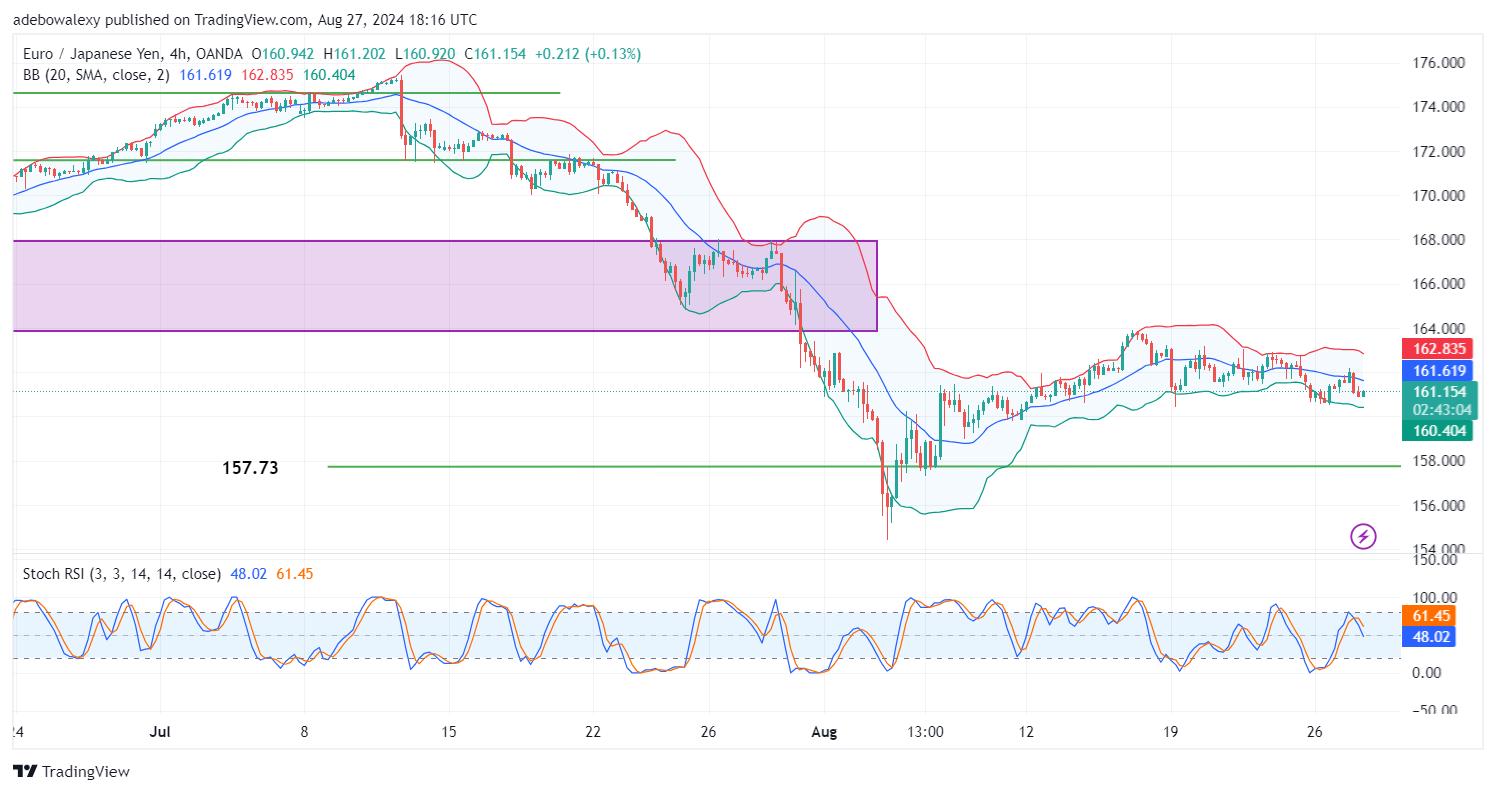

The EUR/JPY continues to show vulnerabilities since the market dipped sharply. The market has fallen significantly through multiple support levels. It seems to remain under the sustained effect of anticipation that the ECB will lower interest rates in September.

Key Price Levels:

Resistance Levels: 165.00, 170.00, 175.00

Support Levels: 160.00, 155.00, 150.00

EUR/JPY Will Likely Descend Lower

Following hints from the ECB that interest rates may be reduced, investors appear to have adopted a more cautious stance in the EUR/JPY market. This caution limits any previous upside recovery, and the market has refocused on lower price levels.

The ongoing session has placed the price of the pair below the middle band of the Bollinger Bands (BB) indicator. The body of the current price candle is closer to the opening price, suggesting that downward forces are active. Additionally, the Stochastic Relative Strength Index (Stochastic RSI) lines have turned smoothly downward, indicating a bearish retracement of prices.

EUR/JPY Stays Consistent With Its Bearish Outlook

Looking at a shorter time frame of the EUR/JPY market, it can be seen that this market retains the potential to fall to lower support levels. Here, price action is positioned further below the middle band. Although the ongoing session appears bullish, the current market position weighs heavily on bullish hopes.

Additionally, the Stochastic RSI indicator lines continue their downward trajectory below the 80 level of the indicator. The BB indicator itself is also tilted slightly downward. Consequently, it seems more likely that this market may soon touch the 160.00 price level.

Do you want to take your trading to the next level? Join the best platform for that here.

Leave a Reply