EUR/JPY Long-Term Analysis: Bearish

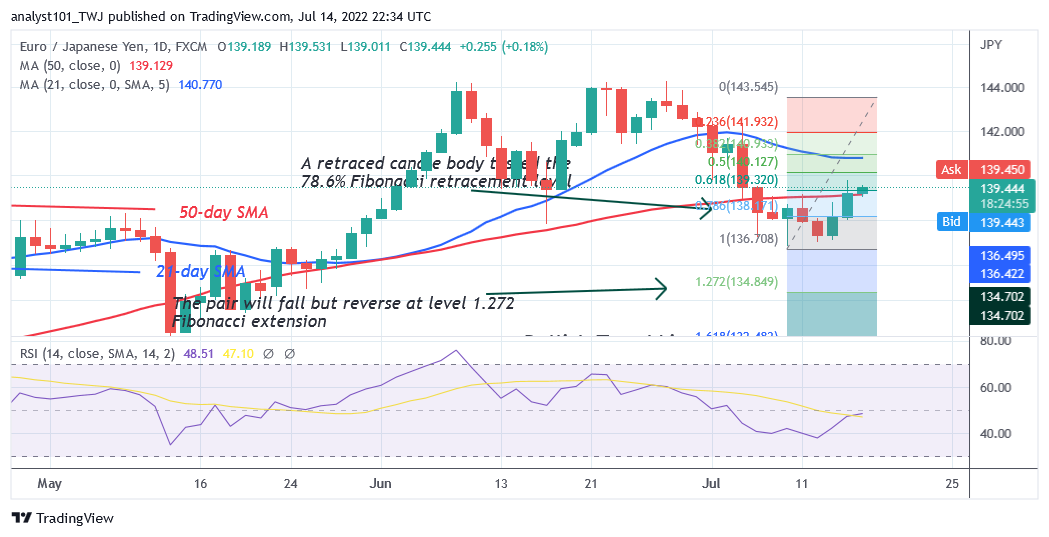

EUR/JPY pair is in a downward correction as it battles the resistance at level 139.77. On the upside, if the bulls break above the 21-day line SMA, it will signal the resumption of the uptrend. In other words, the market will rise to revisit the overhead resistance at 144.00. However, further upward move is doubtful as the market reaches the overbought region. The Yen will fall if it faces rejection at the recent high.

EUR/JPY Indicator Analysis

EUR/JPY is at level 48 of the Relative Strength Index for period 14. The pair is trading in the downtrend zone but approaches the bullish trend zone. The currency pair has resumed a sideways move. The 50-day line SMA and the 21-day line SMA are sloping horizontally.The Yen is above the 80% range of the daily stochastic. The market has resumed bullish momentum as it approaches the overbought region.

Technical indicators:

Major Resistance Levels – 133.00, 134.000, 135.000

Major Support Levels – 128.000, 127.000, 126.000

What Is the Next Direction for EUR/JPY?

The currency pair has resumed its upward move but battles the resistance at level 139.77. The pair is battling to break the resistance at level 139.77. A break above the resistance will propel the pair to reach the overhead resistance at level 144.00. Rejection will cause the pair to retrace above the moving averages.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

Leave a Reply