EUR/JPY Long-Term Analysis: Bearish

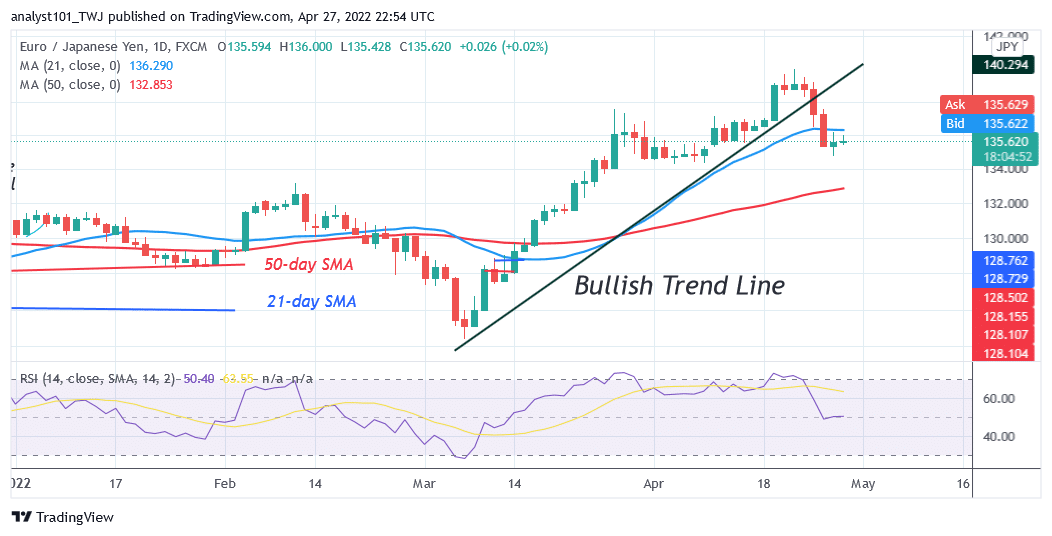

EUR/JPY pair is in a downtrend but rebounds to an overbought region. The current uptrend has been terminated. The Yen is above the 50-day line SMA but below the 21-day line SMA. The currency pair will be compelled to fluctuate between the moving averages for a few more days. On the downside, if price retraces and breaks below the 50-day line SMA, the downtrend will resume. The Yen will fall and revisit the previous low at level of 124.39. On the other hand, if price breaks above the 21-day line SMA, it will signal the resumption of the uptrend.

EUR/JPY Indicator Analysis

Because of the recent downtrend, the currency pair is at level 54 of the Relative Strength Index for period 14. The currency price is between the moving averages which indicates that the Yen will resume a sideways move between the moving average lines for a few days. The uptrend has been terminated as price breaks below the trend line. The pair is above the 40% range of the daily stochastic. It indicates that the market is in a bullish momentum.

Technical indicators:

Major Resistance Levels – 133.00, 134.000, 135.000

Major Support Levels – 128.000, 127.000, 126.000

What Is the Next Direction for EUR/JPY?

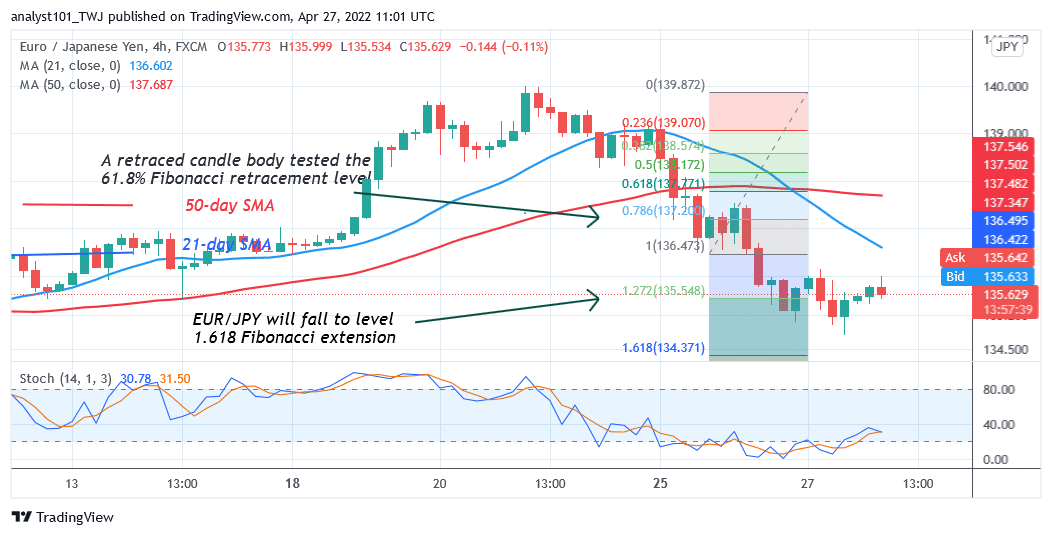

On the 4-hour chart, the Yen is in a downtrend but rebounds to an overbought region. The downtrend has subsided as the pair fell to the oversold region of the market but resumed upward. Meanwhile, on April 25 downtrend; a retraced candle body tested the 78.6% Fibonacci retracement level. The retracement indicates that EUR/JPY will fall to level 1.272 Fibonacci extension or $135.54. From the price action, the Yen has retested the level 1.272 Fibonacci extension and resumed upward.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

Leave a Reply