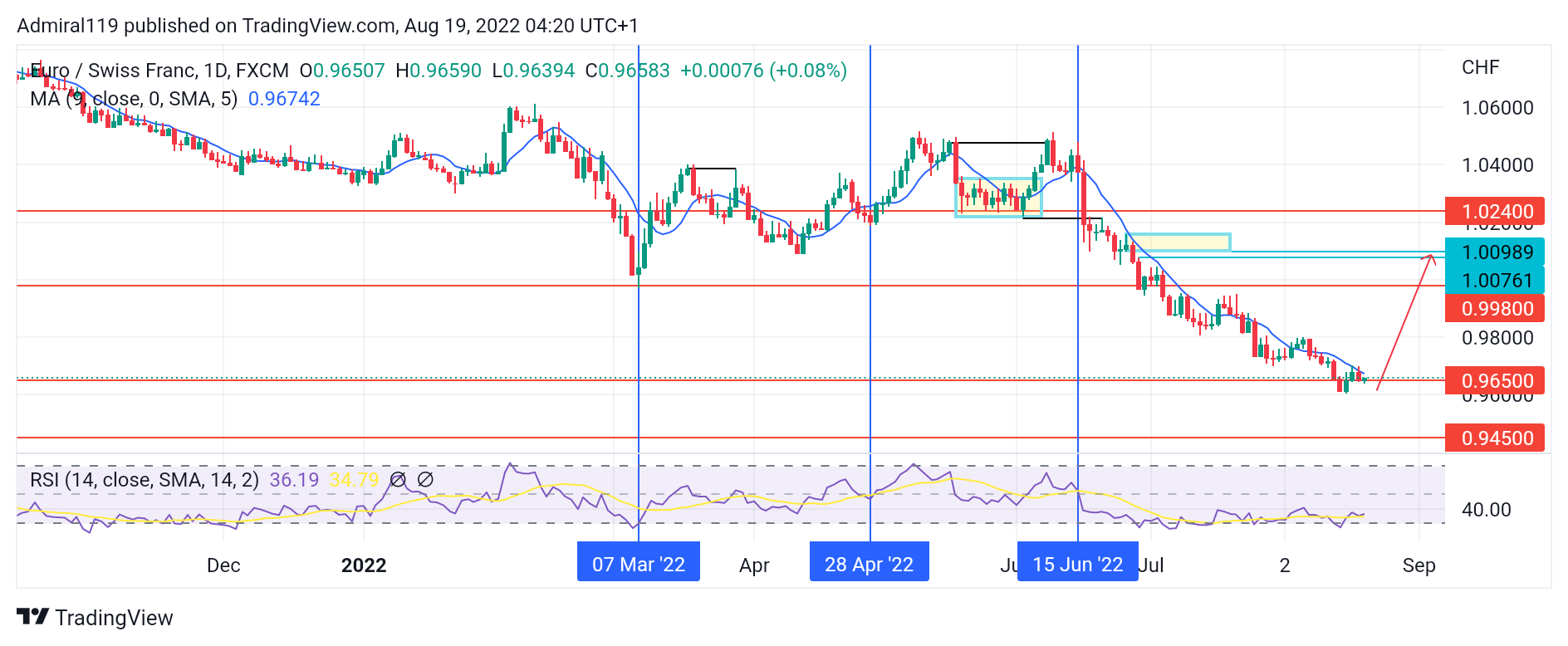

EURCHF Analysis – The Bears Began to Close Their Short Positions Into the Demand Zone at 0.9650

EURCHF bears began to close their short positions into the demand zone at 0.9650. The market’s order flow remains bearish. The market has been falling downward since the June 16, 2022, trend reversal. The change in character aroused the bears, who invaded the market and pushed prices further down.

EURCHF Significant Zones

Resistance Zones: 0.9980, 1.0240

Support Zones: 0.9650, 0.9450

On March 7, 2022, the prior support at 0.9980 and the Relative Strength Index (RSI) indicating an oversold zone prompted a change in the market environment by rejecting price to the upside. As the market moved upward, each downward retracement was prompted by its matching rejection block. The resistance level of 1.0240 was retested on April 28th, and the bulls propelled the market to a 5-month high.

The consolidation between the peaks was caused by the bullish factor that emerged on April 28th, 2022. This consolidation, together with the break in market structure to the downside, was later utilized to warn bearish about the decline. The Simple Moving Average confirms that the market is now in a downward trend (SMA). As the market exits the oversold region and moves out of the demand zone at 0.9650, the price is expected to rise until the fair value gap below the daily order block is filled.

Market Expectation

In the four hours, market order flow appears bearish as the market makes lower highs and lower lows. A retest of the broken support zone of 0.9650 is expected to change the market’s character and propel it higher until the liquidity above the swing high created on July 21st, 2022 is taken out.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply