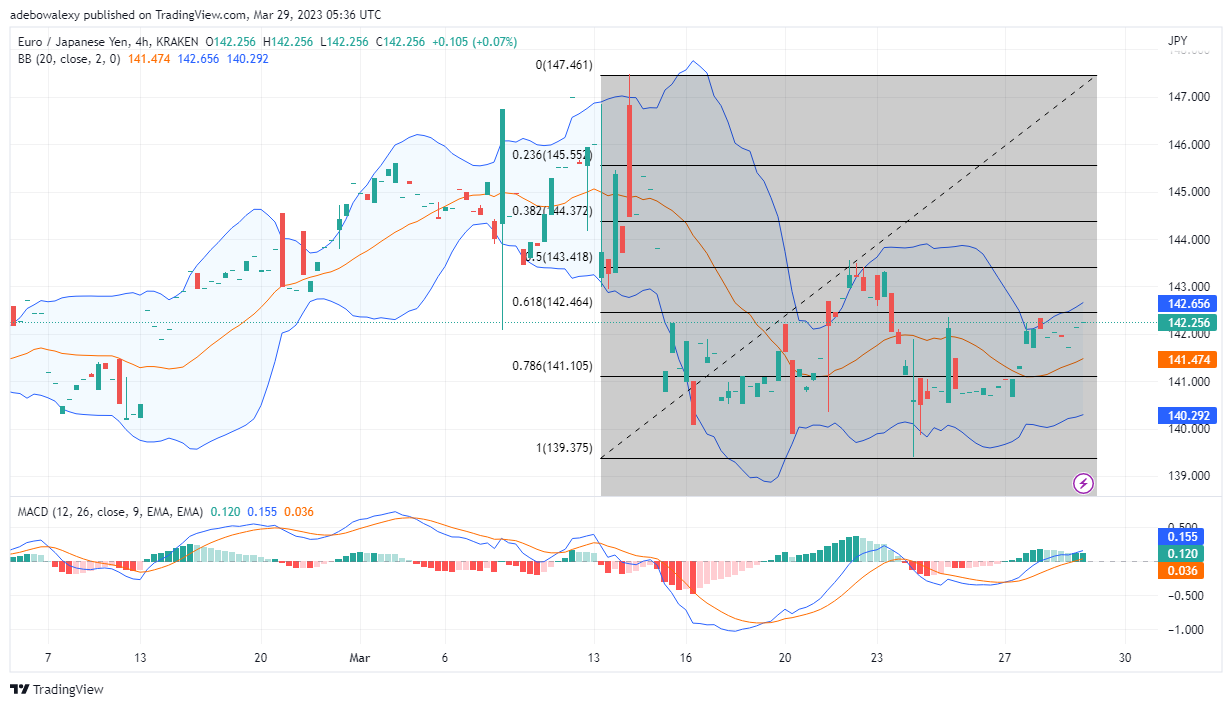

Moving to the 4-hour EURJPY market, one could perceive that trading indicators are increasingly revealing that upside momentum is developing. Looking at the Bollinger Bands indicator, it can be seen that it is now tilted upwards to indicate that price action is trending upwards. Also, the last price candle has nearly hit the 61.80 Fibonacci Retracement level as a resistance. Meanwhile, the MACD lines have risen beyond the 0.00 mark of the indicator. Also, the bars of this indicator are now green, indicating that bulls are in fine control of price movements. Consequently, the EURJPY price will close in on the 143.00 price mark as trading activities continue.

Do you want to take your trading to the next level? Join the best platform for that here.

Leave a Reply