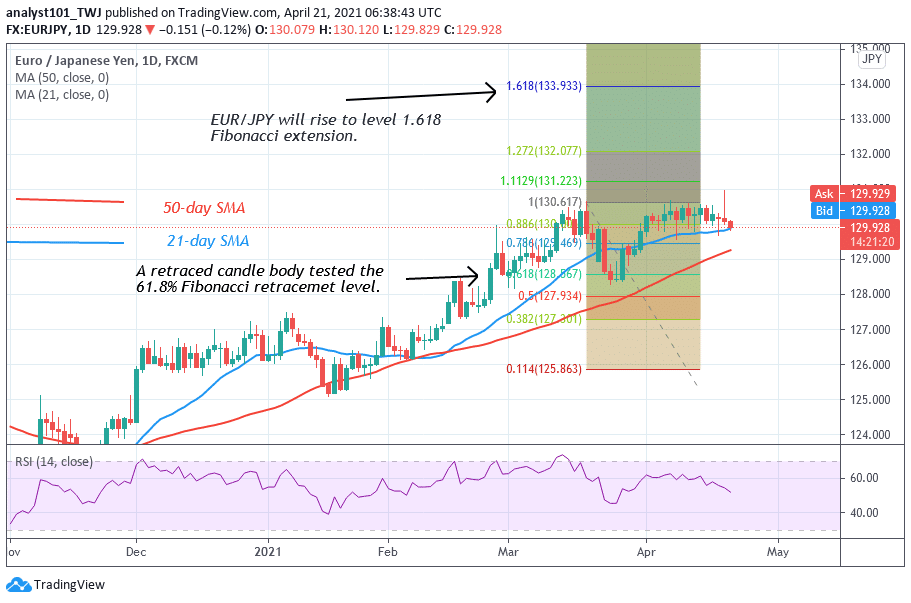

EUR/JPY Long-Term Analysis: Bullish

EUR/JPY pair has been in an uptrend since October 2020. The uptrend has been interrupted in March 2021. On March 18, the currency pair faced rejection at level 130.500. The Yen fell to level 128.500 and resumed a fresh uptrend. Since April, the resistance at level 130.500 is yet to be broken. The uptrend will resume if the overhead resistance is breached. On March 18 uptrend; a retraced candle body tested the 61.8% Fibonacci retracement level. The retracement indicates that EUR/JPY will rise to level 1.618 Fibonacci extension or the high of level 133.93.

EUR/JPY Indicator Analysis

The currency pair price is above the 21-day and 50-day SMAs which suggests a further rise in price. The moving averages are pointing northward indicating the uptrend. The Yen is at level 52 of the Relative Strength Index period 14. It indicates that there is a balance between supply and demand.

Technical indicators:

Major Resistance Levels – 131.00, 132.000, $133.000

Major Support Levels – 128.000, 127.000, 126.000

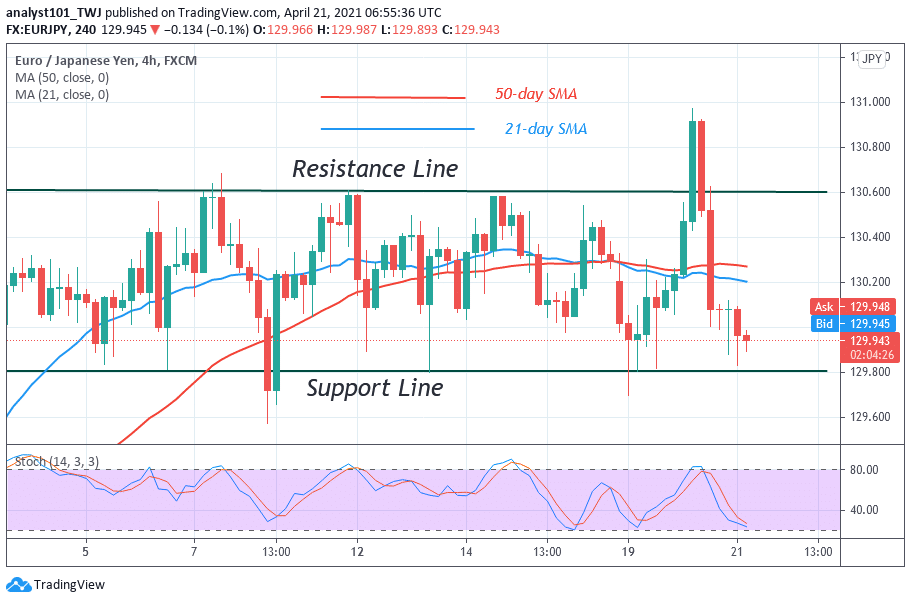

What Is the Next Direction for EUR/JPY)?

EUR/JPY is in a sideways trend. The currency pair has fallen to the lower price range. There is a likelihood of price rising on the upside to retest the overhead resistance at 130.500. On the 4-hour chart, the pair is fluctuating between level 129.800 and 130.600. A break above the resistance will signal the resumption of the uptrend.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

Leave a Reply