EUR/JPY Long-Term Analysis: Bearish

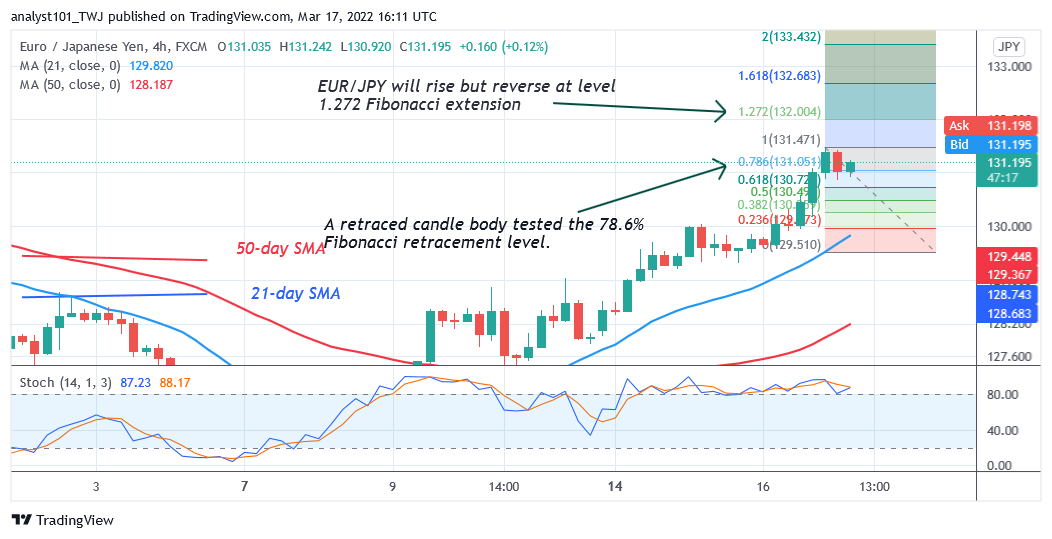

EUR/JPY pair has continued to make a positive move but targets resistance at 133.00. The currency pair has reached the high of level 131.36. The pair is trading in the overbought region of the market. Prices tend to fall when the market reached the overbought region. However, in a strong trending market, the overbought region may not hold. The market will rise to retest the overhead resistance at level 133.00. Meanwhile, on March 10 uptrend, a retraced candle body tested the 61.8% Fibonacci retracement level. The retracement indicates EUR/JPY will rise to level 1.618 Fibonacci extension or level 131.16. From the price action, EURJPY has reached the level 1.618 Fibonacci extension.

EUR/JPY Indicator Analysis

EUR/JPY is at level 60 of the Relative Strength Index for period 14. The currency pair is in the uptrend zone and capable of a further upward move. The 21-day SMA and 50-day SMA are sloping upward indicating the uptrend. The pair is above the 80% range of the daily stochastic. The market has reached the overbought region of the market. Further upward move is doubtful. The moving averages are sloping upward indicating the uptrend.

Technical indicators:

Major Resistance Levels – 133.00, 134.000, 135.000

Major Support Levels – 128.000, 127.000, 126.000

What Is the Next Direction for EUR/JPY?

On the 4- hour chart, the currency pair is in an uptrend but targets resistance at 133.00. The EURO is likely to make a possible reversal at the recent high. Meanwhile, on March 17 uptrend, a retraced candle body tested the 78.6% Fibonacci retracement level. The retracement indicates that EUR/JPY will rise but reverse at level 1.272 Fibonacci extension or level 132.00.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing result

Leave a Reply