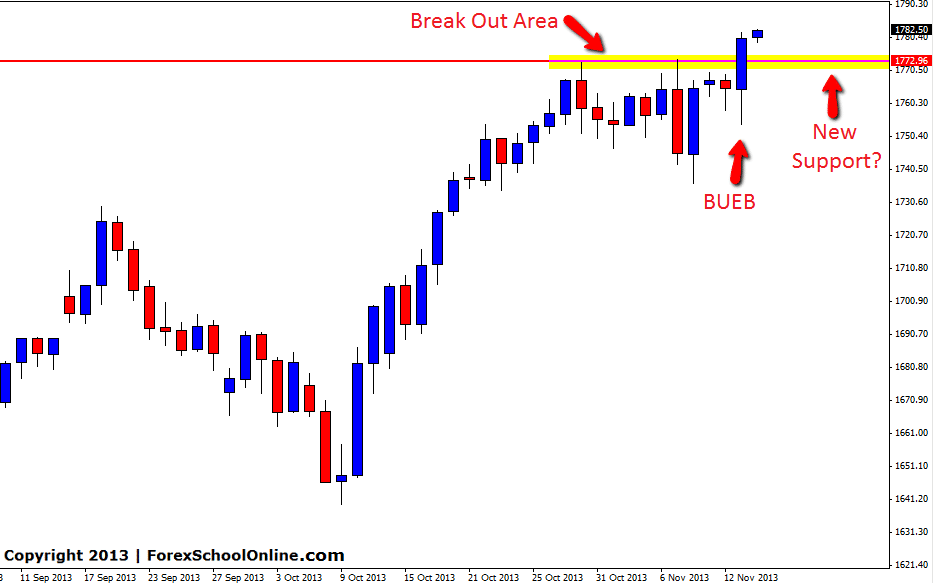

Both the Down Jones and the S+P 500 have burst higher and closed at all time highs. Both these markets have engulfed their previous candles and created bullish engulfing bars (BUEB). In this case of the S+P 500 price has broken out of the recent consolidation that price had been stuck in and broken out of the near term resistance and break out area to close out and above. Price has now broken out and above and formed a large and commanding BUEB.

The level that price has closed above that was acting as resistance and break out area could not act as a price flip and a new support area should price move lower. Because price is at all time highs, this market could now be tricky to gauge should it move higher. Price action traders have to levels to monitor, so traders will have to look to the price action clues that price is giving off candle by candle. Whilst this is never the ideal situation because traders can tend to overreact to each individual candle, when given this unusual situation monitoring price is one of the best options when looking for where price is looking to go and when it may reverse or continue.

S+P 500 Daily Chart

Leave a Reply