EURCHF Sellers Show Signs Of Taking Charge

EURCHF is experiencing increased selling pressure as the pair hovers near the 0.94000 significant level. Although bulls have shown determination this month, signs of weakness around this key area suggest that sellers may be preparing to regain control.

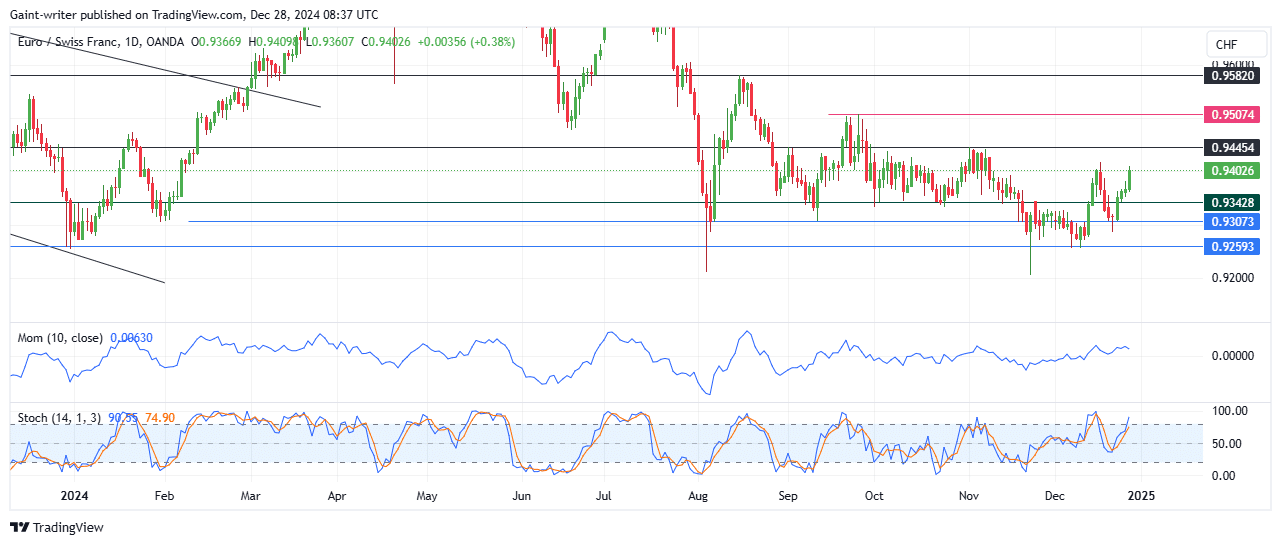

EURCHF Key Levels

Resistance Levels: 0.94000, 0.94450

Support Levels: 0.93500, 0.93000

The 0.94000 market area has proven to be a critical resistance zone for EURCHF. Last week, sellers reversed the market after the price reached this level, and current bullish momentum appears to be waning. If sellers build enough pressure here, the market could reverse, pushing the price toward lower support levels at 0.93500 or 0.93000.

The Momentum indicator, which had been building up, is now slipping, reflecting weakening bullish momentum. Additionally, the Stochastic Oscillator signals an overbought condition, hinting at a potential bearish turn. For traders seeking guidance, forex signals can provide real-time insights on market trends.

If sellers maintain their current stance, EURCHF is likely to face a pullback toward the 0.93500 support level. A deeper decline could see the price testing 0.93000 in the coming days. However, if buyers manage to regain strength and push past the 0.94000 resistance, the next target would be the 0.94450 key area.

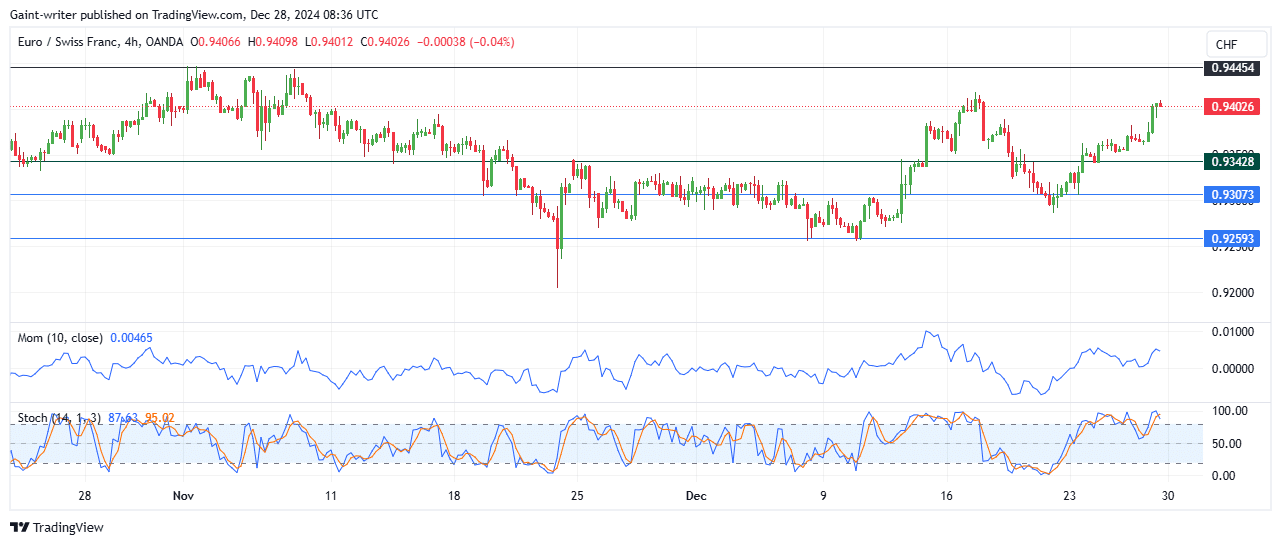

Market Expectation

On the shorter time frame, buyers are losing momentum, and sellers are gradually gaining control. The Stochastic Oscillator remains in the overbought zone, while the Momentum indicator suggests a slowing pace from the bulls.

Should bearish pressure intensify, EURCHF could slide toward 0.93700 in the medium term. It will, therefore, be a tough call for the bulls in the market.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not for your investing results.

Leave a Reply