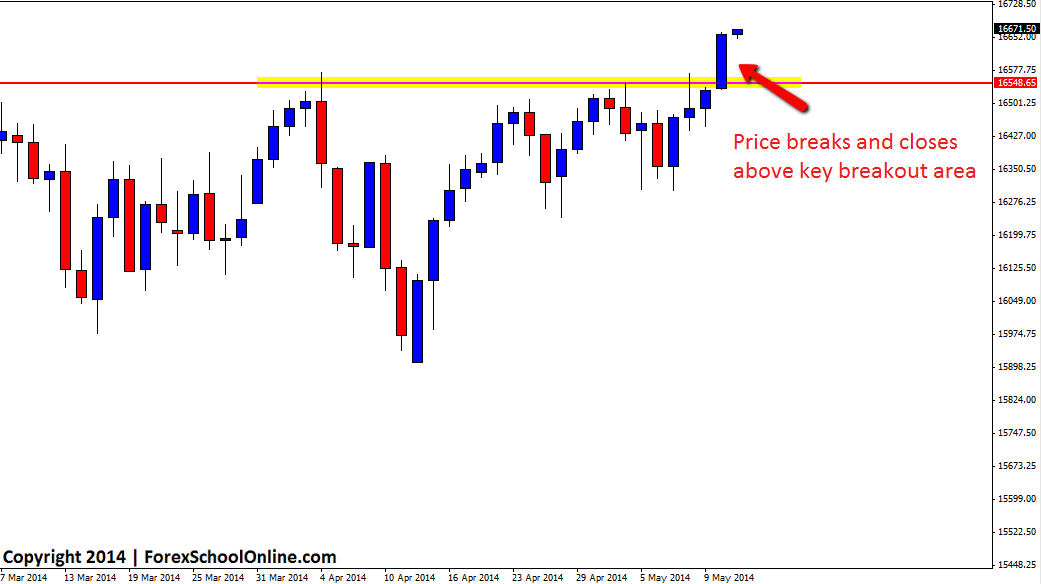

The Dow Jones has finally broken out higher and moved into an all time high on the daily price action chart. Price had been stuck trading in a sideways range for the past few months with price continually attacking the highs, but being unable to break through and push onto the fresh all time highs. In the last daily session, price made a huge breakout and as the daily chart shows below; price was able to not only make a break above the key resistance area, but also most importantly close above it with a very strong close (note how price closed up and near the sessions high).

Now that price has shown it’s hand and broken higher above this key resistance breakout area, this market could be a good market to start looking for long trades. Often when price breaks out strongly like this it will continue as long as the old breakout support or resistance area holds. In this market that would mean the old resistance needs to now hold as a new price flip support level if price rotates back lower at any stage to test it. I discuss how this works in detail in my latest trading lesson The Ultimate Guide to Marking Support and Resistance on Price Action Charts.

Traders can look for trades with this new strong momentum higher from any rotations back into value on both their daily and intraday charts such as the 4hr time frame, should price fire off any high probability price action setups, such as the trigger signals taught in the Forex School Online Price Action Courses.

Dow Jones Daily Chart

I think Mr Jonathan Fox is really a professional trader. Thank you for this great information and research about DJIA. Keep up the good work. Keep posting articles , we’ll counting on it.